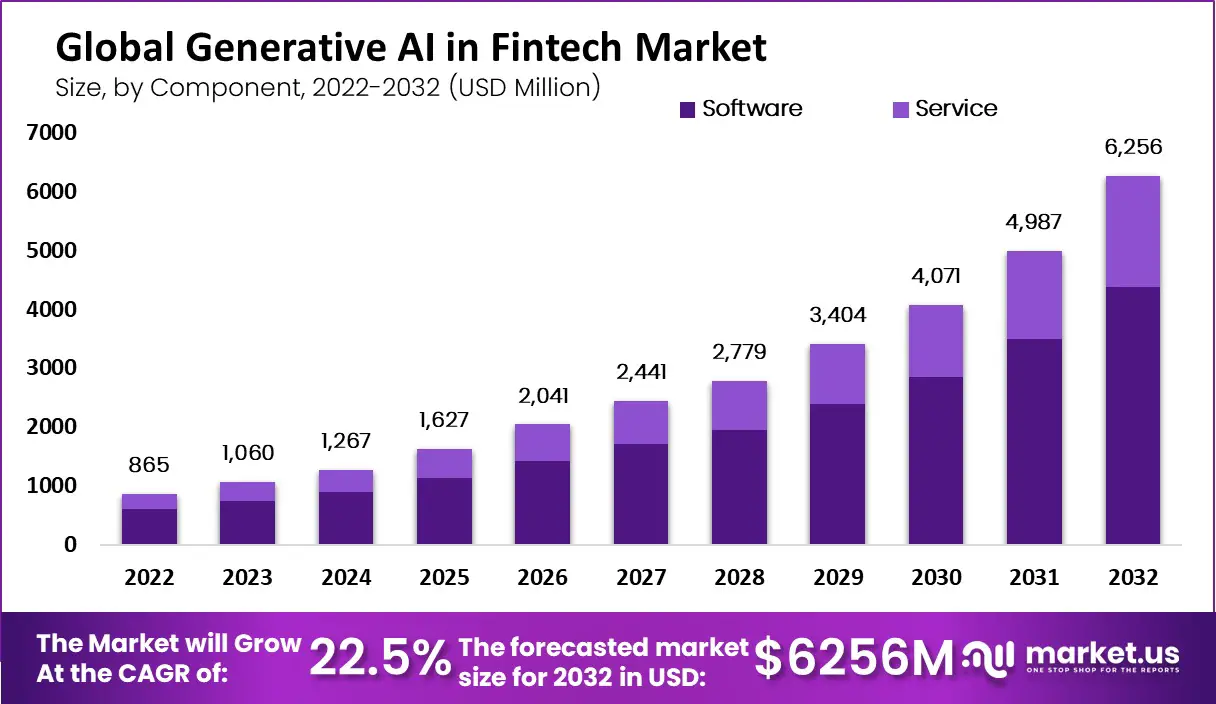

Generative AI in Fintech Market Size is estimated to reach USD 6,582.3 Mn in 2032

Page Contents

Market Overview

Published Via 11Press : Generative AI in Fintech Market will reach USD 6,582.3 Million by 2032, up from an initial value of USD 865 Million in 2022, growing at an expected Compound Annual Growth Rate (CAGR) rate of 22.5% from 2023-2032.

Generative AI is an exciting area in fintech that could revolutionize many areas of industry. Generative AI refers to an area of AI models capable of producing new data samples or outputs based on patterns learned from existing data samples or outputs.

Generative AI could revolutionize how financial institutions approach risk management, fraud detection and customer service. By analyzing large datasets of transactions and customer behavior, generative AI models can detect patterns that traditional rule-based systems might miss.

One area where generative AI is being implemented in fintech is fraud detection. With fraudsters constantly finding new ways around existing fraud detection systems, traditional solutions often find it challenging to keep pace. By contrast, Generative AI can be trained on large amounts of data in order to recognize new patterns of fraudulent activity and flag suspicious transactions immediately.

Generational AI models are also being leveraged within fintech to enhance credit scoring. Traditional credit scoring models rely on historical data and may take too long to adjust with changing market conditions; by contrast, generative AI models can be trained on real-time data to deliver more accurate and up-to-date credit scores.

Generative AI models are being utilized by fintech firms to enhance customer service by analyzing customer behaviors and preferences; using these insights, generative AI can provide personalized recommendations tailored specifically for each customer's unique requirements.

For further details on major revenue-producing segments, request a pricing optimization software market Request for PDF sample report

Key Takeaways

- Growing Adoption: Generative AI has experienced dramatic adoption rates within fintech, with financial institutions tapping its power for risk management, fraud detection, credit scoring, and customer service purposes.

- Potential Benefits: Generative AI could change how financial institutions approach risk management and fraud detection by detecting patterns missed by traditional rule-based systems. Furthermore, it could provide more accurate credit scoring as well as personalized recommendations and financial advice for customers.

- Challenges: Generative AI has its own set of hurdles to clear when used in fintech, such as data privacy and security concerns as well as needing highly skilled data scientists and engineers in order to develop and maintain AI models.

Regional Snapshot

- North America: North America is expected to dominate the generative AI in fintech market due to the presence of several leading fintech firms and adoption of advanced technologies, particularly within the US market.

- Europe: Europe is expected to experience significant growth in the generative AI in fintech market as more organizations utilize machine learning technologies for financial services. The UK, Germany and France should lead this expansion.

