2G and 3G Switch Off Market Revenue USD 274.72 million by 2032 + Thriving Opportunities

Page Contents

Market Overview

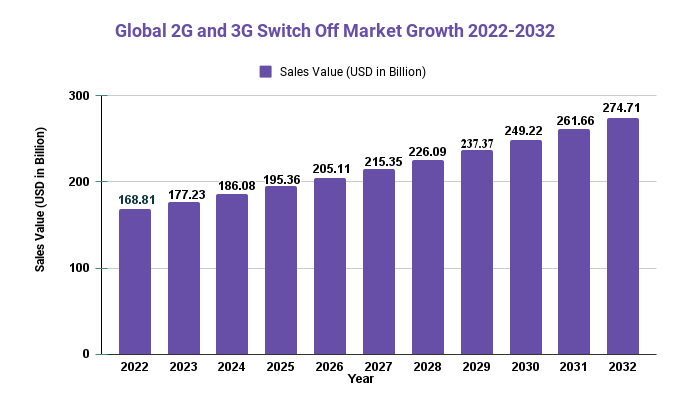

Published Via 11Press: The global 2G and 3G Switch Off market size was valued at USD 168.81 million in 2022 and is expected to expand at a CAGR of 4.99% during the forecast period, reaching USD 274.72 million by 2032.

The 2G and 3G Switch Off market refers to the gradual removal of 2G and 3G networks in favor of newer technologies such as 4G and 5G. This transition is being driven by several factors, including increasing demand for faster data speeds, efficient spectrum use, and rising maintenance costs associated with legacy networks.

The switch-off of 2G and 3G networks is expected to have a profound effect on the telecommunications industry, freeing up spectrum resources that can be utilized for expanding the capacity of newer networks. This will enable telecom operators to offer faster data speeds, reduced latency times, and superior network performance to their customers.

Get a Sample PDF of the Report at– https://market.us/report/2g-and-3g-switch-off-market/request-sample

Key Takeaways

- The global 2G and 3G Switch Off market is forecast to reach USD 76.25 billion by 2026, growing at a compound annual growth rate (CAGR) of 25.1% between 2021-2026.

- The 2G and 3G Switch Off market refers to the gradual transition away from 2G and 3G networks in favor of newer technologies like 4G and 5G. This transition is being spurred on by several factors, including increasing demand for faster data speeds, efficient spectrum use, and rising maintenance costs for legacy networks.

- Decommissioning 2G and 3G networks is expected to have a major impact on the telecom industry, freeing up spectrum resources that can be put towards expanding capacity on more modern networks. This will give telecom operators the ability to offer faster data speeds, reduced latency times, and enhanced network performance to their customers.

- Strong market growth: The 2G and 3G Switch Off market is expected to grow rapidly in the coming years, particularly in developed regions where the switch-off of legacy networks is already underway.

- Regulatory challenges: The switch-off of legacy networks presents regulatory challenges, particularly in terms of ensuring that all users have access to basic mobile services during the transition to newer technologies.

Regional Snapshot

- North America: The transition away from 2G and 3G networks in North America is well underway, with most major telecom operators either having already decommissioned their legacy networks or planning to do so soon.

- Europe: Europe has become a mature market for 4G and 5G networks, with many countries transitioning off 2G and 3G services. However, some regions still rely heavily on legacy infrastructure – particularly in rural areas.

- Asia-Pacific: In comparison to North America and Europe, Asia-Pacific has lagged behind when it comes to transitioning away from 2G and 3G networks, with many countries still relying on legacy infrastructure for basic mobile services.

- Latin America: The transition away from legacy networks in Latin America is expected to take longer than in other regions, as many countries are still in the early stages of 4G and 5G network adoption.

- Middle East and Africa: Transitioning away from legacy networks in the Middle East and Africa is expected to be gradual due to the difficulty of upgrading infrastructure in these regions, as well as the large number of users who still rely on basic mobile services.

Market Dynamic

Drivers

- Growing demand for higher data speeds and superior network performance: The growing need for faster data services as well as improved network performance is propelling the adoption of 4G and 5G networks, with many discontinuing legacy networks like 2G or 3G.

- Need for Spectrum Resources: Shutting down legacy networks will free up valuable spectrum resources that can be utilized to expand the capacity of newer networks, enabling telecom operators to offer faster data speeds and improved network performance.

- Cost Savings for Tele Operators: Disconnecting legacy networks can result in cost savings for telecom operators, as they no longer need to maintain and support older infrastructure. This frees them up to invest in more modern technologies and improve their overall network performance.

- Improved network efficiency: 4G and 5G networks are more spectrum efficient than their predecessors, meaning they can support more users and offer faster data speeds with the same amount of spectrum. This has become a key motivating factor behind the switchoff from legacy networks.

- Regulatory Mandates: Some governments and regulatory bodies have mandated the shutting down of legacy networks in an effort to promote the adoption of more modern technologies and enhance overall network performance.

Restraints

- Cost of Upgrading Infrastructure: For some telecom operators, the expense of upgrading infrastructure to support newer technologies like 4G and 5G can be a significant barrier, particularly in developing countries or rural areas where user bases may be smaller.

