CRM Evaluations Not Thorough Enough?

Page Contents

CRM sales hit $23.2 billion in 2014, an increase of 13.3 percent from 2013, according to Gartner. The research firm expects CRM's healthy growth to accelerate even more, reaching sales of $36.5 billion by 2017. In fact, CRM leads all enterprise software categories in projected growth, with a compound annual growth rate (CAGR) of 15 percent from 2012 to 2017, according to the research firm.

With numbers like that, CRM vendors must be doing something right. It seems so, based on a new report from software selection site Capterra, which found that 71 percent of CRM users are satisfied with their software. Only 11 percent of companies surveyed by Capterra reported being dissatisfied with their CRM.

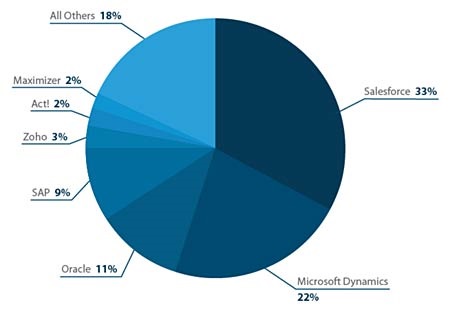

While there are hundreds of CRM options available, Capterra found just a few vendors dominate the market. Salesforce CRM was used by 33 percent of respondents, with Microsoft, SAP and Oracle accounting for another 42 percent of the market.

The lopsided nature of the market may account, in part, for the fact that CRM buyers conduct relatively few product demonstrations before buying, said Katie Hollar, Capterra's director of marketing.

The lopsided nature of the market may account, in part, for the fact that CRM buyers conduct relatively few product demonstrations before buying, said Katie Hollar, Capterra's director of marketing.

Capterra found that just 38 percent of companies did more than two demos, she said.

“I think the tendency is for buyers to ask friends and colleagues what systems they've used, do a search online and just go with whichever one or two they find first,” Hollar said. “Unfortunately, that is a dangerous way to select software. What works for one business could be far too expensive, cumbersome or advanced for the next business.”

She encouraged companies to consider more options in the CRM evaluation stage. “Most people have heard of Salesforce. So they demo Salesforce and decide since it's the most popular, that's what they'll go with. But they're missing out on all of the niche CRM solutions and small business alternatives that could be a much better fit for their needs. At least give them a look!”

CRM and Marketing

CRM is increasingly used by marketing organizations, the report found. Sales departments are power users, with 80 percent of respondents saying sales had access to a CRM system. The marketing team was the second highest in terms of CRM usage at 46 percent, just edging out the customer service function. In addition, 44 percent of CRM users had integrated with a marketing automation system.

“This shows that the marketing component of CRM is growing very fast,” Hollar said. “Even a few years ago, CRM was more thought of as a salesforce automation and sales enablement tool, but it's good to see that businesses are now using their CRM to reach prospects and customers throughout the entire funnel.”

Number of customers is one of the key components in CRM adoption, Capterra found. Two-thirds of respondents had at least 100 customers when they first purchased CRM software, and more than a quarter had more than 1,000 customers. “The number of customers being over 100 is the best indicator of whether you're ready or not” for CRM, according to the report.

Cloud CRM

Like Gartner, which said 47 percent of all CRM revenue in 2014 came from software-as-a-service (SaaS) applications, Capterra found CRM buyers increasingly prefer cloud deployments. Only 2 percent of survey respondents said they preferred on-premise CRM. The two leading verticals for on-premise CRM are hospitality, at 67 percent, and nonprofits, at 50 percent.

Those two industries tend to be a bit slower in terms of technology adoption, Hollar said. “I expect that hotels and nonprofits may have adopted an on-premise CRM back when those were more common, and because they have all of their legacy data and history tied up in the on-premise solution, they've just delayed making the switch.”

“The operational risk is fairly high for a hotel if new technology fails, plus, since the industry is mostly franchised, it can take a while for new systems to roll out and take effect. Similarly, nonprofits are often working on tight budgets, and investing in a new CRM may not fall high on the list of possible expenses,” she added.

The three features used the most were calendar management, cited by 52 percent of respondents, followed by email marketing (50 percent) and quote/proposal management (46 percent).

Social CRM

In terms of desired features, companies expressed interest in CRM capabilities that leverage social media. A quarter of respondents wanted social media monitoring functionality, and 24 percent said they wished their CRM system could pull prospect information from social media profiles.

Those numbers surprised Hollar, who thinks CRM vendors have been pretty proactive about adding social features to their products.

“Social CRM has been a hot topic among industry experts for years now. And we've seen plenty of CRM acquisitions of social media marketing and monitoring solutions that have been baked into the CRMs, such as Salesforce's acquisition of Radian6 and Oracle's acquisition of RightNow,” she said. “I think the problem is more the lack of education from vendors about these new features to their existing customer base. Often, if you're already a user, the add-on social media functionality comes at an additional cost, and if you weren't aware of that functionality when you first purchased your CRM, you may not know that it now exists.”

Ann All is the editor of Enterprise Apps Today and eSecurity Planet. She has covered business and technology for more than a decade, writing about everything from business intelligence to virtualization.

Public relations, digital marketing, journalism, copywriting. I have done it all so I am able to communicate any information in a professional manner. Recent work includes creating compelling digital content, and applying SEO strategies to increase website performance. I am a skilled copy editor who can manage budgets and people.