A Few Vital Visa Statistics To Understand Its Scale and Expansion Across The World

Visa Statistics: Visa Inc. is a reliable network that offers digital payments in more than 200 countries around the globe and regions to an international group of consumers, traders, financial bodies, businesses, strategic associates, and government organizations via innovative technologies. It is a transaction processing network that allows authorization, clearing, and settlement of payment transactions. It also provides credit cards. Visa Electron, Interlink, VPAY, and PLUS brands are some services offered by the Visa network. The fintech firm was launched in 1958. The headquarter of Visa Inc. is located in San Francisco, California, United States. Here are some vital Visa statistics that will give an insight into the growth and the current status of the financial firm in the digital payment market.

Key Visa Statistics

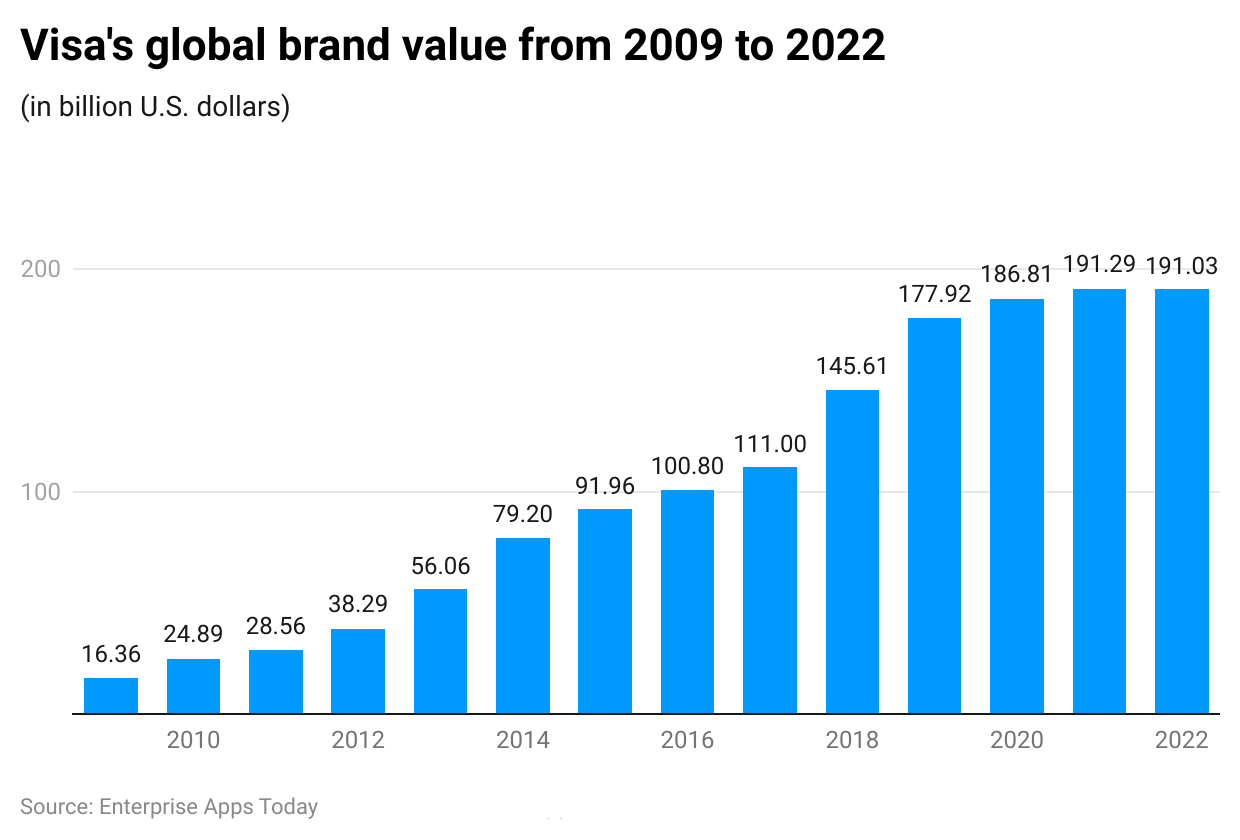

- In 2022, Visa secured the seventh spot with a brand value worth $191.03 billion in the ranking of global brands based on their brand value. In the same timeframe, the value of the company shot up around twelvefold.

