AI In Fintech Market surpass a valuation of USD ~76.2 billion by 2033

Page Contents

AI In Fintech Market Overview

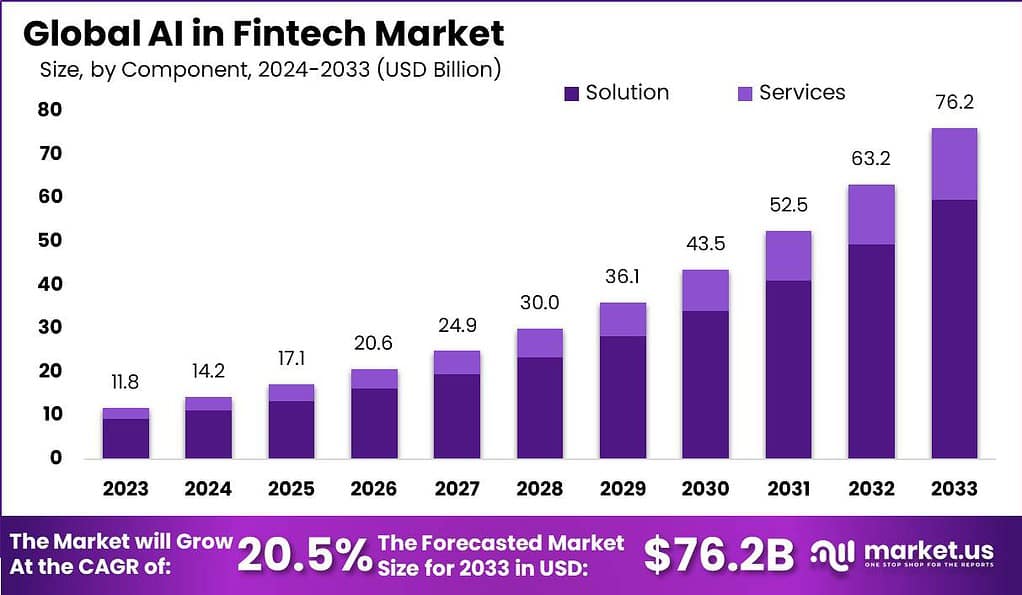

The AI In Fintech Market is experiencing remarkable growth, estimated to reach a substantial value of USD 76.2 billion by 2033, with a strong CAGR of 20.5% throughout the forecast period. This growth is fueled by the application of AI technologies in the financial technology industry to enhance services, improve decision-making processes, and foster innovation.

Artificial Intelligence (AI) in fintech refers to the integration of AI technologies, including machine learning, natural language processing, and robotics, into financial services to enhance operational efficiency, risk management, and customer service. This integration enables the automation of complex financial processes, facilitates personalized customer experiences, and strengthens fraud detection and prevention mechanisms. AI applications in fintech range from algorithmic trading and credit scoring systems to chatbots for customer service and personalized financial advice platforms.

The AI in fintech market is experiencing rapid growth, driven by the increasing demand for automated financial services and advanced analytics for decision-making. Financial institutions are investing significantly in AI technologies to remain competitive, reduce operational costs, and enhance customer satisfaction. The market encompasses a wide range of applications, including payment processing, risk management, asset management, and customer relationship management.

Get Instant Access to Your Visuals-Packed Report, and Request PDF sample

The rise of digital data and advancements in AI and machine learning algorithms have further propelled the market's expansion. As a result, the AI in fintech sector is set to witness substantial growth, characterized by innovative solutions and services that meet the evolving needs of the financial industry.

Analyst Viewpoint

The growth of the AI in fintech market can be attributed to several key factors. Firstly, the increasing availability of big data and the continuous advancements in AI and machine learning technologies have significantly improved the accuracy and efficiency of financial services. Secondly, the growing demand for personalized financial solutions has led to the adoption of AI to deliver customized advice and products. Furthermore, regulatory support for digital financial services has created a conducive environment for the growth of AI in fintech.

