Online Payment Statistics – By Demographic, Country, Region, Brands, Consumer Attitudes, Problems and Factors Influencing Digital Payments

Page Contents

- Introduction

- Editor’s Choice

- What is Online Payment?

- Pros of Online Payment

- Cons of Online Payment

- General Online Payment Statistics

- Online Payment Statistics by Demographic

- Online Payment Statistics By Shopping Platform

- Online Payment Statistics By Country

- Online Payment Statistics by Region

- Online Payment Statistics by Methods

- Online Payment Statistics by Brands

- Online Payment Statistics by Consumer Attitudes

- Online Payment Statistics by factors influencing digital payments

- Online Payment Statistics by Problems

- Conclusion

Introduction

Online Payment Statistics: Technology is evolving and connecting the world digitally. E-commerce is the biggest industry that has benefited because of digital technology. We can shop from corners of the world as well as in the local markets just by making digital payments. The contactless payment technology boomed during COVID-19 and is expected to reach trillions of transactions globally. We can make mobile payments, in departmental stores, medical shops, grocery shops, or at service providers such as doctors, gym trainers, etc without carrying bundles of cash.

These online Payment Statistics are focused on the American market with exclusive content on the insights from regions.

Editor’s Choice

- Online Payment Statistics state that the global revenue in the digital payment market is projected to reach $14.79 trillion by 2027.

- While making contactless payments, 44% of Americans prefer to receive discounts, coupons, and special offers.

- Only 50% of millennials and Gen Zers are willing to share bank details with third-party service providers.

- From a global perspective, as of 2023, the highest cumulated transaction value is generated in China resulting in $3,639 billion.

- 60% of the users prefer wallets that track payment from multiple payment providers allowing control and transparency.

- 48% of Americans believe that the biometric authentication method makes digital payment more secure.

- 9 out of 10 users in the United States of America were using online payment as of 2022.

- 42% of businesses strongly believe that digital payment methods will help boost instant and B2B payments in the cross-border and cross-currency segments.

- 32% of Americans used debit cards for abroad purchases in 2022.

- Google Pay was the most commonly used in-store payment method in India, Russia, the United Kingdom, and the United States of America in 2022 in the mobile payment segment.

What is Online Payment?

Online Payment, Mobile or Wallet Payment, or Digital Payment or Contactless Payments are word terms for electronic payment systems. It has become easy to attach credit cards to wallets and make payments online. They have a widespread use and money can be transferred to any corner of the world. A million websites accept this type of payment. Moreover, it also becomes a deciding factor for shopping if the company supports online payment or not, otherwise, it will experience major issues to create conversions. Therefore, today it has become a crucial step in running the business online.

Pros of Online Payment

- Online payments save money because they give discounts, cash-back offers, and other vouchers.

- The environment is sustained because demand for cash payment is reduced, as paper requires cutting down trees.

- Your payment has a reach in all corners of the world.

- Easy and hassle-free payments.

- Digital receipts are Immediately offered after the payment.

- Increase the total number of conversions in the case of businesses.

- Wider access in global markets for businesses.

- Multiple options for online payments are available.

- Money in the account is secured by biometric options.

Cons of Online Payment

- There is a limit for monthly or daily digital payments.

- Common data breaches.

- Various security concerns.

- Unknown automatic debits.

- Increases chances of fraud.

- Server or other technical problems.

- Merchant charges.

- It may take around 1 to 2 days to receive a huge amount.

General Online Payment Statistics

- 32% of Americans used debit cards for abroad purchases in 2022.

- 42% of businesses strongly believe that digital payment methods will help boost instant and B2B payments in the cross-border and cross-currency segments.

- More than 76% of adults around the world use at least one mobile money provider.

- 9 out of 10 users in the United States of America were using online payment as of 2022.

- Online Payment Statistics state that the global revenue in the digital payment market is projected to reach $14.79 trillion by 2027.

- While making contactless payments, 44% of Americans prefer to receive discounts, coupons, and special offers.

- The total transaction value of QR Code payments will reach $2.27 trillion by 2025.

- 5% of users prefer online payment in the absence of cash.

