Worldpay Statistics 2023 – Facts, Market Share, Features and Trends

Page Contents

Introduction

Worldpay Statistics: Don’t you think carrying bundles of cash in the pocket has become a bit old-fashioned? There are many companies around the world that have started online payment services other than their original category of application. For example, WeChat and WhatsApp both provide chat services. Moreover, WeChat allows you to connect with people around the world. But as the world focused on the technology and pandemic took place, all kinds of such applications started their own online payment services. Just like Worldpay is an online payment service provider. In Worldpay Statistics we will have a look at its features, general statistics from around the globe, and the differentiation between Worldpay and Stripe. In our past few stats, we have also listed statistics about PayPal, Stripe, Amazon Pay, and Alipay.

Key Worldpay Statistics (Editor’s Choice)

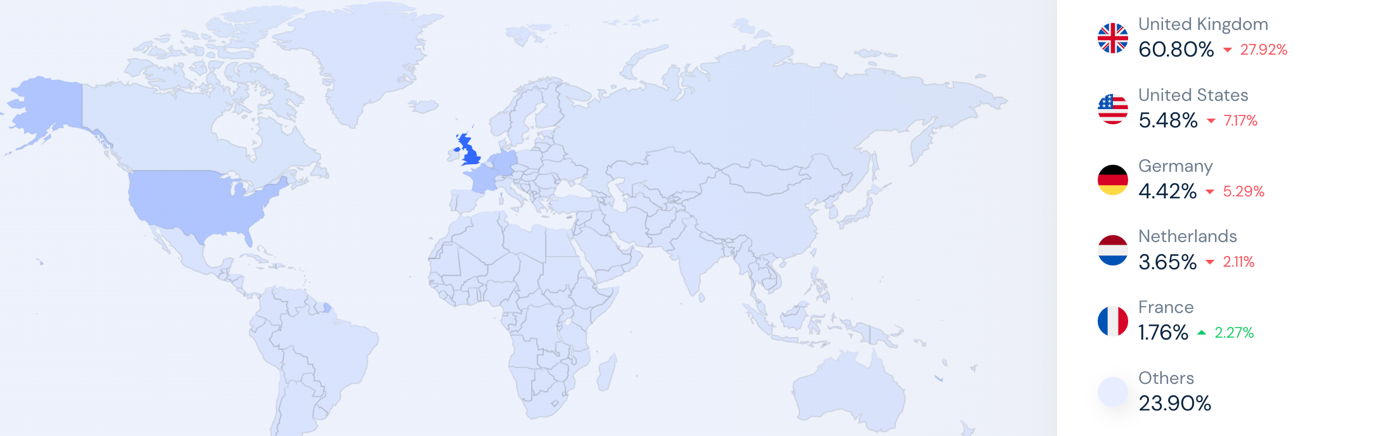

- Worldpay users are more in the United Kingdom than in the United States of America resulting in 60.80% and 5.48% respectively.

- Worldpay’s market covers around 99% of the World’s GDP.

