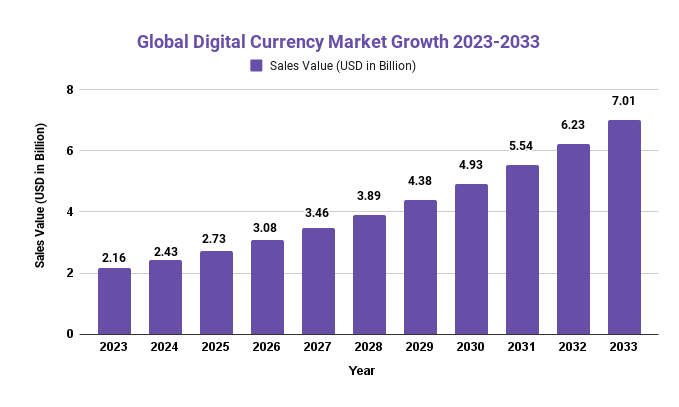

Digital Currency Market To Develop Strongly And Cross USD 7.01 Billion by 2033

Page Contents

Published Via 11Press: As its name implies, digital or electronic currency is a virtual asset. This refers to an account balance stored in a distributed database on computer systems for electronic transactions. There are various types of digital currencies: cryptocurrencies, virtual currency, central bank digital currencies and e-cash. Many companies provide electronic money transactions such as Square and PayPal.

Physical currency usage has seen a steady decrease due to the increasing use of contactless payments and many global players launching digital wallets. Digital currency has gained prominence due to its transparency and security. Many countries have invested in R&D related to digital currencies with many expected to launch their own virtual currencies within the forecast period. Below is a chart that details who is authorized to issue currencies within each country.

Market Overview

The digital currency market, also referred to as cryptocurrency, is a decentralized marketplace operating independently from traditional banking systems. It encompasses various digital coins like Bitcoin or Ethereum as well as related services like cryptocurrency exchanges, digital wallets, and mining operations.

In 2023, the global digital currency market was valued at USD 2.16 billion and is projected to reach a peak of USD 7.01 billion by 2033 with an annual compound growth rate (CAGR) of 12.3%.

The digital currency market is the global platform for cryptocurrencies like Bitcoin and Ethereum. This decentralized ecosystem operates independently from traditional banking systems and has become increasingly popular with both investors and consumers. The digital currency market comprises cryptocurrency exchanges, digital wallets, mining services – everything you need to stay ahead! Plus it's accessible 24/7 on any internet connection!

One of the latest developments in the digital currency market is an increasing acceptance of cryptocurrencies as a form of payment by mainstream companies such as PayPal, Tesla and Mastercard. Furthermore, governments around the world show greater interest in developing central bank digital currencies (CBDCs).

Digital currency is becoming an increasingly popular method for financial trading and transactions due to its many benefits. The primary advantage of digital currencies is their speed; transactions can be completed almost instantly, without waiting for a bank to process or approve them. Furthermore, these coins exist solely digitally and require no physical storage space compared to traditional forms of money which require physical space for storage.

Request For Sample Report@ https://market.us/report/digital-currency-market/request-sample/

However, using digital currencies comes with its own risks. Just like other investments, they're subject to market volatility which means values can shift drastically due to external influences. Furthermore, your wallet could be compromised due to inadequate security practices or malicious actors online.

The demand for digital currencies is on the rise due to their advantages, such as speedy, secure, and low-cost transactions. Furthermore, the trend toward digitizing financial services is further fueling demand for these digital assets.

Largest Market and Fastest Growing Market

The United States is currently the leading market for digital currencies, followed by China and Japan. Asia-Pacific has seen the fastest growth in this space due to rising adoption in countries like India and South Korea.

Asia Emerges as a Key Player, As China Strives to Counter Dollar Monopoly

China plans to introduce a virtual currency payment system using its official digital currency (eRMB) in response to the COVID-19 pandemic. The Digital Currency Research Institute of People's Bank of China reported that R&D on China's official digital currency is continuing apace, with many pilot tests underway in various regions. To guarantee stability and security, banks and some end-users have tested out the payment tool; its technology is expected to be widely adopted by more people going forward.

China also hinted that they may launch their digital currency on 5G-equipped telecom companies in the near future. According to South China Morning Post, China's total digital currency could reach USD ~140 billion within a few decades. Current market capitalization for cryptocurrencies, including Bitcoin, stands at approximately USD ~200 billion. China plans to incorporate digital currency into hundreds more blockchain projects after its trial period concludes. Information can be exchanged using digital sensors embedded in devices, and China intends to do so immediately. They plan to automate their entire Internet of things (IoT) ecosystem and offer DCEP-based direct payment through their global Belt and Road Initiative, helping foster healthy economic growth.

Covid-19's Impact Analysis

To prevent the COVID-19 pandemic from spreading further, governments have had to shut down inter-nation, intra-state and inter-city borders. According to WHO guidelines, cash and bank cards may facilitate disease transmission too, so currently digital payments seem like the best solution – many businesses opting to do business online as many retailers refuse hard cash payments.