- 66% of Americans regularly use mobile wallet payments because they find it more convenient than any other payment method.

| U.S.Consumers | Percentage |

|---|---|

| Using digital payments | 89% |

| Used two or more forms of digital payments | 62% |

| Done in-app and peer-to-peer (P2P) purchase | 69% |

| Expect to have a digital wallet within two years | 60% |

(Source: ecommercetips.org)

- As of 2022, around 89% of people were using digital payments.

- Furthermore, Online payment Statistics state that 62% of the users used two or more two types of applications for contactless payments.

- On the other hand, 69% of the users across the globe completed in-app and peer-to-peer purchases.

- And 60% of users have yet to shift to digital wallets in two years.

Online Payment Statistics by Demographic

- 44% of men and only 26% of women make payments using mobile wallets.

- Discounts and Rewards or offers are deciding factors for online payment for 70% of millennials.

- 60% of the users prefer wallets that track payment from multiple payment providers allowing control and transparency.

- 68% of users in Gen Z are more interested in instant P2P payment than any other generation.

- Only 50% of millennials and Gen Zers are willing to share bank details with third-party service providers.

(Reference: etactics.com)

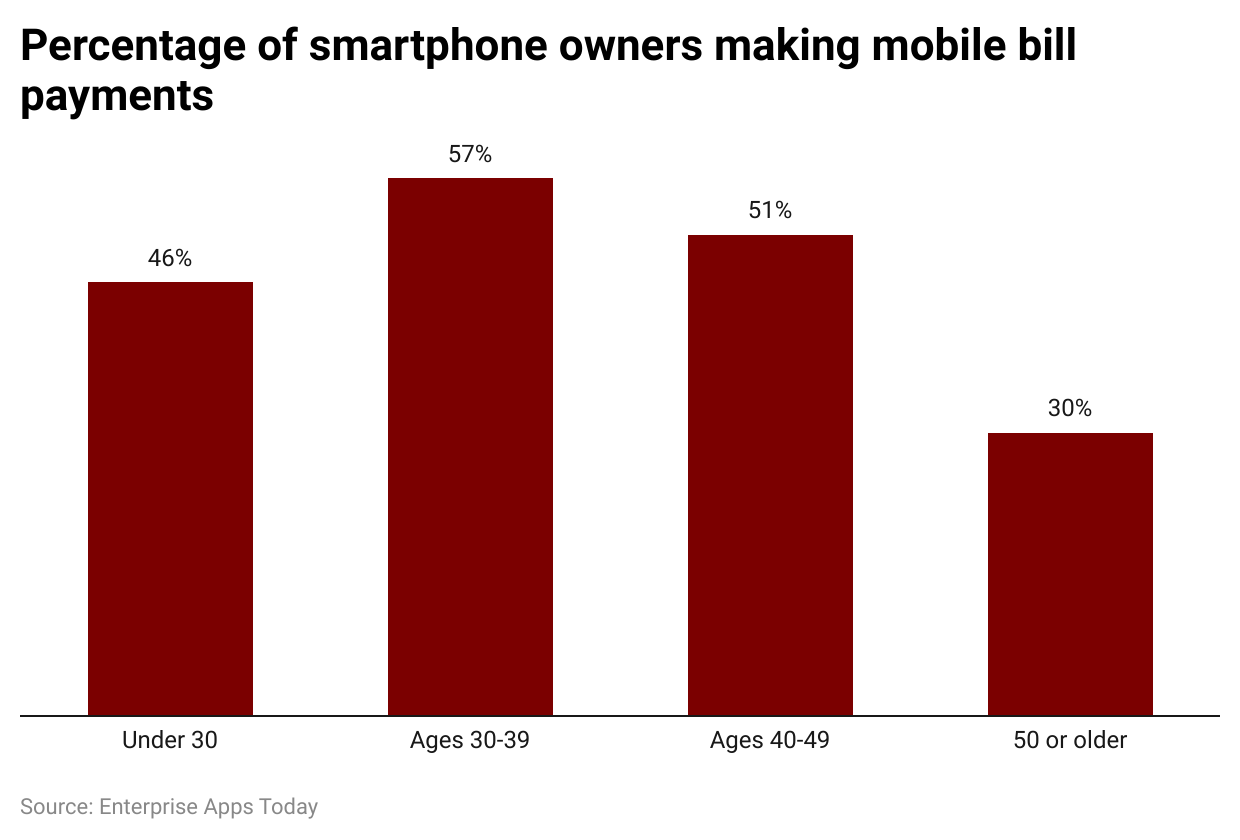

- There are around 46% of the users make mobile payments, while the highest number of users belong to the age group between 30 to 39 years.