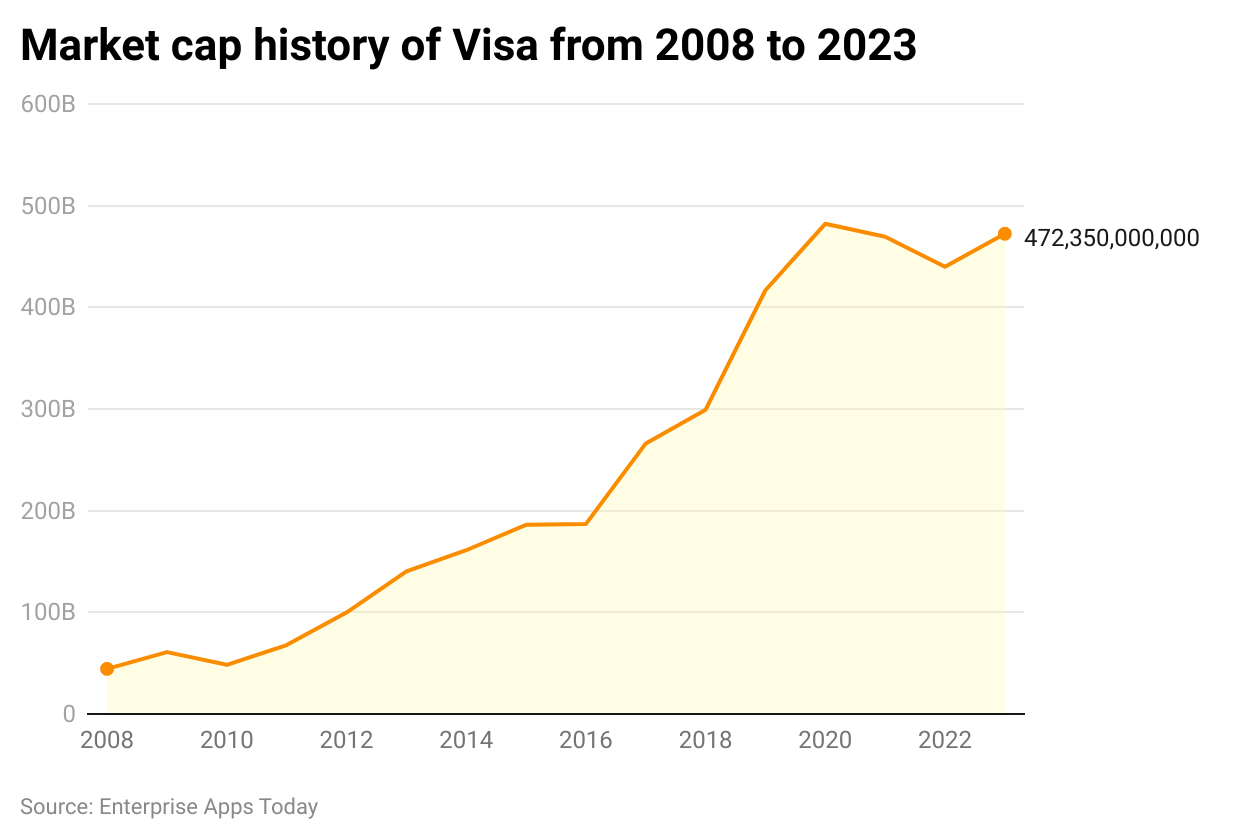

- As per 2023 Visa statistics, Visa accounts for a market cap of $470.32 Billion.

- Visa handled around 164.733 billion transactions in the financial year 2021, which showed a major increase from the total transaction of 140.839 billion in the previous fiscal year.

- Visa operates in nearly 200 countries and regions across the world.

- In 2022, Visa handled around 255.4 billion transactions.