Opportunities within the AI in fintech market are abundant, particularly in developing innovative solutions that enhance customer experience, streamline operations, and ensure security. The integration of AI in regulatory compliance and fraud detection presents a significant opportunity for market players to offer value-added services. Additionally, the untapped potential in emerging markets, where financial services penetration is low, offers a vast landscape for the application of AI in expanding access to financial services. As financial institutions continue to navigate the digital transformation, the strategic implementation of AI technologies will be crucial in capturing growth opportunities and sustaining competitive advantage in the fintech sector.

Latest Statistics of AI in Fintech Market

- AI in Fintech market poised to reach USD 76.2 billion by 2033, with a robust CAGR of 20.5%.

- Adoption of AI in financial services sector surged, with 92% of firms investing in AI and machine learning technologies.

- Top AI applications in fintech include risk analytics, predictive modeling, and trade analytics, enhancing decision-making processes.

- North America leads the AI in fintech market, capturing over 41.5% of the global market share in 2023.

- Solution segment dominates the market, capturing over 78.3% market share in 2023.

- Cloud-based deployment mode established dominance, capturing over 62.9% of the market in 2023.

- Analytics & Reporting emerged as the dominant application segment, capturing over 30.7% market share in 2023.

- The World Economic Forum and the Cambridge Center for Alternative Finance report that 85% of financial service providers now employ AI in some capacity.

- More than 80% of banking institutions are in the process of deploying or planning to implement AI solutions.

- The adoption of AI in fintech saw a growth exceeding 40% in 2023, with over 90% of fintech companies incorporating AI in various forms. This figure is anticipated to climb beyond 95% by 2024.

- AI algorithms processed over 75% of digital payments and remittances in 2023, a notable increase from 65% in the previous year. Predictions suggest this could rise to 85% by 2024.

- In the realm of credit underwriting and scoring, over 65% of digital lenders and fintech firms leveraged AI-powered solutions in 2023. Traditional banks have also embraced this trend, with adoption rates jumping to over 35% from 20% in 2022.

- The efficacy of fraud prevention has been enhanced by more than 50% through AI systems' capability to identify new patterns of fraud. The market sector for AI-powered cybersecurity is projected to reach $30 billion by 2024.

- AI initiatives have demonstrated potential to slash operational costs for banks by 22% while boosting revenues by 34%.

- Over 60% of financial institutions are utilizing or experimenting with AI for fraud prevention and detection.

- The deployment of chatbots and robo-advisors powered by AI could supplant human roles, potentially saving the banking industry approximately $490 billion.

- The primary applications of AI in finance have been identified as personalized recommendations (32%), predictive analytics (27%), and customer service chatbots (19%).

- An overwhelming 86% of organizations believe that AI will be pivotal in how banks deliver value to their customers in the future.

- 80% of banks are confident that AI will significantly aid in regulatory compliance by enhancing risk oversight.

- The most significant uptake of fintech AI has been observed in developed countries such as the US, UK, and Japan, while emerging markets are yet to catch up fully.

- Prominent players driving innovation include IBM Corporation, Microsoft Corporation, and Google LLC.

Best 8 ways AI can help in the FinTech industry:

Artificial Intelligence (AI) has been a game-changer for the FinTech industry, offering innovative solutions to complex problems. Here are the eight best ways AI contributes to the sector:

- Enhanced Customer Service: AI-driven chatbots and virtual assistants provide 24/7 customer support, handling inquiries and resolving issues efficiently. This not only improves customer experience but also reduces operational costs.

- Fraud Detection and Prevention: By analyzing transaction patterns and identifying anomalies, AI algorithms can detect and prevent fraudulent activities in real-time, significantly reducing the risk of financial losses.

- Credit Scoring and Underwriting: AI improves the accuracy of credit scoring by considering a wider range of factors, including non-traditional data. This enables lenders to make more informed decisions and extend credit to underserved segments.

- Personalized Banking Experience: AI can analyze customer data to offer personalized financial advice, product recommendations, and investment strategies, enhancing customer engagement and satisfaction.

- Operational Efficiency: Through automation and AI-driven processes, financial institutions can streamline operations, reduce manual errors, and save time, resulting in cost savings and increased productivity.

