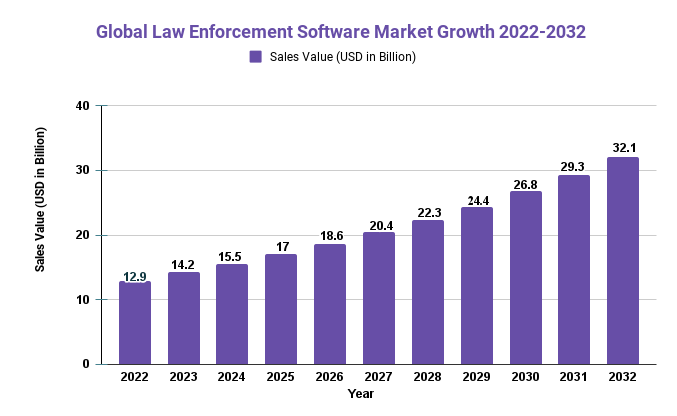

Law Enforcement Software Market Size Expected To Reach USD 32.1 Bn by 2032 | at a CAGR 9.5%

Page Contents

Market Overview

Published Via 11Press: The Law Enforcement Software Market is a rapidly developing industry that is expected to keep growing in the coming years. This market offers various software solutions tailored towards law enforcement agencies and other organizations involved in public safety and security, which help manage data, automate processes, and promote communication and collaboration between different entities.

In 2022, the Global Law Enforcement Software Market was valued at USD 12.9 Bn and is projected to reach a value of USD 32.1 Bn by 2032, growing at an annual compound growth rate (CAGR) of 9.5% between 2032 and 2033.

The primary drivers of this growth include an increasing need for public safety and security, the rising demand for advanced technologies, as well as the rise in mobile device and cloud computing usage.

The market is segmented based on software type, deployment mode, end-user, and region. By software type, it's divided into CAD, RMS, jail management, incident response, and others; with CAD holding the largest share in 2020 due to its capability for law enforcement agencies to efficiently manage resources in real-time. Deployment mode divides into on-premises and cloud-based solutions; cloud-based solutions are expected to grow at a faster pace due to their cost efficiency and scalability.

Drivers, trends, and challenges have an impact on market dynamics, which can impact businesses. Request for PDF sample report

Key Takeaways

- The global law enforcement software market is projected to expand at a compound annual growth rate (CAGR) of 9.5% during the forecast period.

- In 2020, the CAD segment held the largest market share, followed by RMS and jail management solutions.

- Cloud-based solutions are expected to grow at a faster rate than on-premises ones due to their cost efficiency and scalability.

- Law enforcement agencies are the primary users of law enforcement software solutions, followed by homeland security organizations and other organizations.

- North America had the leading market share in 2020, followed by Europe and Asia Pacific.

- Some of the key players operating within this space include IBM Corporation, Motorola Solutions Inc., Axon Enterprise Inc., and Palantir Technologies, Inc.

Regional Overview

- North America led the market share in 2020, driven by major vendors and increasing adoption of advanced technologies in the region.

- Europe is expected to experience significant growth during the forecast period, due to an increasing need for public safety and security as well as the adoption of advanced technologies.

- Asia Pacific is expected to experience substantial growth over the forecast period, driven by an uptick in demand for law enforcement software solutions and the growing adoption of cloud-based solutions across the region.

Drivers

- Growing Concerns Over Public Safety and Security: As public safety and security are becoming more pressing issues, law enforcement software solutions are being adopted to efficiently manage data, automate processes, and facilitate communication and collaboration between different agencies. These tools help manage information more efficiently and securely than ever before.

- Rising Demand for Advanced Technologies: The growing need for cutting-edge technologies like artificial intelligence, machine learning, and big data analytics is fueling the growth of the law enforcement software market. These tools assist in analyzing and interpreting large amounts of data, allowing law enforcement agencies to identify potential threats quickly and take appropriate actions.

- Growing Adoption of Cloud-Based Law Enforcement Software Solutions: As mobile devices and cloud computing become more commonplace, more law enforcement software solutions are moving into the cloud. Cloud-based solutions offer greater adaptability, scalability, and cost efficiency compared to traditional on-premises options.