- There are more than 80 million merchant locations that utilize services offered by Visa.

- More than 3.9 billion Visa cards are in circulation across the world.

- The total payment volume of Visa shot up to $14 trillion in the financial year 2022.

- Visa has around 26500 employees working for Visa offices located in over 80 countries across the world.

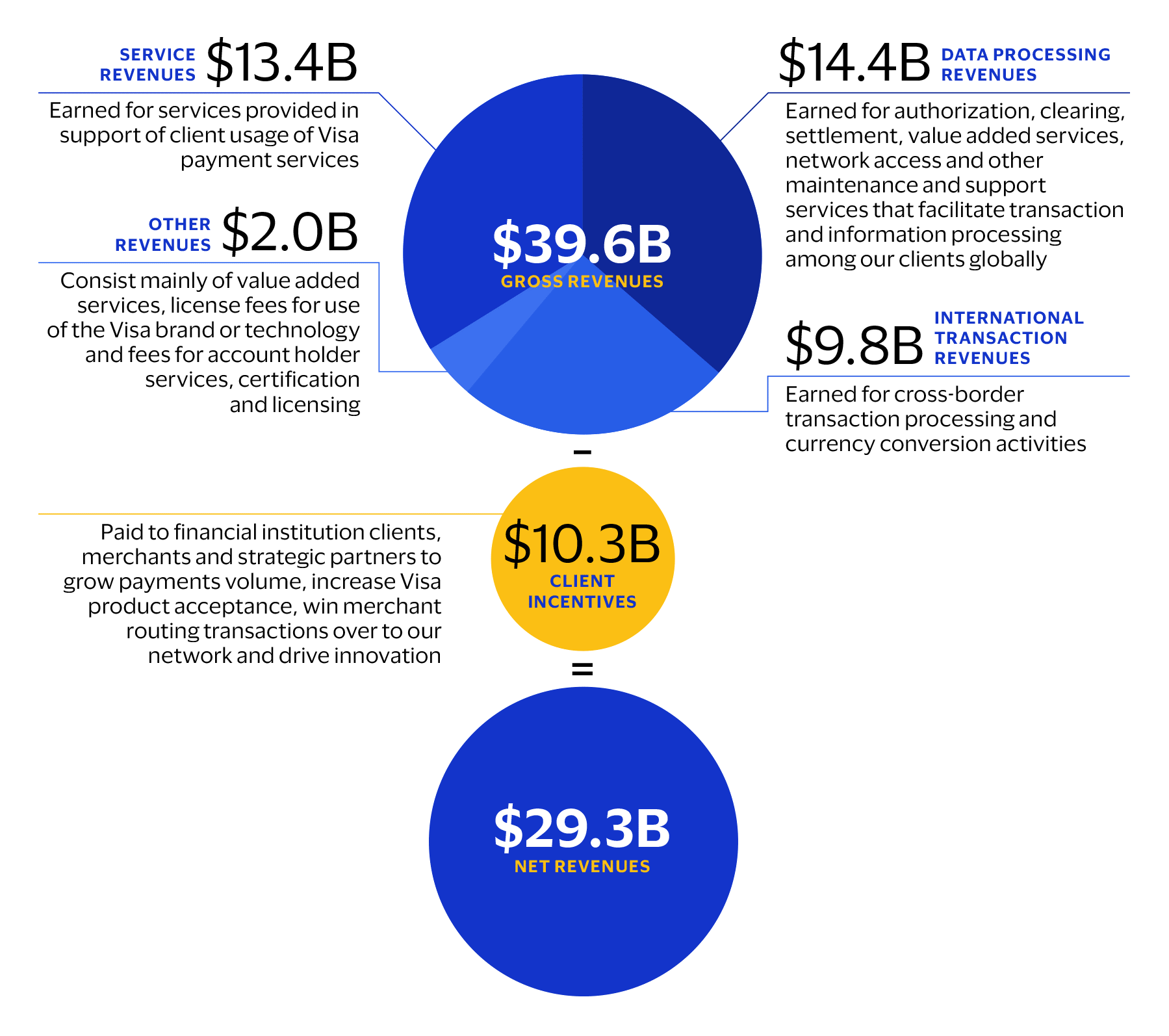

- The fintech company generated net revenue worth $29.3 billion in the fiscal year 2022.

