Digital Signature Software Market: (CAGR 22.3% ) Technical Report + Feasibility Study, 2022-2032

Page Contents

Market Overview

Published Via 11Press: Recently, e-signatures have seen a meteoric rise in use. This is expected to fuel the market for digital signatures further, as stringent e-signature regulations continue to drive demand. Nowadays, digital signature solutions are in high demand across various verticals such as banking and finance (BFSI), government and defense (including healthcare and life sciences) and legal.

Key Takeaways

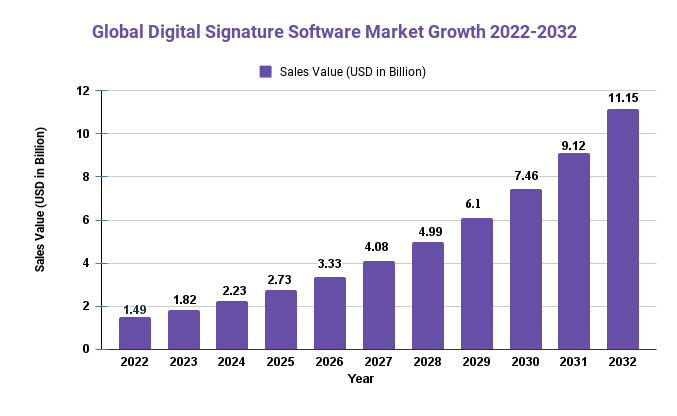

- In 2022, the global digital signature software market size was valued at USD 1.49 billion and is projected to expand at a compound annual growth rate (CAGR) of 22.3% from 2022-2032.

- Digital signature software is seeing an uptick in demand across various industries due to its advantages such as reduced paperwork, improved efficiency and enhanced security. This trend is fuelling market expansion.

- The cloud-based deployment model is expected to dominate the digital signature software market due to its flexibility, scalability and cost-efficiency.

- North America is expected to lead the digital signature software market due to the presence of major players and increasing adoption rates for these solutions in the region.

Get a Preview PDF of the Report here: https://market.us/report/digital-signature-software-market/request-sample/

Regional Snapshot

- North America is expected to lead the digital signature software market due to the presence of major players, high adoption rate for digital signature solutions, and supportive government initiatives that promote digitization.

- Europe is expected to witness significant growth in the digital signature software market due to increasing e-commerce adoption and demand for secure online transactions.

- The Asia Pacific digital signature software market is expected to witness strong growth due to the increasing adoption of digital signature solutions across various industries and an emerging trend toward digitalization in the region.

- Latin America and the Middle East & Africa are expected to witness moderate growth in the digital signature software market due to an increasing adoption of these solutions across various industries.

Drivers

- The growing adoption of digital signature solutions by various industries due to their advantages such as reduced paperwork, enhanced efficiency and enhanced security is fueling market expansion.

- The growing trend of digitalization and the need for secure online transactions are driving demand for digital signature solutions.

- Furthermore, numerous government initiatives to promote digitalization are propelling market growth.

Restraints

- Lack of awareness among small and medium-sized enterprises (SMEs) about the advantages of digital signature solutions is impeding market expansion.

- The high cost of digital signature software and the need for technical expertise to deploy and manage it are hindering market expansion.

- Furthermore, lack of standardization in laws and regulations regarding digital signatures across different countries are further impeding progress within this space.

Drivers

- Cloud-Based Solutions Are Becoming More Popular: As cloud-based services gain in popularity, digital signature software vendors are exploring ways to integrate with them. This integration allows users to sign documents remotely from any device connected to the internet.

- Security and Compliance: Digital signatures are indispensable in industries like healthcare, finance and legal. They guarantee document authenticity while aiding with compliance and security measures. As more businesses prioritize regulatory observance, demand for digital signature software will only grow.

- Rising Trend of Remote Work: The COVID-19 epidemic has made remote work increasingly popular, and this trend is expected to continue even after the crisis ends. Businesses will find digital signature software a valuable asset; it enables employees to electronically sign documents without needing physical signatures.

Due to the rise of eSignatures, there is now an urgent need for fraud prevention measures and techniques that can effectively combat signature forgery.

