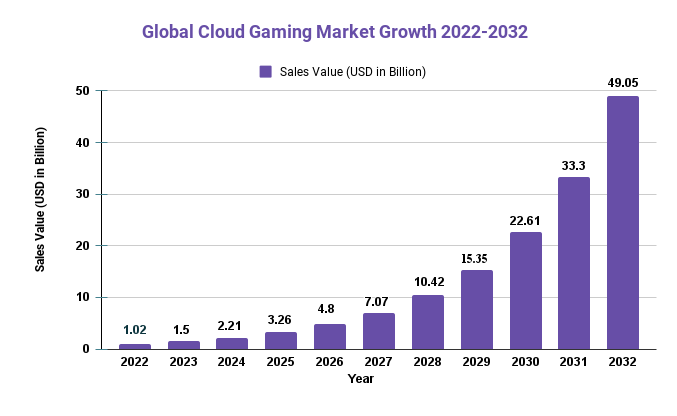

Cloud Gaming Market Value to Hit USD 49.05 Billion by 2032 | At a CAGR of 47.3%

Page Contents

Market Overview

Published Via 11Press: The increased availability of game streaming services coupled with enhanced data speeds is also contributing to the growth of this market. Additionally, various companies such as Microsoft Corporation, Google LLC, and Sony Corporation are investing heavily in research & development activities related to cloud gaming technologies which are further propelling its usage across multiple regions worldwide.

The global Cloud Gaming market is estimated to be valued at USD 1.02 Billion in 2022, and it is expected to reach USD 49.05 Billion by 2032 with a CAGR of 47.3% during the forecast period.

Companies like Amazon Web Services and Subnation have also launched dedicated platforms for gamers that provide them access to AAA games with enhanced graphics quality at an affordable cost thereby augmenting its demand in both developed as well as developing countries across all age groups in recent times.

Request For Sample Report Before Purchasing: https://market.us/report/cloud-gaming-market/request-sample

Key Takeaways

- The Cloud Gaming market grew to USD 1.02 Billion in 2022.

- Forecasted compound annual growth rates between 2022 and 2032 is 47.3%.

- By 2032, the Cloud Gaming market is projected to reach USD 49.05 Billion.

- This market was driven by increasing gaming adoption as an entertainment medium, advances in cloud technology, and growing access to high-speed internet.

- Subscription-based cloud gaming was the most popular model among consumers, accounting for more than 70% of the market share by 2020. This popularity stems from its cost efficiency, convenience, and ease of use.

- Over the forecast period, the Asia Pacific region experienced a CAGR exceeding 30% for cloud gaming due to a large number of gamers present and increasing access to high-speed internet.

Regional Snapshot

- North America: North America was the leading regional market for cloud gaming in 2020, accounting for over 40% of the market share. This growth was due to numerous influential actors, widespread cloud computing usage, and fast internet accessibility. The United States led this region followed by Canada.

- Europe: Europe was the second-largest regional market for cloud gaming in 2020, accounting for over 30% of the market share. This growth was due to rising interest among players, fast internet access, and the presence of significant players within the area. Germany, France, and the United Kingdom led this charge with their respective markets accounting for over 30% each.

- Asia Pacific: With a compound annual growth rate (CAGR) of over 30% during the forecast period, Asia Pacific was the region with the fastest-growing cloud gaming market. This growth was fuelled by the increasing popularity of gaming as entertainment, high-speed internet penetration rates, and an established gaming community in the area. The major markets included China, Japan, and South Korea.

- Latin America: With a compound annual growth rate (CAGR) of over 25% during the projection period, Latin America was an impressive but rapidly expanding regional market for cloud gaming. This was driven by an increased player interest in cloud gaming, high-speed internet access, and increasing expenditures on gaming infrastructure. The two leading markets in this area were Brazil and Mexico.

- Middle East and Africa: With a compound annual growth rate (CAGR) exceeding 20% over the forecast period, the Middle East and Africa were relatively small regional markets for cloud gaming. This growth was spurred by increasing interest in gaming as entertainment, the expansion of high-speed internet connections, and investments made into gaming infrastructure. The biggest markets within this region were Saudi Arabia, South Africa, and the United Arab Emirates.

Drivers

Growth of Cloud Gaming as 5G Takes Off spam despite advances in data networking technology, there are still limitations to mobile cloud gaming. 4G networks lack dependability and speed, while fast broadband infrastructure may not always be accessible. Due to last-mile packet loss and network congestion, performance standards may not be met when players are close to cloud servers. Even small delays due to input latency from button presses, gestures, or external input may cause noticeable delays. 5G promises to solve these issues so many organizations are venturing into mobile cloud gaming.

5G makes efficient use of the signal spectrum through mmWave technology. MMWave utilizes larger bandwidth frequencies than TV and radio communications, making it ideal for areas with high user densities and dense population densities. Furthermore, by using an unlicensed frequency, gaming traffic may be offloaded from congested areas.