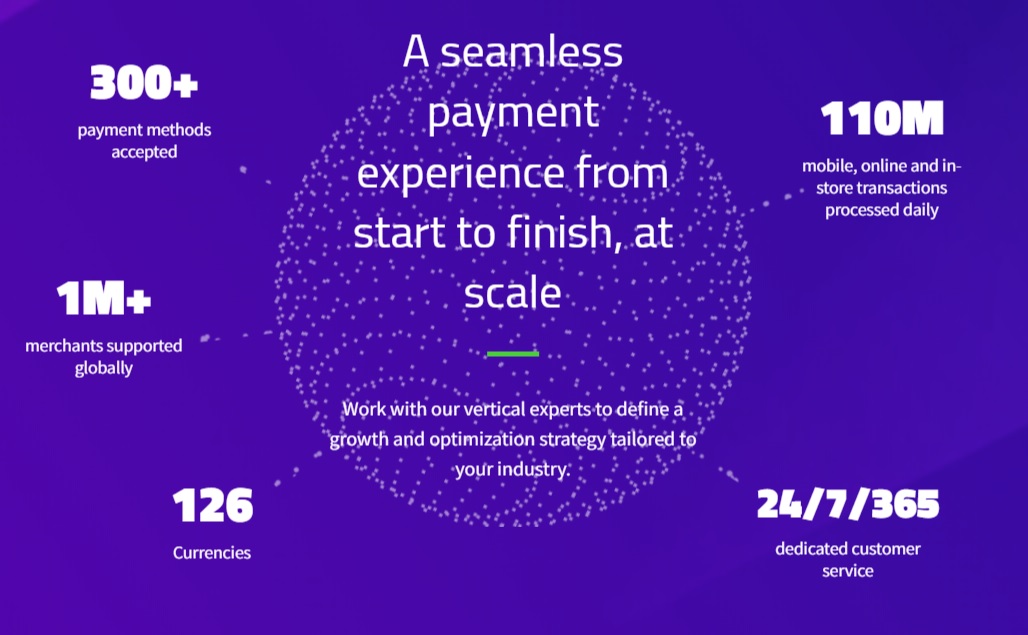

- There are more than 1 million merchants who support Worldpay around the globe.

- The company has spent around $40 trillion on FIS management technology.

- WorldPay statistics confirmed that total payments including online and offline are more than 110 million every day.

- They offer 24/7 of 365 days customer service available via phone, chat, and email.

- On the other hand, the platform has ranked first rank with overall culture score, gender and diversity score, and employee net promoter score among the competitors.

- Worldpay offers services related to 4 out of the top 5 cryptocurrency exchanges.

- A few of the most famous companies that support the WorldPay platform are Disney, Microsoft, emirates, Lenovo, Norwegian Cruise Line, and Amazon.

What is Worldpay?

Worldpay is an online payment service that lets users transfer money using a mobile or desktop. The company is based in Ohio, United States of America, and currently has around 8,500 employees working with them. The company specializes in Debit PIN processing, pre-paid and gift cards, prevention from rewards and fraud, ATM processing, credit cards, services offered to cardholders as well and card personalization.

Features of Worldpay

Being an online payment platform Worldpay offers a wide range of features. Here are some of the world-class features provided by the company.

- Worldpay has a global reach. Users can use the online payment platform from anywhere in the world.

- According to Worldpay Statistics, this platform is supported by millions of merchants around the world, including banking, insurance, shopping as well as restaurants.

- They offer 24/7 of 365 days customer service available via phone, chat, and email.

- The flexible and easy user interface of the application and desktop website.

- Worldpay is better for freelancers, entrepreneurs, large-scale industries as well as small-scale industries.

- Online payments are completed within seconds.

- The platform supports around 126 currencies.

Worldpay can also be used for online ticket booking as well as recurring payments such as mobile recharge, electricity bills, etc.

General Worldpay Statistics

- Worldpay has 300-plus accepted payment methods.

- There are more than 1 million merchants who support Worldpay around the globe.

- Worldpay Statistics show that the platform accepts payments in 126 currencies.

- Moreover, WorldPay statistics confirmed that total payments including online and offline are more than 110 million every day.

- A few of the most famous companies that support the WorldPay platform are Disney, Microsoft, emirates, Lenovo, Norwegian Cruise Line, amazon, google, and Sotheby’s.

- Worldpay is supported by retail businesses, restaurants, insurance, merchants, financial institutions, and securities and investments.

- Worldpay’s market covers around 99% of the World’s GDP.

- The company has spent around $40 trillion on FIS management technology.

- As of 2023, the top three countries with the highest users are the United Kingdom, Netherlands, and Germany.

- Furthermore, global traffic by device contributed to 51.5% of desktop and 48.5% of mobile devices.

- Over the last 6 months of 2023, the total number of devices that used Worldpay was (7.1 million), out of which 3.6 were desktops and 3.4 were mobile devices.

- As compared to July 2023, August generated negative 9.2% of traffic comparing 7.9 million to 7.1 million.

- There are around 8,143 Worldplay customers in the United States of America.

- Worldpay Statistics say that they receive 66% of the digital payments.

(Source: Similarweb)

- The above map shows that Worldpay users are in the United Kingdom than in the United States of America resulting in 60.80% and 5.48% respectively.

- However, the usage report of Worldpay Statistics shows that there is a reduction in users by 27.92% and 7.17% in the United Kingdom and the United States of America respectively.

- While Germany has 4.43% of the users with a declining rate of 5.29%.

- The Netherlands also tops the list of most users around the world with 3.65% of the total with a similarly declining rate of 2.11%.

- On the other hand, France has around 1.76% of the users with an increasing rate of 2.27%.

- Overall other countries with bare users have in total percentage of 23.90%.

- According to Worldpay statistics, the total number of website visitors for the official website in the month of October 2022 was 4.3 million.

- Whereas total visitors in the month of September and August were 5.2 million and 5.7 million respectively.

- There is a declining website visitor change at the rate of 18.58%.