- In 2022, Visa reported GAAP net income worth $15 billion.

- In the financial year 2022, the company recorded non-GAAP net income worth $16 billion.

- Nearly 232 billion online payments and cash transactions were processed through Visa's brand in the financial year 2021, which showed a major increase from 204 billion in the fiscal year 2020.

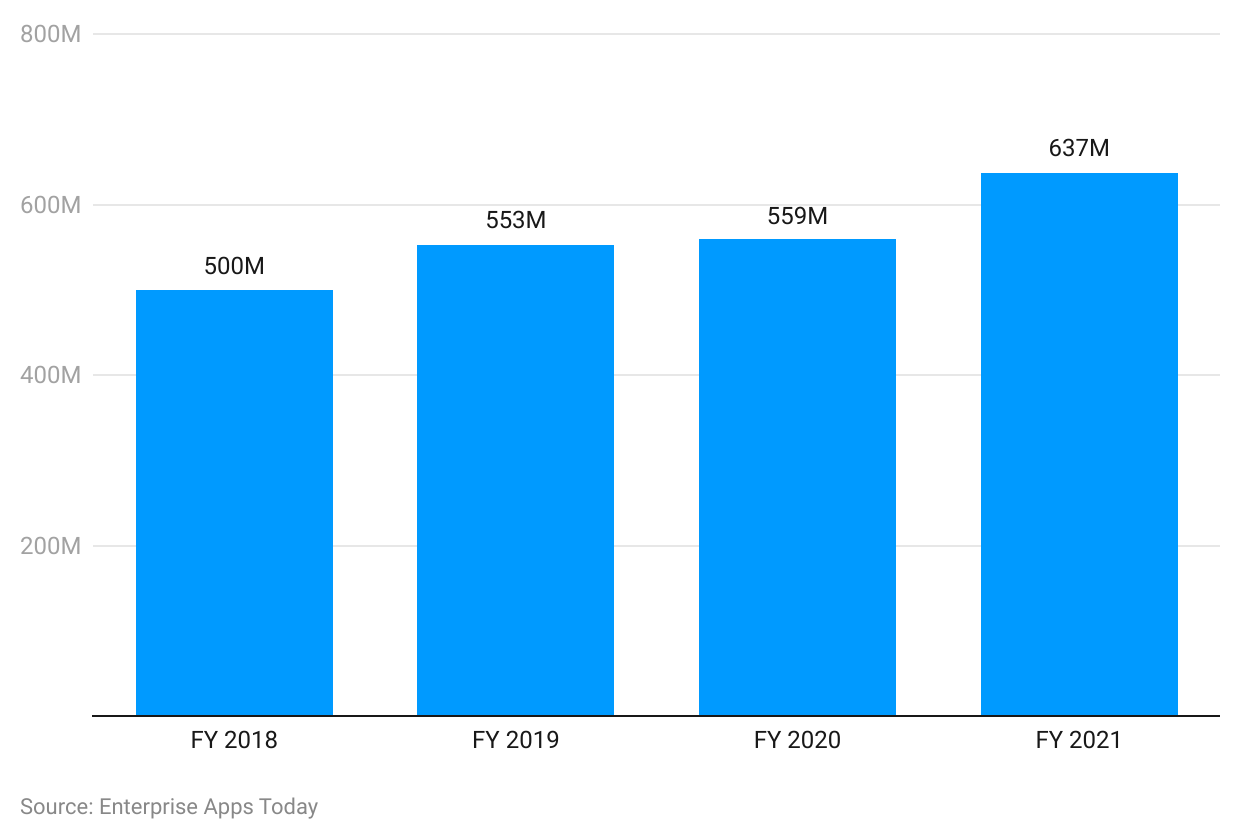

- As per Visa statistics, Visa processed an average of 637 million transactions per day in the financial year 2021.