- User Reliance on Legacy Networks: Some users may still rely on legacy networks like 2G and 3G for basic mobile services, without the means to upgrade to newer technologies. This makes it difficult for telecom operators to shut down legacy networks without leaving some users without access to mobile services.

- Technical Challenges: Transitioning away from legacy networks can present technical difficulties, particularly for telecom operators with complex and interconnected networks. This may cause delays and disruptions during the transition period.

- Regulatory Challenges: Some countries may face regulatory barriers when switching off legacy networks, or may need a longer transition period to guarantee all users access to mobile services.

- Network Coverage Issues: Some areas may lack coverage for newer technologies like 4G and 5G, making it difficult to switch off legacy networks without leaving some users without access to mobile services.

Inquire more or share questions if any before the purchase on this report at: https://market.us/report/2g-and-3g-switch-off-market/#inquiry

Opportunities

- Increased Demand for 4G and 5G Services: As legacy networks transition away, demand will increase for faster data speeds provided by newer technologies like 4G and 5G. This presents telecom operators with an opportunity to expand their user base as well as boost revenues through these services.

- The emergence of New Services and Applications: The adoption of 4G and 5G networks will open the door for the development of new services that require high-speed data connectivity, such as IoT applications and augmented/virtual reality experiences. This presents telecom operators with an opportunity to offer these new offerings while creating additional revenue streams.

- Increased Spectrum Availability: The decommissioning of legacy networks will release valuable spectrum resources that can be utilized to expand the capacity of newer networks, allowing telecom operators to offer faster data speeds and superior overall network performance. This increased spectrum availability presents telecom operators with an opportunity to enhance their services and differentiate themselves from competitors.

- Cost Savings for Tele Operators: Shutting down legacy networks can result in cost savings for telecom operators, as they no longer need to maintain and support older infrastructure. This frees them up to invest in more modern technologies and enhance their overall network performance.

- Increased Network Efficiency: 4G and 5G networks are more spectrum efficient than 2G and 3G, meaning they can support more users and offer faster data speeds with the same amount of spectrum. This presents telecom operators with an opportunity to enhance their services and differentiate themselves from competitors.

Challenges

- User Migration: As legacy networks transition away, users must migrate to more modern technologies like 4G and 5G. However, this transition process may take a considerable amount of time for those in rural or remote areas, leading to a slow migration pace and an extended transition period.

- Interference with Other Networks: Disabling legacy networks can cause interference with other networks that share the same spectrum, disrupting services and impacting users.

- Infrastructure Upgrade Costs: Upgrading infrastructure to support modern technologies like 4G and 5G can be expensive, especially for smaller telecom operators. This could cause delays in the switch-off of legacy networks and slow migration towards more modern ones.

- Regulatory Challenges: Some countries may face regulatory barriers that prevent the switch-off of legacy networks, or require a longer transition period to guarantee all users have access to mobile services. This could delay the process and prolong transition periods.

- Network Coverage Issues: Some areas may lack coverage for newer technologies like 4G and 5G, making it difficult to transition away from legacy networks without leaving some users without access to mobile services. This presents challenges in ensuring all users have access to mobile services during the transition period.

Key Market Segments

Type

- 2G

- 3G

- 4G

Application

- Message

- Voice

- Data

- Video

Key Market Players included in the report:

- AT&T

- Verizon

- China Mobile

- NTT

- Telefonica

- Deutsche Telekom

- America Movil

- Orange

- China Telecom

- KDDI

- China Unicom

- AIS

- T-Mobile

- Bell Canada

- Telus

- Telenor

- Swisscom

- SK Telecom

- Korea Telecom

Recent Developments

- Australia: Telstra, Australia's largest mobile network operator, announced plans to switch off its 3G network by June 2024. This move will free up spectrum resources that can be utilized for improving 4G and 5G services.

- India: The Indian government has set a goal to shut down all 2G networks by March 2023, freeing up the spectrum for 4G and 5G services. Furthermore, they plan to auction spectrum in 700 MHz, 800 MHz, 900 MHz, 1800 MHz, 2100 MHz, 2300 MHz, and 2500 MHz bands.

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 168.81 Bn |

| Revenue forecast by 2032 | USD 274.72 Bn |

| Growth Rate | CAGR Of 4.99% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Frequently Asked Questions

Q: What is the market size of the 2G and 3G Switch Off market?

A: The market size of the 2G and 3G Switch Off market is expected to reach USD 274.72 billion by 2032, growing at a CAGR of 4.99% from 2022 to 2032.

Q: Who are the key players in the 2G and 3G Switch Off market?

A: The key players in the 2G and 3G Switch Off market include AT&T, Verizon, China Mobile, NTT, Telefonica, Deutsche Telekom, America Movil, Orange, China Telecom, KDDI, China Unicom, AIS, T-Mobile, Bell Canada, Telus, Telenor, Swisscom, SK Telecom, Korea Telecom.

Q: Which regions are expected to dominate the 2G and 3G Switch Off market?

A: The Asia Pacific region is expected to dominate the 2G and 3G Switch Off market during the forecast period, due to a high rate of adoption of 4G and 5G technologies and government initiatives to phase out legacy networks. Europe and North America are also expected to see significant growth, driven by increased investment in 5G networks and government regulations around spectrum allocation.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.