- Worldpay’s website has a 41.64% of the bounce rate.

- According to Worldpay Statistics, a user on average spends 02:01 minutes on the website.

- Worldpay statistics show that it has 100% organic traffic, while 20.75% is direct traffic.

- The total percentage of traffic towards the website from referrals is at the rate of 78.10%.

- From social media, the traffic is accounted for up to 0.40%, whereas emailers add 0.46% of the total traffic.

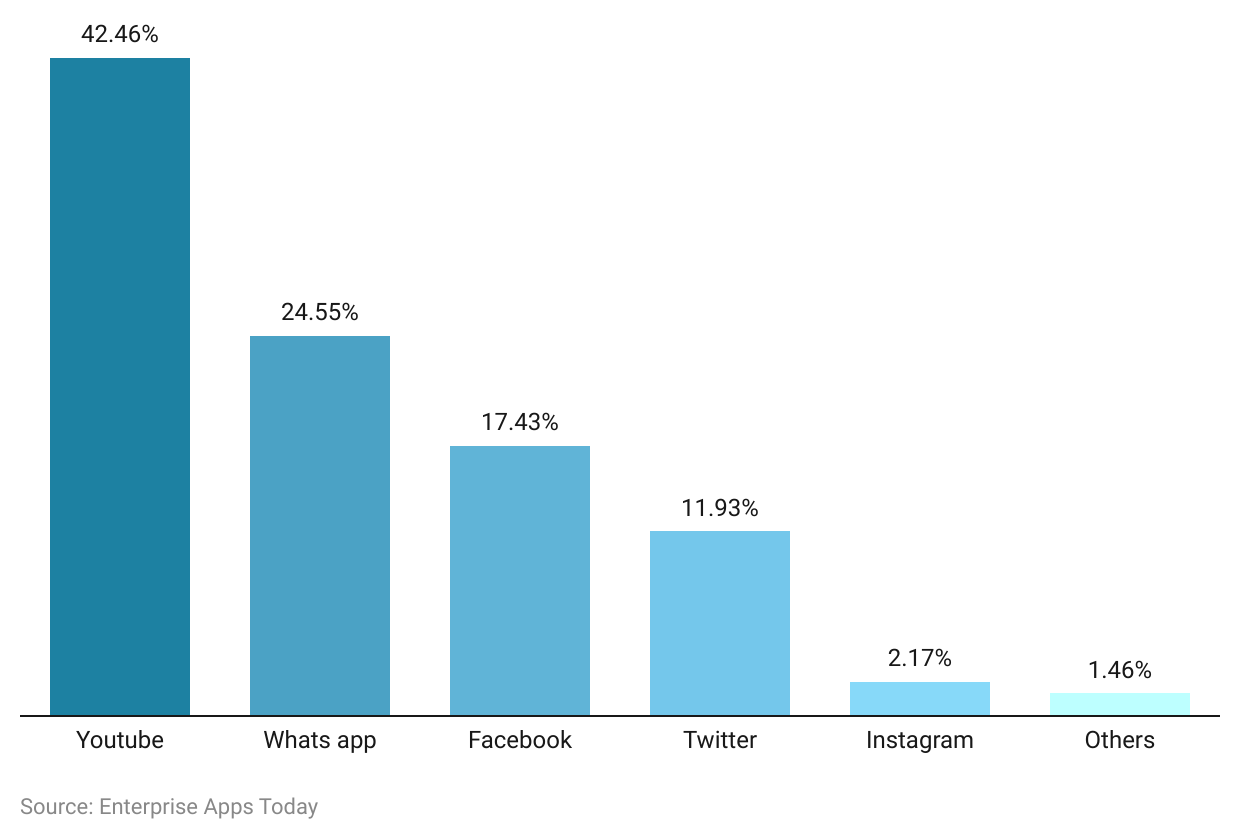

- Considering social media, traffic referred from YouTube is around 42.46%, WhatsApp has around 24.55% of website traffic, Facebook allocates 17.43%, Twitter has 11.93% and Instagram has around 2.17%. While website traffic from other sources is around 1.46%.

- The working culture at Worldpay has been rated 82/100.

- The diversity at Worldpay is rated also around 85/100.

- The WorldPay platform has ranked 6th in various categories such as net promoter, product quality score, customer service, and pricing store.

- On the other hand, the platform has ranked first rank with overall culture score, gender and diversity score, and employee net promoter score among the competitors.

- Worldpay offers services related to 4 out of the top 5 cryptocurrency exchanges.