Authorities have turned their focus toward expanding online payments systems and contactless cards in light of the pandemic. Countries like China and the U.S. have announced plans to promote electronic cash as it's easy-to-use and widely accepted among business executives; businesses and governments in these regions are investing heavily in this emerging form of currency. Examples include Visa's infrastructure for electronic money in the U.S., as well as China's recent announcement about electronic Renminbi or e-RMB currency – just two examples that demonstrate current conditions.

- Trade Globalization

- Globalization of the Economy

- Globalization of Military and Geostrategic Forces

Post COVID-19 – China's Digital Currency Market

- With the backing of PBoC, the digital Yuan can be “tokenized,” enabling e-RMB to expand rapidly and compete head-on with Alipay or WeChat pay services.

- The trial of the digital currency has been started in Shenzhen and Suzhou, Chengdu, and Xiong'an. It has also included some areas hosting the 2022 Beijing Winter Olympics.

- Subway, McDonalds and Starbucks will all be taking part in this trial.

- The country plans a nationwide rollout within two or three years, with the aim of decreasing hard cash printing.

- Beginning May 2020, civil servants in certain provinces has received half their monthly salary as e-RMB payments.

- Due to the proliferation of QR-code-based digital wallets in China, some traditional banking hass been replaced with e-currency.

Rest Of The World Trend

- Governments across the globe have been forced to prioritize Central Bank Digital Currencies due to factors such as declining cash use and private stablecoins.

- In April, Switzerland's Financial Market Supervisory Authority confirmed it had received a payment system license request from an organization in Geneva that oversees Facebook's planned cryptocurrency Libra.

- Both the Bank of England and Central Bank of France (Banque de France) are making progress with CDBCs.

- Markets worldwide will benefit from an uptick in cryptocurrency investment from South Africa, Africa and the Middle East.

Key Takeaways

- The digital currency market refers to cryptocurrencies such as Bitcoin and Ethereum that trade on an independent system.

- It operates independently from traditional banking systems and has become increasingly popular among investors and consumers.

- The digital currency market consists of cryptocurrency exchanges, digital wallets and mining services.

- Demand for digital currencies is rising due to their advantages such as speedy, secure and low-cost transactions.

Drivers

- Increased Adoption: The growing acceptance of digital currencies among businesses and consumers alike is fueling demand for these digital tokens.

- Growing Awareness: As more and more people learn of the advantages of digital currencies like fast, secure, and low-cost transactions, demand them is on the rise.

- Benefits of Digital Currencies: The advantages of digital currencies, such as fast, secure, and low-cost transactions, have led to an uptick in demand for them.

Restraints

- Regulatory Uncertainty: The lack of uniformity in regulation worldwide creates uncertainty and can be a deterrent to investment in digital currencies.

- High Volatility: High volatility among digital currencies adds another layer of risk and uncertainty, potentially impeding investment into these tokens.

- Security Concerns: Security risks related to storing and trading digital currencies can be a deterrent for the digital currency market.

Opportunities

- The growing trend towards digitalization of financial services presents opportunities for the digital currency market.

- Development of Central Bank Digital Currencies (CBDCs): CBDCs offer unprecedented possibilities for innovation and new business models.

- Growing Adoption in Emerging Markets: The growing acceptance of digital currencies in emerging markets provides opportunities for growth within the digital currency market.

Challenges

- Regulatory uncertainty: The lack of uniformity in regulation worldwide creates challenges for the digital currency market.

- Security concerns: The security risks associated with storing and trading digital currencies create challenges for the digital currency market.

- Education and awareness: The need for greater education and awareness among consumers about the benefits and risks of digital currencies presents a challenge for the digital currency market.

Do Inquiry Before Buying @ https://market.us/report/digital-currency-market/#inquiry

Market Segmentation

Type

- Type 1

- Type 2

Application

- Banks

- Finance

- Other

Key Market Players

- Bitcoins

- Ethereum

- Ripple

- Litecoin

- Dogecoin

- Dash

- Factom

- MaidSafeCoin

- Peercoin

- Novacoin

- Namecoin

Purchase This Report Via Secured Link and Avail Discount @ https://market.us/purchase-report/?report_id=54391

Report Scope

| Report Attribute | Details |

| Forecast Years | 2023-2033 |

| Historical Years | 2017-2022 |

| Revenue 2023 | USD 694.24 million |

| Revenue 2033 | SD 1052.62 million |

| Revenue CAGR (2023 – 2033) | 4.25% |

| Fastest Growing Region | Asia Pacific |

| Largest Region | North America |

| Report Scope | Market Trends, Drivers, and Restraints; Revenue Estimation and Forecast 2023-2033; Segmentation Analysis; Impact of COVID-19; Companies’ Strategic Developments; Market Share Analysis of Key Players; Company Profiling |

| Regional Coverage & Country Coverage | 5 Regions & Top 22 Countries

|

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2033 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

FAQ.

A digital currency is a type of cryptocurrency that is created and managed using encryption techniques.

You can buy digital currency on a cryptocurrency exchange or through a digital wallet.

Digital currencies are generally safe, but there are security risks associated with storing and trading them. Investors should exercise caution and take steps to protect their digital assets.

Yes, many businesses now accept digital currencies as a form of payment.

The regulatory status of digital currencies varies by country, and there is currently a lack of uniformity in regulation worldwide.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.