- Asia-Pacific: The Asia-Pacific region is expected to experience the highest compound annual growth rate for generative AI fintech, due to rising adoption and presence of several emerging economies such as China and India. China may lead the market within this region.

- Rest of World: Global growth projections also call for significant expansion of the generative AI in fintech market, with many emerging fintech firms adopting AI technologies in order to stay ahead of competitors.

Drivers

- Advanced fraud detection and risk management solutions: Generative AI offers financial institutions an edge in real time by quickly detecting suspicious transactions that involve new forms of fraudulent behavior – making generative AI an attractive investment decision for financial services firms.

- Generative AI is becoming an indispensable asset to providing personalized financial services: by understanding customer behavior and preferences, Generative AI can analyze customer data to provide tailored recommendations and financial advice, leading to increased customer satisfaction and loyalty.

- Digitizing banking and payments: As consumers transition toward digital banking and payments, demand has skyrocketed for advanced fintech solutions – including artificial intelligence-powered generative AI.

- Advances in AI and machine learning technologies: Advancements in AI and machine learning technologies have allowed researchers to create more sophisticated generative AI models capable of providing accurate, reliable insights.

Restraints

- Data Privacy and Security Issues: Generative AI models require access to large volumes of sensitive financial data, raising potential data privacy and security concerns.

- Lack of competent data scientists and engineers: Financial institutions often struggle with accessing qualified data scientists and engineers for developing and maintaining AI models that generate revenue for them, which requires special skills and expertise that may prove challenging to attain.

- High implementation costs: Implementing generative AI solutions may be expensive for smaller financial institutions that may lack sufficient resources.

- Limited regulatory framework: Due to a lack of regulations pertaining to generative AI's use in fintech, which could create uncertainty and compliance risks for financial institutions.

Opportunities

- Adoption of AI in regulatory compliance: Artificial Intelligence can assist financial institutions with meeting regulatory compliance requirements by detecting suspicious transactions and protecting data privacy and security.

- Enhance customer experience: Generative AI can analyze customer behavior and preferences to deliver customized financial services, leading to higher customer satisfaction and loyalty.

- Generational AI provides enhanced risk management: Generative AI has proven its ability to detect new patterns of fraudulent activity and highlight suspicious transactions quickly, which is essential for effective risk management within fintech.

- Cost Savings: Generative AI has the potential to automate various processes within financial institutions, leading to cost savings.

Challenges

- Data Privacy and Security Concerns: Applying AI technology in fintech requires accessing sensitive financial data, leading to concerns over data privacy and security.

- Limited interpretability: Generative AI models often appear opaque to financial institutions, making it challenging to comprehend their logic behind decisions made by these models.

- Bias and Discrimination: Generative AI models can contribute to bias and discrimination if trained on biased data or are not designed to take demographic differences into account.

- Due to an absence of regulatory framework: Fintech institutions currently lack guidance regarding their use of generative AI for fintech purposes, leading to uncertainty and compliance risks for them.

Recent Developments

- In December 2021, Goldman Sachs announced that it is using generative AI to enhance its credit risk management and fraud detection capabilities.

- In October 2021, Mastercard announced that it is using generative AI to provide more personalized financial advice and recommendations to its customers.

- In August 2021, JPMorgan Chase announced that it is using generative AI to improve its customer service and fraud detection capabilities.

- In June 2021, Visa announced that it is partnering with several fintech startups to develop generative AI solutions that can improve payment processing and risk management.

Key Market Segments

Based on Component

- Service

- Software

Based on Deployment

- On-Premises

- Cloud

Based on Application

- Credit Scoring

- Compliance & Fraud Detection

- Personal Assistants

- Digital assistants

- Financial assistants

- Asset Management

- Predictive Analysis

- Insurance

- Debt Collection

- Business Analytics & Reporting

- Customer Behavioral Analytics

Based on End-Use Industry

- Retail Banking

- Investment Banking

- Stock Trading Firms

- Hedge Funds

- Other Industries

Market Key Players

- Open AI

- Microsoft Corporation

- Google LLC

- Genie AI Ltd.

- IBM Corporation

- MOSTLY AI Inc.

- Veesual AI

- Adobe Inc.

- Synthesis AI

- AI

- Other Key Players

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 865 Mn |

| Revenue forecast by 2032 | USD 6,582.3 Mn |

| Growth Rate | CAGR Of 2.5% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

FAQs

Q: What is generative AI in fintech?

A: Generative AI in fintech is a type of artificial intelligence that uses machine learning algorithms to generate new data based on existing data. It can be used in several applications in the fintech industry, including risk management, fraud detection, credit scoring, and personalized financial services.

Q: How does generative AI improve fraud detection in the fintech industry?

A: Generative AI can identify new patterns of fraudulent behavior and flag suspicious transactions in real-time, which is crucial for effective fraud detection in the fintech industry.

Q: What are some of the challenges of using generative AI in fintech?

A: The challenges of using generative AI in fintech include data privacy and security concerns, limited interpretability, bias and discrimination, and a lack of regulatory guidance.

Q: What are some of the potential benefits of using generative AI in fintech?

A: The potential benefits of using generative AI in fintech include improved risk management, enhanced customer experience, cost savings, and more personalized financial services.

Q: Which regions are expected to witness significant growth in the generative AI in fintech market?

A: North America, Europe, and Asia-Pacific are expected to witness significant growth in the generative AI in fintech market, with the highest growth rate expected in the Asia-Pacific region.

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.