- With minor different people aged between 40 to 40 years contribute around 51% in mobile payments.

- Whereas, users of smartphones aged 50 years and above are 30% in total.

Online Payment Statistics By Shopping Platform

(Reference: financesonline.com)

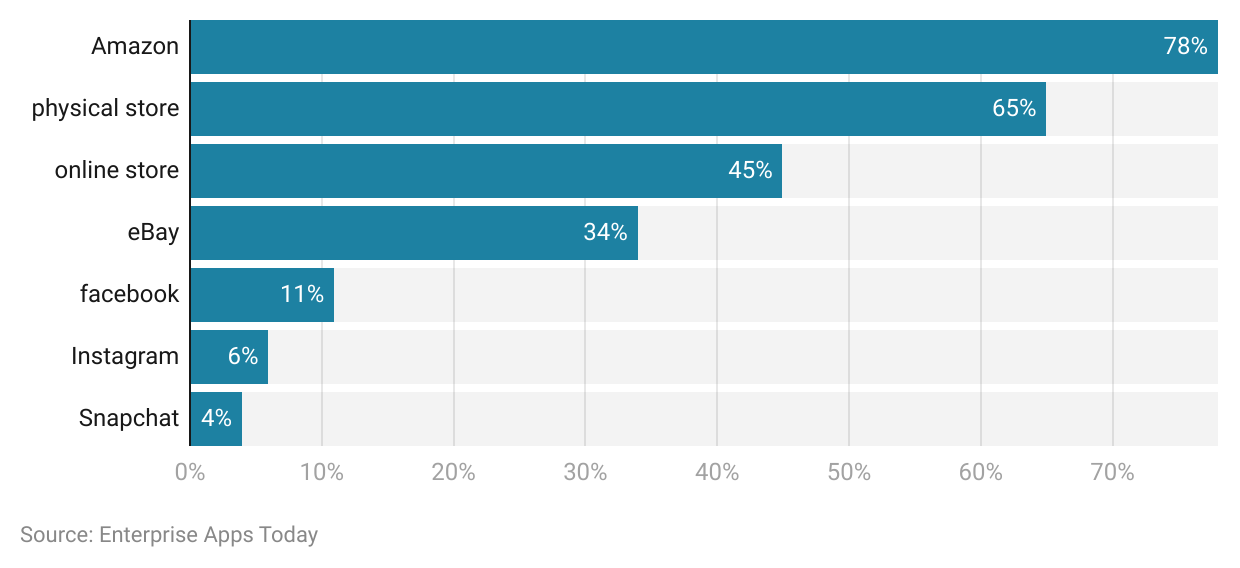

- 78% of Americans make online payments on Amazon, whereas 65% of the users transfer money contactless in physical stores.

- 45% of Americans spend money by online means on online stores while 34% choose eBay.

- Whereas, very few spend on social media platforms such as Facebook (11%), Instagram (6%), and Snapchat (4%).

Online Payment Statistics By Country

(Reference: businessofapps.com)