- Visa operates in more than 160 currencies across the globe.

- Nearly more than 14900 financial institutions across the world use services provided by Visa.

- Visa was established back in 1958 by Bank of America (BOA) as the BankAmericard credit card initiative.

- The market share of Visa in the US improved over time increasing from nearly 50 percent of the market share in 2007 to more than 60 percent in 2022.

- As per Visa stats, nearly a transaction value of nearly $4.68 trillion was processed via Visa in the U.S. in the fiscal year 2020.

- As per the latest Visa statistics, a transaction value of 5.9 trillion was processed through Visa in the United States in the financial year 2022.

- The number of transactions via Visa payment reached nearly in the US in the fiscal year 2020.

- According to Visa statistics, nearly 3.586 billion Visa cards were in circulation across the world by the end of the financial year 2021.

- In 2020, Visa handled around $8.911 trillion in payments, which was far more than MasterCard’s payment handling worth $4.743 trillion in the same year.

Essential Visa Statistics and Trends

#1. As per 2023 Visa statistics, Visa accounts for a market cap of $470.32 Billion

It makes Visa the 7th most valued firm by market cap in the world. Market capitalization, commonly known as market cap, is defined by the total market worth of a publicly traded firm’s outstanding shares and It is usually used to assess the worth of the company.

(Source: companiesmarketcap.com)

#2. Visa operates in nearly 200 countries and regions across the world

Visa was established back in 1958 by Bank of America (BOA) as the BankAmericard credit card initiative, which claims that it can process more than 65000 transaction messages per second.

#3. Visa operates in more than 160 currencies across the globe

It also provides credit cards. Visa Electron, Interlink, VPAY, and PLUS brands are some services offered by the Visa network.

#4. In 2022, Visa secured the seventh spot with a brand value worth $191.03 billion in the ranking of global brands based on their brand value

In the same timeframe, the value of the company shot up around twelvefold.

(Source: Statista)

#5. Currently, Visa has around 26500 employees working for Visa offices located in over 80 countries across the world

Visa is an opportunity hub for many people who want to make a career in the finance industry. Visa accounted for 21,500 employees in the fiscal year 2021. It is the biggest key payment network, that is used by more than 80 million traders around the world.

#6. Visa transacted around $11.38 trillion in the financial year 2020

While MasterCard transacted only $6.34 trillion in the same year.

#7. As per Visa statistics, the revenue of Visa by the end of 2021 was around $7.059 billion

While MasterCard’s revenue was around $5.2 billion.

#8. Nearly 3.59 billion Visa cards were in circulation in 2020

While MasterCard has around only 2.334 billion cards in circulation.

#9. Currently, more than 3.9 billion Visa cards are in circulation across the world

There are more than 80 million merchant locations that utilize services offered by Visa.

#10. Visa handled around 164.733 billion transactions in the financial year 2021

It showed a major increase from the total transaction of 140.839 billion in the previous fiscal year.

#11. In the financial year 2022, Visa handled around 255.4 billion transactions

As per the latest statistics, Visa showed significant growth in fund processing as compared to the previous fiscal year.

#12. The total payment volume of Visa shot up to $14 trillion in the financial year 2022

The total volume of Visa including payments and cash volume reached $14 trillion in the financial year 2022.

#13. Visa processed an average of 637 million transactions per day in the financial year 2021

As per Visa statistics, the usage of Visa services improved even further during the pandemic.

(Source: Wallstreetzen)

#14. Visa generated nearly $11.475 billion from service fees in its fiscal year 2021

According to Visa statistics 2020, Visa made only $9.804 billion through service fees in the fiscal year 2020.

#15. The fintech company generated net revenue worth $29.3 billion in the fiscal year 2022

Visa recorded gross revenue of $39.6 billion in the financial year 2022. In 2022, Visa reported GAAP net income worth $15 billion. In the financial year 2022, the company recorded non-GAAP net income worth $16 billion.