- According to the WorldPay report, it has been forecasted that mobile wallets will become a preferred payment option by the year 2024 taking up to 47.9% of total transactions.

- Furthermore, cash transactions will reduce to 12.7% by the year 2024 as they were at 20.5% in 2020.

- By the year 2024, mobile and digital wallets are expected to share around 51.7% of the market for global eCommerce payment methods.

- According to Worldpay global report, the usage of credit cards will be reduced in 2021.

- Furthermore, the report states that physical use of cash will also reduce by the year 2025, to at least an overall 9.8%. While MEA will experience 31.3%, APAC will show a 7.7% reduction and North America will face 5.6%.

(Source: Worldpayglobal.com)

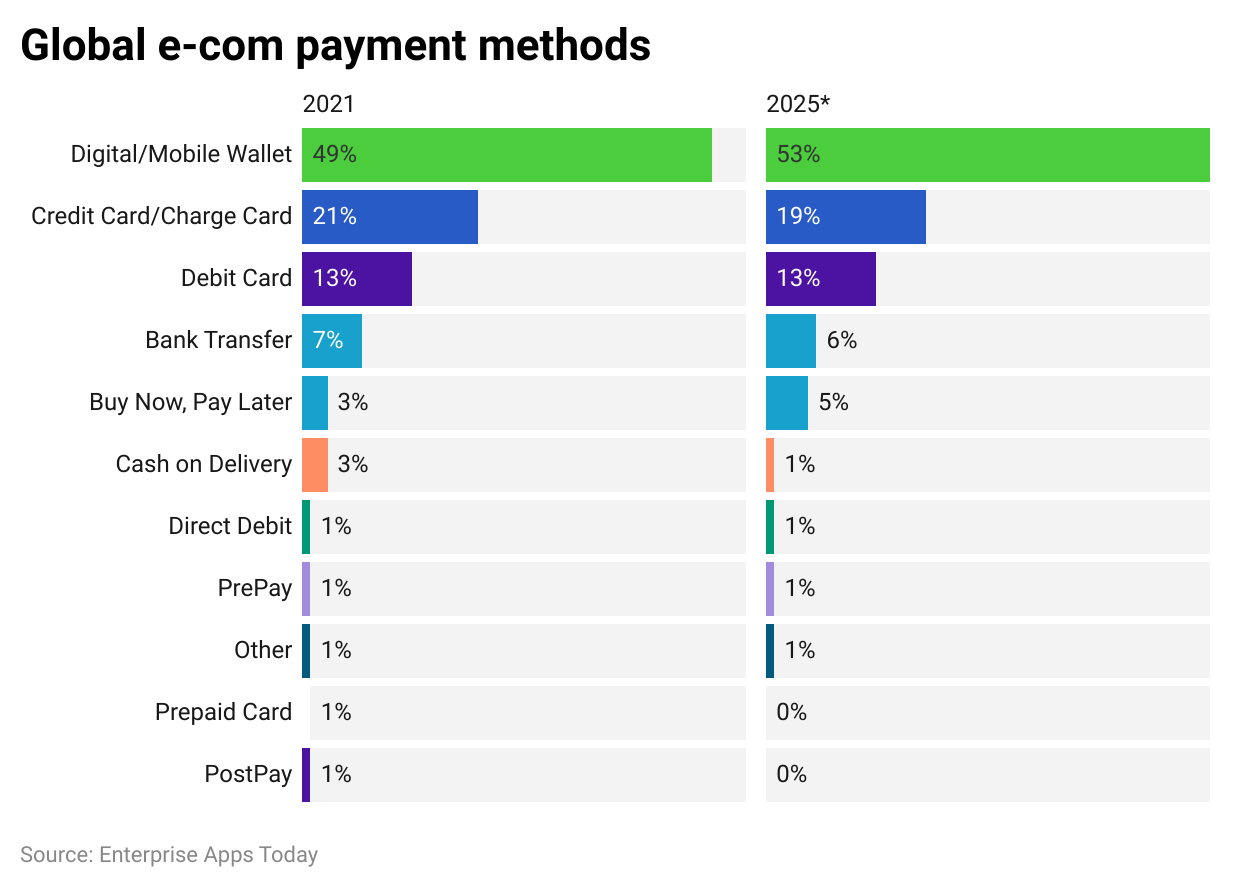

- As per the WorldPay global reports from 2021, different payment methods have been analyzed, in a way, they will capture the market.