- Over the past decade, green movements have gained momentum worldwide. This has caused corporate offices and governments to move away from paper-intensive processes towards electronic documentation in an effort to save paper. While eSign had long been in existence, COVID-19 spurred its adoption exponentially.

- Remote workers and approvers can now sign contracts and approvals electronically, making it simple and efficient for them to do so securely and reliably. The need to eliminate fraud and forgery is one of the primary drivers behind demand for digital signatures. As more businesses adopt eSignature technology, phishing attacks and scams that compromise financial and personal information have grown in frequency. As a result, demand for digital signatures has grown. There are various regulations that govern their use. The Federal Reserve Bank (US), Securities and Exchange Commission (SEC), and Internal Revenue Service (IRS) all have electronic signature guidance in place, enabling more forms, documents, and transactions than ever before to be signed electronically.

Restraint

Variation in digital signature rules and regulations across regions

- Digital signature solutions automate the business processes for bringing about digital transformation; at the same time, users expect business processes to be easy-to-use, to be able to provide flexible accessibility with high security and to be compatible with all rules and regulations. The digital signature provides security and boosts trust in a business process, playing a crucial role in business transactional processes.

- Digital signature technology is related to documents that contain financial information, designs, product and service-related information, defense strategies, government policies, and other important documents. SMEs are focused on satisfying regional needs using digital signature technology. The government’s rules and regulations and the judiciary's acceptance of digital signatures as witnesses or proofs vary geographically. Region-wise, new rules and regulations are emerging. Changing rules and regulations are becoming a challenge for the digital signature market.

Challenges

- Lack of Awareness: Despite the many advantages offered by digital signature software, many people remain unaware of its existence or how it functions. This lack of understanding makes it challenging for software providers to persuade potential customers to invest in their solutions.

- Integration Challenges: Integrating digital signature software with existing business systems can present unique challenges, particularly for businesses that have legacy systems. This could result in lengthy implementation delays and increased costs.

- Security Concerns: Although digital signatures provide more security than physical ones, there remain concerns about their reliability. Cyberattacks and data breaches could compromise the integrity of digital signatures, leading to potential legal and financial repercussions.

Traditional business methods are deeply-engrained in today's business environment.

- Businesses have a longstanding practice of using antiquated paper-based operations. Many find it challenging to transition away from these outdated practices in an expeditious manner.

- Other major obstacles to digital signature adoption across organizational processes include lack of trust and difficulty with implementation. This can be resolved through more convenient business solutions. Implementing digital signature technology into traditional business practices – which require routing documents signed by all signatories – poses a problem or hindrance in the digital signature market.

Purchase This Report Via From Here And Avail Discount: Get this Report

Recent Developments

- Integration With Blockchain Technology: Some digital signature software providers are exploring the use of blockchain technology to strengthen security and authenticity of digital signatures. Blockchain records provide a tamper-proof record of all signature activity, making it more difficult for fraudsters to manipulate signatures.

- Mobile-First Approaches: As mobile usage continues to rise, many digital signature software providers are creating solutions tailored for mobile use that include features like document scanning, biometric authentication and touch-screen signature capture. These solutions often offer features such as document scanning, biometric authentication and touch-screen signature capture capabilities.

- Artificial Intelligence (AI) Integration: Some digital signature software providers are incorporating AI into their solutions to improve user experience and automate certain tasks. For instance, AI can automatically detect and extract signature fields from documents, making the signing process faster and more efficient.

Key Market Segments

Type

- Cloud

- SaaS

- Web

- Mobile – Android Native

- Mobile – iOS Native

Application

- Small Enterprise

- Medium-sized Enterprise

- Large Enterprise

Key Market Players

- PandaDoc

- DocuSign

- Adobe

- eSign Genie

- PDCflow

- VASCO

- InsureSign

- RightSignature

- eversign

- SignRequest

- SignNow

- Rpost

Report Scope

| Report Attribute | Details |

| The market size value in 2022 | USD 1.49 Bn |

| Revenue forecast by 2032 | USD 11.15 Bn |

| Growth Rate | CAGR Of 22.3% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.