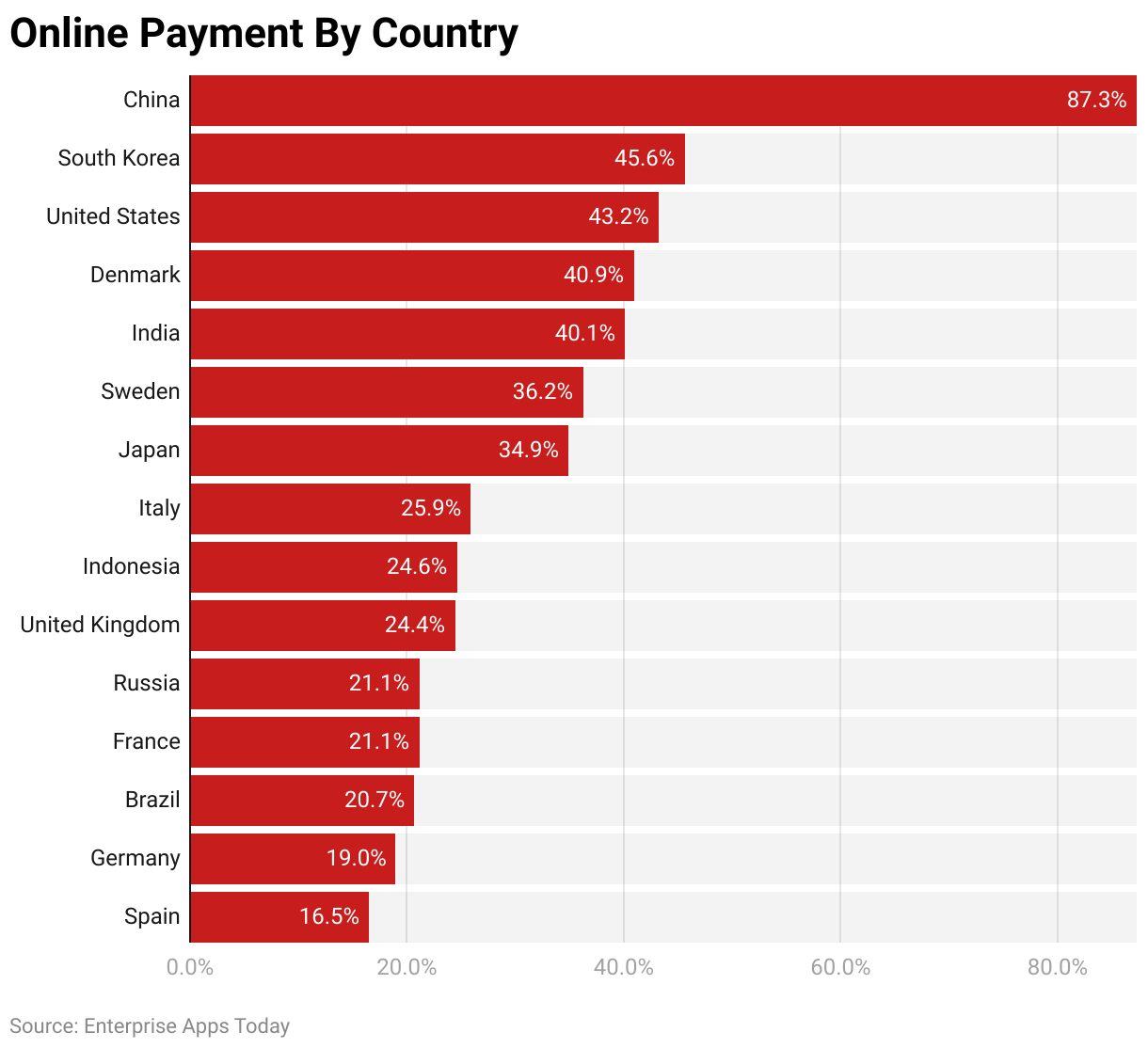

- China is the largest market for mobile payments apps resulting in 87.3% as of 2022.

- The other two countries for capturing the largest market for mobile payments are South Korea (45.6) and the United States of America (43.2).

- In addition, other countries are ranked as Denmark (40.9%), India (40.1%), Sweden (36.2%), Japan (34.9%), Italy (25.9%), Indonesia (24.6%), United Kingdom (24.4%), Russia (21.1%), France (21.1%), Brazil (20.7%), Germany (19%) and Spain (16.5%).

Online Payment Statistics by Region

Worldwide

- The projected global total transaction value in digital payment is $9.46 trillion in 2023.

- From a global perspective, as of 2023, the highest cumulated transaction value is generated in China resulting in $3,639 billion.

- Moreover, the transaction value is expected to change by segment by 13.3%.

- The total transaction value is projected to reach $14.78 trillion by 2027 at a CAGR of 11.80%.

Europe

- The European online payment market is expected to reach $1,795 billion with a change by segment at 17.3% in 2023.

- Similarly, Digital Commerce is expected to generate a total transaction value of $1,225 billion in 2023 being the largest segment.