- Digital/mobile wallets in the year 2021 captured the market at 49%, whereas it is estimated that it will increase to 53% by the year 2025.

- Credit cards in the year had a total market share of 21% which will experience a reduction to 19% by the year 2025.

- As seen in the above chart, debit card transfers will stay at 13% with no change even in the year 2025.

- Online bank transfers and the recently introduced option buy now and pay later were at 7% and 3% in the year 2021. On the other hand, a bank transfer will reduce to 6%, and buy now and pay later will increase to 5% respectively.

- Cash on delivery will have a neglected percentage of share in the market at 1% in the year 2025, where it was seen at 3% in the year 2021.

- On the other hand, the direct debit will remain the same throughout the years till 2025.

- Prepay options and other global e-commerce payment methods are also expected to remain at 1% till the year 2025.

- While prepaid cards and PostPay which had a market share of 1% in the year 2021 respectively, will reduce to 0% by the year 2025.

- According to the Worldpay global report, other than China, cash payments are also favored in the APAC area.

- Bahrain has around 79% of the real-time electronic fund transfers.

- In the United States of America, digital payment will be a leading method of credit card payments by the year-end of 2022.

- It has been forecasted that, by the year 2025, Mexico will still prefer cash payment methods over any other online payment options.

- Worldpay global report states that with real-time payments businesses can sell to the customer to whom they are not selling anything today.

- Till today German residents use cash payments 4 times more than France and Swedish residents.

- According to Worldpay global report, Nigeria is the first country to provide digital currency.

- In the year 2022, China has recorded around on average 43 million real-time online payments.

- An area prefers credit card transactions more than anything according to the Worldpay global reports.

Worldpay VS Stripe

Stripe and Worldpay operate on the same functional levels. But there are some minor features that differentiate them from each other. The following are those features.

Worldpay

- Worldpay platform supports the English language.

- This platform has integrations with applications such as JotForm, ApplePay, PayPal, Amadeus, Cybersource, SAP Hybris, NCR, and many more.

- Monthly charges for WorldPay are pounds 19.95.

- It is compatible with desktops, Macs, iPhones, and Android.

- Moreover, payments are transferable from and to, small, large, and medium-sized businesses, furthermore, freelancers can also ask for payments with the help of this platform.

- Customer support is available through email and phone with 24/7 availability.

- Online and offline payments are possible.

- The price model is quote-based.

- The platform has gained 94% of user satisfaction and has earned an 8.8 smart score.

- Other features include card payments, mobile wallets, credit card machines, shopping carts, hosted payment pages, recurring payments, and mobile and tablet point of sale.

Stripe

- Stripe has various extensions such as Visa Checkout, Ronin, InviteRobot, Taxamo, Attribution, Hall Monitor, Excel Rescue, Ship and Co, Swift Enterprise Search, and much more.

- The supported languages by Stripe are English, Dutch, Italian, French, Spanish, and Chinese.

- The pricing pattern for payment is 2.9% plus 30 cents per transaction.

- Stripe is compatible with desktops, Macs, iPhones, Windows, and Android.

- Furthermore, Stripe can be used by small, medium, and large-sized businesses as well as freelancers.

- The platform offers 24/7 support over email, chat, and phone.

- Stripe is a developer app, that uses AI-based protection technology to protect customers from pride.

- Stripe has more customer satisfaction score than Worldpay which is 97%.

- And the SmartScore is 9.6.

Which One Is Better?

Stripe and Worldpay applications are both online payment platforms and run on an almost equal level of competition. If we look at the numbers, then Stripe is a winner but if we consider general information WorldPay is also providing competitive features. Both of the platforms are considered better options for all kinds of businesses. Therefore, it is upon the user to which online payment platform he/she wants to use.

Conclusion

As stated in Worldpay Statistics, Worldpay has more features than any other online payment platform available today. It has become a necessity to use such payments at least once a day to ease the routine. Nowadays, nobody carries bundles of cash but has 2 or 3 online payment applications downloaded to their mobile phones.

The pandemic has changed the way technology is at the speed at which it has entered all sectors today. It is not only online payments, but also online education, remote work, and online doctor counseling that are now possible. Life has become easier, and it will be in the coming future. The only hope is that technology will not destroy humankind.

Sources

FAQ.

Yes. Worldpay protect its customer from fraud at all times.

Of course! Worldpay offers payment services in offline and online mode.

Yes. While shopping online, you can pay with Worldpay.

You can use Worldpay in restaurants, online shopping, ticket booking, online payments such as bill payments, recurring bills and many other things.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.