Trading Software: A Strategic Approach for Organizations

Page Contents

- Customizability in Trading Platforms Holds Allure for Traders

- Having Your Own Analytics Can Upgrade Your Strategy

- Psychological Advantages of an Individual Trading Environment

- Predictive Analytics

- Continuous Learning for Continuous Improvement

- Balance Automation With Human Intuition

- Regulation's Impact on Customization

- Prospects and Their Consequences

In the unpredictable world of Forex and Crypto trading, personalizing your platform gives you an edge – it's a critical tool to navigate these choppy waters. Customizing one's investment platform should not just be seen as an indulgence but an essential means to improve decision-making ability and performance.

Customizability in Trading Platforms Holds Allure for Traders

Imagine investing environments tailored precisely to your style and preferences. This imagination is made real by powerful platforms such as the TradingView app that enable traders to customize every tool, data set, and alert according to their styles and strategies. On these platforms, traders can craft their dashboards to closely watch anything from foreign exchange rates to the rollercoaster world of cryptocurrency.

Having Your Own Analytics Can Upgrade Your Strategy

Investment software tailored to a trader's specific goals, and their tactics makes the output more targeted, timely, and actionable, giving traders a tool to spot opportunities others miss. When software is tailored specifically for an individual user's goals and tactics, its output becomes even more targeted, timely, and actionable. This gives traders a tool they need to spot opportunities others miss.

Using Smart Automation Tech Has Really Paid Off

At a time when time is as valuable as currency traded, automation stands out as an invaluable feature of personalized trading software. By setting automatic rules for trade entries and exits and risk management, traders can execute strategies more precisely while meeting individual traders' risk tolerance, investment objectives, and trading times with this intelligent automation.

Psychological Advantages of an Individual Trading Environment

Trading can be both psychologically and technically daunting, making a profoundly introspective interface all the more helpful in maintaining clarity when faced with market turmoil. When markets get crazy, having a clean, distraction-free investment interface helps keep your head straight for intelligent decision-making.

In Today’s Ever-Changing Trade Scene, Software for Trading Is Shining

Financial markets change rapidly, necessitating tools that change with them. Customized trading software must adapt and learn according to each trader's pattern of trades; its software should adapt continuously with each transaction for maximum utility. With each trade completed through personalized software, its adaptation becomes ever more refined as feedback loops constantly improve user experiences.

With traders adapting software to suit their strategies, the need for effective security measures increases exponentially. Personalized trading systems must use top-notch security tech to keep private data safe. Furthermore, adaptive measures that detect potential threats must also be used as this guarantees their ecosystem remains uncompromised from intrusions or breaches.