- The total transaction value is projected to reach $2,994 billion by 2027 at a CAGR of 13.64%.

Africa

- The African largest segment Digital Commerce market is expected to generate a total transaction value of $72.73 billion in 2023.

- Furthermore, the transaction value by segment in 2023 is expected at $146.40 billion with a change by segment at 18.4%.

- It has been estimated that the total value of transactions will reach $265.20 billion by 2027 at a CAGR of 16.01%.

Asia

- The Asian digital payment segment is expected to reach $4.87 trillion in 2023.

- Moreover, the largest segment – Digital Commerce is expected to reach $2.96 trillion of total transaction value in 2023, with a change by segment at 10.3%.

- And the total transaction value is expected to reach $6.95 trillion at a CAGR of 9.29% by 2027.

Americas

- As of 2023, the transaction value by segment in the United States of America is $2,529 billion.

- Moreover, 16% is the transaction value change by segment.

- The total transaction value is projected to reach $4,365 billion by 2027 at a CAGR of 14.62%.

- In the United States of America, the largest segment for Digital Commerce is expected to reach a transaction value of $1,696 billion in 2023.

Online Payment Statistics by Methods

- In the United States of America,35% of users used PayPal for cross-border purchases.

- Credit card and Debit Card payments are the top 2 methods in most common online payments by type segment in the United States of America as of 2022.

Online Payment Statistics by Brands

- Google Pay was the most commonly used in-store payment method in India, Russia, the United Kingdom, and the United States of America in 2022 in the mobile payment segment.

(Reference: statista.com)