- Regulatory Compliance: AI systems can monitor transactions and customer activity to ensure compliance with regulatory requirements, reducing the risk of fines and penalties for financial institutions.

- Risk Management: By leveraging predictive analytics, AI can forecast market trends, assess loan risks, and identify potential defaulters, enabling better risk management strategies.

- Blockchain and Cryptocurrency: AI enhances the security and efficiency of blockchain transactions and cryptocurrency trading by identifying patterns, predicting market movements, and automating trading processes.

Top AI Use Cases in Fintech

Artificial Intelligence (AI) has significantly transformed the FinTech industry, driving innovations and enhancing efficiencies across various financial services. The top AI use cases in FinTech are:

- Customer Service and Support: AI-powered chatbots and virtual assistants provide round-the-clock customer service, handling queries, and offering solutions instantly. This improves customer experience while reducing operational costs.

- Wealth Management and Robo-Advisory Services: AI-driven robo-advisors provide automated, algorithm-based portfolio management advice, making wealth management services more accessible and affordable.

- Payment and Money Transfer Services: AI enhances the efficiency and security of digital payments and remittances, enabling faster transaction processing and improved anti-fraud measures.

- Market Prediction and Trading: AI algorithms analyze market data to predict trends, providing insights that help investors and traders make informed decisions.

- Payment Processing and Fraud Prevention: AI streamlines payment processing by quickly validating transactions and employing sophisticated algorithms to prevent fraud, ensuring safe and efficient payment ecosystems.

- Insurance Underwriting and Claims Processing: In the insurance sector, AI transforms underwriting by accurately assessing risk profiles, and speeds up claims processing through automated verification, significantly improving customer satisfaction and operational efficiency.

- Data Analytics and Insights: AI's prowess in data analytics enables financial institutions to derive actionable insights from vast datasets, informing strategy, improving customer understanding, and identifying new market opportunities.

Top Market Leaders

The FinTech industry is undergoing a transformative shift, largely driven by the integration of Artificial Intelligence (AI) across various applications, with key players spearheading this change. IBM Corporation is at the forefront, leveraging its vast AI expertise to enhance industry-specific solutions. Microsoft Corporation's Azure AI platform provides essential tools for developing advanced AI models, optimizing customer experience and operational efficiency. Google LLC offers TensorFlow and cloud-based AI services, crucial for developing analytical solutions that accurately predict financial trends.

Amazon Web Services, Inc. delivers scalable and secure AI services, facilitating insightful analytics and decision-making for FinTech companies. Nuance Communications, Inc. enhances customer service through its advanced voice recognition and conversational AI technologies. Axyon AI specializes in deep learning, transforming data into predictive insights for the financial sector. ForwardLane uses AI to personalize financial advice, demonstrating the impact of AI in wealth management.

Salesforce, Inc. integrates AI into CRM, improving customer engagement and retention for FinTechs. SAS Institute Inc. supports risk management and fraud detection with its analytics and data management solutions. Mastercard Inc. applies AI in securing transactions and preventing fraud. Inbenta Technologies Inc. improves customer support through natural language processing. Amelia.ai automates customer service with human-like interactions, increasing efficiency and satisfaction. Together, these key players and others are redefining FinTech through AI-driven innovations, enhancing service delivery, security, and customer engagement.

Recent Developments

1. Salesforce:

- In February 2023, Salesforce made a significant move by acquiring Vectra AI, an AI-powered data security platform, for $1.12 billion.

- This strategic acquisition aims to bolster Salesforce's security solutions, potentially introducing advanced AI-powered threat detection capabilities into their Financial Services Cloud, enhancing the security and efficiency of financial operations.

2. Mastercard:

- Throughout 2023, Mastercard has been focusing on leveraging AI across various areas, including enhancing fraud detection, improving risk management, and personalizing customer experiences.

- Despite their investments in AI, Mastercard has not announced any specific acquisitions or launched products exclusively focused on AI in FinTech during 2023.

3. Google:

- Google LLC, through its Google Cloud platform, provides a suite of AI and machine learning tools that cater to the FinTech sector, offering solutions in fraud detection, risk management, and data analytics.

Summary

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.