Restraint

- Low Bandwidth Issues

Cloud gaming requires real-time rendering to deliver seamless gaming experiences that meet players' expectations. Low latency must be combined with high resolutions and frame rates in order to meet these requirements, though current internet technology speed cannot match what players desire. As a result, cloud gaming services are less popular in developing countries where broadband penetration levels are low – leaving them with traditional gaming options only. With modern games featuring ever-changing images, data transmission has increased exponentially to meet this need.

Highspeedinternet.com recommends that for most online gaming, a minimum download speed of 3 megabits per second (Mbps) is necessary, with 15 Mbps recommended for more intensely competitive titles. Uploading data from one device at least 1 Mbps is sufficient to allow these games to function properly; cloud games cannot be processed locally so this requirement applies both to online and single-player play; cloud gaming must have 3.33 times the internet speed as traditional ones in order for it to be as effective as traditional ones.

Opportunities

- Cloud Infrastructure: Supporting Government Initiatives

Due to the ambitious cloud infrastructure plans of European and North American governments, many regional startups have ventured into this industry. Shadow, Blacknut, and LiquidSky are just a few examples from this region. Additionally, The US government introduced The Cloud First Initiative which sought to reduce waste and enhance efficiency within federal technology services while encouraging cloud infrastructure development and decreasing government IT spending. Moreover, cloud computing is expected to boost Europe's data sovereignty as stated in EU Commission documents such as Data Strategy & Digital Strategy, Industrial Strategy & EU Recovery Plan

The European Commission will establish the European Alliance on Industrial Data Edge, Cloud, and Cloud to facilitate the growth of multiple work streams. The EU Cloud Rulebook sets forth a standard framework for regulations, transparency about their compliance, best practices, and guidelines related to cloud service use in Europe; these include European cloud service marketplaces which offer users access to offerings that meet key EU standards through one centralized platform. Collectively these initiatives will create the next generation of cloud supply chains.

Ensure everything is in line with your specific requirements here: https://market.us/report/cloud-gaming-market/#inquiry

Challenges

- Latency Issues: Cloud gaming requires high-speed internet connections for a seamless gameplay experience. Even small delays in video and audio feed can cause lag and poor gameplay, frustrating gamers.

- Infrastructure Restrictions: Cloud gaming requires high-capacity data centers and cutting-edge server technology in order to guarantee reliable, efficient gameplay performance. Unfortunately, building and maintaining such infrastructure can be expensive and time-consuming – particularly in less developed regions.

- Security Concerns: Cloud gaming involves storing sensitive user data such as personal information and payment details on cloud servers. Protecting this data against cyber threats and hacking attempts can be a significant challenge.

- Limited Game Selection: Not all games are compatible with cloud gaming, and some may not even be optimized for it. This can restrict gamers' choices and reduce the appeal of cloud gaming overall.

Recent Developments

- September 2021: To increase the selection of games available on the gaming platform for GeForce NOW, NVIDIA Corporation worked with Electronic Arts Inc. Through this collaboration, Electronic Arts made its popular games available on NVIDIA's GeForce NOW. Games including Mirror's Edge Catalyst, Battlefield 1 Revolution, Dragon Age: Inquisition, Apex Legends, and Unravel Two were introduced to the NVIDIA gaming service by the firm.

- November 2020: Ubitus Inc. and Intel Corporation released a game app for Android. As the system is built on an Intel Server GPU, gaming performance is enhanced.

Key Market Segments

Type

- Video Streaming

- File Streaming

Application

- PC

- Connected TV

- Tablet

- Smartphone

Market Key Players

- Sony

- GameFly (PlayCast)

- Nvidia

- Ubitus

- PlayGiga

- Crytek GmbH

- PlayKey

- Utomik (Kalydo)

- 51ias.com (Gloud)

- Cyber Cloud

- Yunlian Technology

- Liquidsky

- Blacknut SAS

- Alibaba Cloud

- Baidu

- Tencent Cloud

- Ksyun (Kingsoft)

- LeCloud

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 1.02 Bn |

| Revenue forecast by 2032 | USD 49.05 Bn |

| Growth Rate | CAGR Of 47.03% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and the Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

FAQ.

The major regions in the global cloud gaming market include North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are the largest markets, while Asia Pacific is the fastest-growing market.

Some of the key players in the global biosensors market include Sony, GameFly (PlayCast), Nvidia, Ubitus, PlayGiga, Crytek GmbH, PlayKey, Utomik (Kalydo), 51ias.com (Gloud), Cyber Cloud, Yunlian Technology, LiquidSky, Blacknut SAS, Alibaba Cloud, Baidu, Tencent Cloud, Ksyun (Kingsoft) and LeCloud

Cloud Gaming market is estimated to be valued at USD 1.02 Billion in 2022, and it is expected to reach USD 49.05 Billion by 2032 with a CAGR of 47.3%

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.