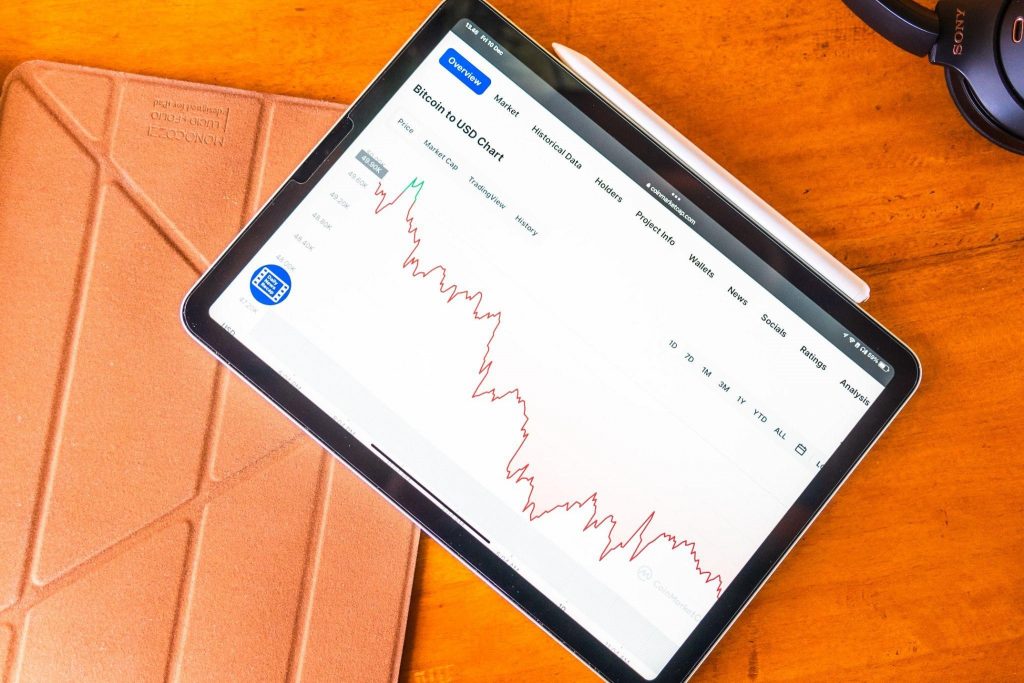

Predictive Analytics

Predictive analytics offer personalized trading software an edge in terms of accuracy. By drawing on historical market data and current market trends, advanced systems such as predictive analytics can accurately forecast potential market movements with great precision. This gives traders a significant edge by suggesting personalized trade adjustments ahead of considerable market events rather than responding reactively.

Continuous Learning for Continuous Improvement

Trading is an ongoing journey of exploration and adaptation; therefore, personalized trading software should reflect this dynamic learning journey. Platforms incorporating machine learning algorithms can analyze past decisions to highlight strengths and suggest improvements. This continuous feedback loop ensures the software evolves alongside your experience and knowledge as your journey unfolds.

Balance Automation With Human Intuition

Automation may be at the core of modern trading software, yet human intuition remains invaluable. The best-personalized trading platforms strike an effective balance between automated operations and leaving room for human intuition to guide decisions. The sweet spot in trading platforms is where human instinct meets automated processes, creating a harmonious blend.

User Experience Should Be a Top Priority When Designing Interfaces

The design of a trading platform's interface is critical. It's the front door for traders to enter markets and can make or break their experience. An interface tailored to meet a trader's needs can drastically decrease the learning curve and maximize overall efficiency. Aiming for an experience where tools and information become an extension of thought processes allows a smooth progression from analysis to action traders take.

Mobile and Desktop Trading Have Come Together in Recent Times

The line between mobile and desktop investing platforms has blurred in our speedy modern world, crafting a smooth trade experience across all gadgets. A personalized platform must deliver this consistency seamlessly, allowing traders to move seamlessly from device to device while enjoying personalized environments wherever and whenever needed. Synchronizing preferences, charts, and watchlists ensures traders always have access to a customized environment when required.

Regulation's Impact on Customization

While customization offers numerous advantages, it must also operate within regulatory compliance parameters. Investment software must adapt to meet users' preferences and comply with legal frameworks governing financial investment activities. Striking the right balance between personalizing the software and adhering to legal rules is critical to keeping legitimizing traders’ experience.

Backtesting in Strategy Development Must Be Considered

Because backtesting lets you try out strategies to see how they would have done historically, it can help traders tweak their methods and gain confidence before using them with real money.

Prospects and Their Consequences

Financial organizations seeking to customize software should take an inclusive approach when customizing it for themselves or their users, focusing not only on technical but also on design, user experience, compliance, and scalability of platforms as critical considerations in personalization. With traders increasingly searching for tools that give them a competitive advantage in market environments explicitly personalized for them, demand will only increase. Platforms that meet this need while upholding security, compliance, and continuous improvement will set themselves apart as leaders within their industries and deliver their users the ultimate investing experience.

Wayne Kernochan has been an IT industry analyst and auther for over 15 years. He has been focusing on the most important information-related technologies as well as ways to measure their effectiveness over that period. He also has extensive research on the SMB, Big Data, BI, databases, development tools and data virtualization solutions. Wayne is a regular speaker at webinars and is a writer for many publications.