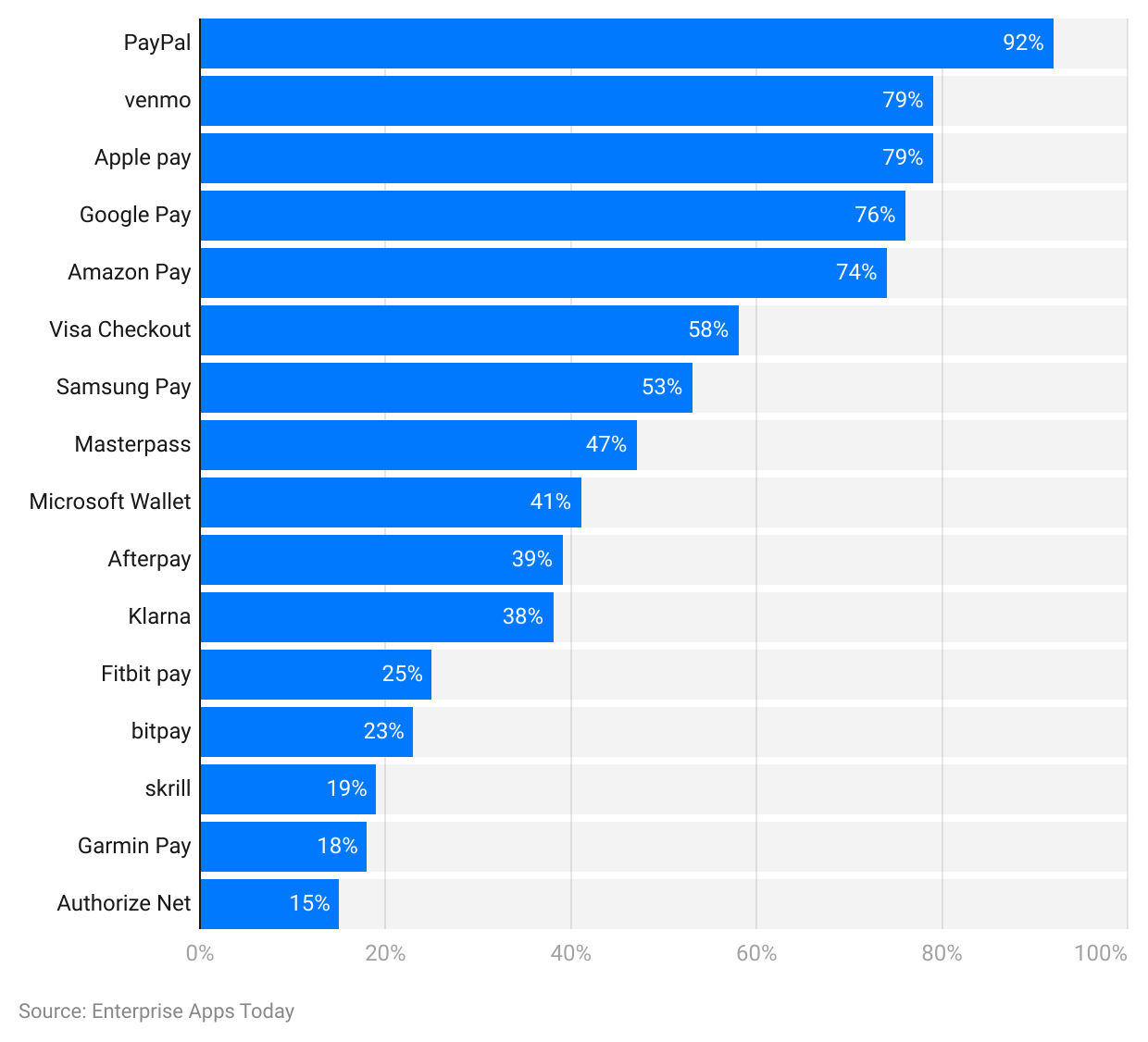

- The top three mobile payment applications in the United States of America as of 2022 are PayPal (92%), Venmo (79%), and Apple Pay (79%).

- Other contactless payment applications used are Google Pay (76%), Amazon Pay (74%), Visa Checkout (58%), Samsung Pay and (53%).

- In addition, other applications in a similar category but less than 50% of users are MasterPass (47%), Microsoft Wallet (41%), AfterPay (39%), Klarna (38%), Fitbit Pay (25%), BitPay (23%), Skrill (19%), Garmin Pay (18%) and Authrize.net (15%).

By Total Users

| Name of Mobile/Digital Wallet | Number of Global Users in 2022 (in millions) |

|---|---|

| Alipay | 650 |

| WeChat Pay | 550 |

| Apple Pay | 507 |

| Google Pay | 421 |

| Paypal | 377 |

| Paytm | 333 |

| PhonePay | 300 |

| Samsung Pay | 140 |

| Venmo | 52 |

| Cash Pay | 36 |

(Reference: meetanshi.com)

- According to the Online Payment Statistics of 2022, AliPay is the most used payment method for having a total number of users resulting in 650 million globally.

- Other top 2 mobile payment applications with the highest number of users globally are WeChat Pay (550 million) and Apple Pay (507 million).

- In addition to these, other applications in the global race are Google Play (421 million), PayPal (377 million), Paytm (333 million), PhonePe (300 million), Samsung Pay (140 million), Venmo (52 million) and Cash App (36 million).

Online Payment Statistics by Consumer Attitudes

- In 2022, 59% of Americans were concerned about online payment fraud.

- Whereas 7 out of 10 consumers are comfortable with those digital payments that don’t require sharing financial details with the merchants while shopping online.

- 48% of Americans believe that the biometric authentication method makes digital payment more secure.

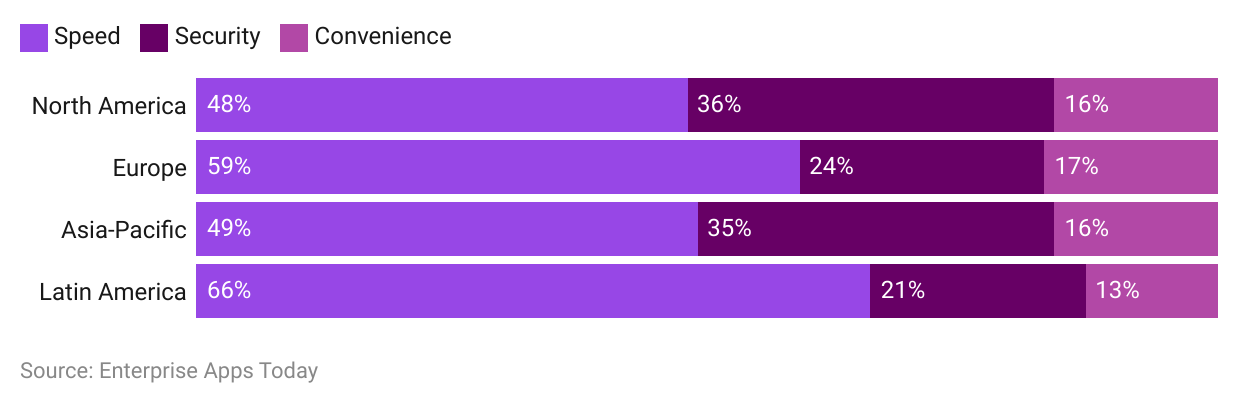

Online Payment Statistics by factors influencing digital payments

(Reference: accenture.com)