(Source annualreport.visa.com)

#16. Nearly 232 billion online payments and cash transactions were processed through Visa's brand in the fiscal year 2021

It highlighted a slight increase from 204 billion online payments and cash transactions in the fiscal year 2020. While MasterCard reported only 126 billion processed online payments and cash transactions in the same year.

#17. In 2020, Visa handled around $8.911 trillion in payments

It was far more than MasterCard’s payment handling worth $4.743 trillion in the same year.

#18. Visa made around $11.16 billion in revenue in The United States in 2021

Visa statistics and trends show that in 2020, the company generated around 10.125 billion in revenue.

#19. As per the data, Visa's costs and expenses grew to $8.301 billion in the financial year 2021

While in the fiscal year 2020, the cost and expenses of the company were around $7.765 billion. The company invested around $1.136 billion in marketing in 2021.

#20. Around 41 percent of Visa’s employees are Asians

While 37 percent of the company’s employees are White Americans. Around 12 percent of Visa employees are from the Hispanic community.

#21. Visa included 500 million unbanked people in its payment system in 2020

The company accomplished its goal of offering 500 million unbanked or underserved people access to online payment accounts by 2020.

#22. As per Visa statistics, nearly 85 percent of Visa employees joined Visa’s CSR (Corporate Social Responsibility) programs in 2021

In the financial year 2021, around 85 percent of Visa employees participated in CSR programs launched by the company to contribute to their communities.

#23. Visa announced its IOP worth $17.9 billion in March 2008 which was the biggest IPO ever in US history at the time.

#24. Visa permits the use of cryptocurrency for transactions and payments on its platform.

#25. An antitrust case worth $6.6 billion was filed against Visa, MasterCard, and some other banks in 2012 where Visa spent $4.1 billion to settle the case.

#26. Visa declared its proposal to obtain a fintech startup known as Plaid for $5.3 billion but canceled the deal in January 2021 after an antitrust case was filed by the Department of Justice.

#27. In 2019, Visa took over a point-of-sale payments firm known as Payworks.

#28. In 2019, Visa took over the British payments firm known as Earthport for $250 million after a bidding conflict with MasterCard.

#29. In 2015, Visa obtained an e-commerce payments firm known as TrialPay.

#30. In 2018, Visa took over a British SaaS payments business called Freedom for $195 million.

#31. In 2020 the company took over the acquired payments firm popularly known as YellowPepper.

#32. Visa obtained a risk management solutions startup firm known as Verifi.

Conclusion

The biggest key payment network is Visa, which is used by more than 80 million traders around the world. From traditional benefits to premium rewards, Visa provides a wide range of advantages for cardholders around the world. Visa is committed to enhancing equitable, comprehensive, and viable growth for its cardholders living across the globe. The company aims to expand its initiatives to traditionally underserved sections of society by utilizing the scale of its network, products, and financial resources and offering people access to resources that might help improve their financial living and businesses. These Visa statistics show that Visa will emerge as the sole major player in the payment network across the globe in the future.

FAQ.

The workplace is affected by mobile phones because they create more distraction and connection. Employees can use mobile phones to stay in touch with colleagues, clients, and managers, boosting productivity.

However, they may also use these to distract themselves from doing their job.

Each time, a consumer uses a Visa card, the data is transmitted to Visa’s server that is situated abroad for processing and confirmation. Banks that offer a Visa card or a MasterCard need to pay a fee per quarter for using the services of these international payment networks.

VisaNet is an automated payment handling system, which is utilized to function with e-commerce transactions. On average an online transfer using VisaNet takes fewer than a second. The trader and customer’s bank must be affiliates of Visa for the system to do a transfer.

It is a safe network that has many layers of security to safeguard customers’ data and uphold great levels of faith in the payment system. As a trader processes your card, the Visa security system is activated to prevent fraud.

Visa can handle more than 24000 transactions per second. While Bitcoin can only handle seven transactions per second and Ethereum can process only 20 transactions per second.

Visa has around 376 servers, 85 routers, 277 switches, and 42 firewalls. All of them are attached by 3000 miles of cable that allows transactions across the world in near real-time and keeps the Visa's functioning afloat all the time.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.