Restraints

- Data Privacy and Security Issues: As law enforcement agencies increasingly use software solutions for investigational work, concerns over data privacy and security have arisen. Law enforcement agencies must safeguard sensitive information, so any breach in security could have serious repercussions.

- High Implementation and Upkeep Costs: Law enforcement agencies may find the cost of implementation and upkeep for law enforcement software solutions to be a significant deterrent, particularly in developing regions where resources may not be sufficient.

- Lack of Standardization and Interoperability: Lacking standards between law enforcement software solutions can pose a problem for agencies that must collaborate and share information. This leads to inefficiencies and delays when responding to critical incidents.

Opportunities

- Rising Adoption of Predictive Analytics: As law enforcement software solutions increasingly incorporate predictive analytics, there is significant market growth potential. Predictive analytics can assist agencies in recognizing potential threats and preventing crime before it takes place.

- Emerging Markets: The growing need for public safety and security in emerging markets presents a major opportunity for the market. Law enforcement agencies in these nations are increasingly adopting cutting-edge technologies to enhance their operations and better detect security threats.

- Integration with IoT Devices: Integrating law enforcement software solutions with the Internet of Things devices such as cameras and sensors presents an exciting market growth potential. This integration can give law enforcement agencies access to real-time data so they can act swiftly when faced with security threats.

Challenges

- Resistance to Change: Law enforcement agencies may be unwilling to embrace new technologies or adjust their processes accordingly. This presents a significant hurdle for vendors in the law enforcement software market.

- Lack of Technical Competency: Law enforcement agencies often lack technical know-how, making implementation and adoption of vendor solutions a significant challenge. Vendors in this space may need to offer training and support in order to guarantee successful adoption and implementation.

- Regulatory Challenges: The regulatory landscape for law enforcement software solutions can be intricate and differ across different regions. Vendors may need to navigate a variety of regulations in order to guarantee conformance with local laws and regulations.

Recent Developments

- In March 2021, Motorola Solutions announced the launch of a new cloud-based records management system (RMS) for law enforcement agencies.

- In January 2021, Axon Enterprise announced the acquisition of two companies, Fossil Group, and DragonForce, to expand its suite of law enforcement software solutions.

- In November 2020, IBM Corporation announced the launch of a new law enforcement software solution, called Safer Neighborhoods, which uses AI and machine learning to help law enforcement agencies identify and prevent crimes.

- In October 2020, Palantir Technologies announced the launch of a new law enforcement software platform, called Gotham Connect, which enables law enforcement agencies to share data and collaborate more effectively.

Key Market Segments

Type

- On-premise

- Cloud-based

Application

- Crime Management

- National Security

Key Market Players

- IBM

- Accenture

- Oracle

- Motorola Solutions

- Axon

- Nuance Communications

- CyberTech

- ESRI

- Palantir Technologies

- Numerica Corporation

- Cyrun

- Incident Response Technologies

- Omnigo?Software

- CODY Systems

- Diverse Computing

- eFORCE?Software

- Wynyard Group

- DFLABS

- ARMS

- PTS Solutions

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 12.9 Bn |

| Revenue forecast by 2032 | USD 32.1 Bn |

| Growth Rate | CAGR Of 9.5% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Frequently Asked Questions

Q: What is law enforcement software?

A: Law enforcement software refers to a range of software solutions used by law enforcement agencies to manage and analyze data, automate processes, and enhance communication and collaboration between different agencies.

Q: What are the key types of law enforcement software solutions?

A: The key types of law enforcement software solutions include computer-aided dispatch (CAD), records management systems (RMS), jail management systems, and crime analysis software.

Q: What are the key drivers of the law enforcement software market?

A: The key drivers of the law enforcement software market include the increasing need for public safety and security, the rising demand for advanced technologies, and the growing use of mobile devices and cloud computing.

Q: What are the key challenges facing the law enforcement software market?

A: The key challenges facing the law enforcement software market include resistance to change, lack of technical expertise, and regulatory challenges.

Q: Which regions are driving the growth of the law enforcement software market?

A: North America held the largest market share in 2020, followed by Europe and Asia Pacific. However, emerging markets in regions such as Latin America and the Middle East are expected to drive significant growth in the coming years.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.