Online Payment Statistics by Problems

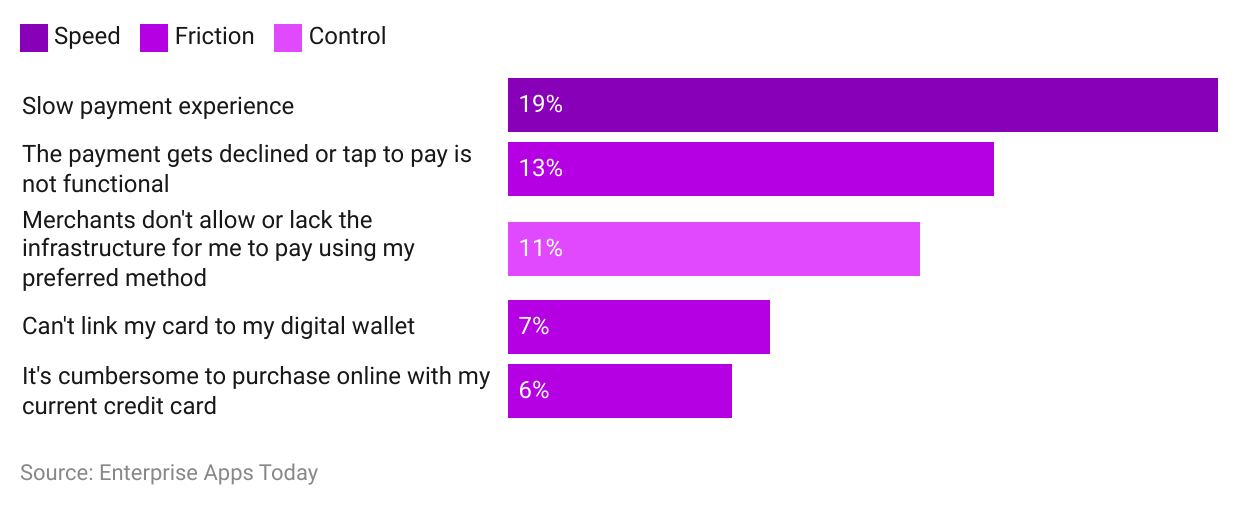

(Reference: accenture.com)

- Around the world, 19% of online payment users experience speed problems.

- Whereas some of them face friction problems such as difficulty in linking the card to the digital wallet (7%), Payment getting canceled, or tap to pay option not working (13%), and problems purchasing using a credit card (6%)

- Whereas, some people say there is a lack of website design to use preferred online payment methods (11%) giving them less control.

Conclusion

These Online Payment Statistics confirm that it has really become easier to make payments online. You just need a bank account and a smartphone to experience contactless payments. Moreover, the most exciting part of such money transfers is, even though you are making payments in your currency, the receiving party will automatically get the amount in their own currency, in this process, the giver and the receiver have no extra work to do.

If you own a business, it is crucial to support various online payment options to attract more people from around the world. But definitely, this is one of the greatest inventions of today.

Sources

FAQ.

Following are the top 5 Applications for Online Payment in 2023 in the United States of America

- Venmo - better for peer-to-peer payments.

- FreshBooks - better for invoicing.

- Wise- better for international payments.

- PayPal - better for convenient payments

- QuickBooks Online mobile- better for invoicing.

PayPal and Google Pay are the most commonly used applications for seamless online payments.

PayPal is one of the best online payment methods for freelancers or small businesses.

Go to your preferred payment method i.e. Apple Pay or Google Pay, then click Add Card, then add your card details or simply scan the card to add it to the system. Insert biometric password and click done.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.