E-Commerce Of Agricultural Products Market [USD 66 Bn By 2032]

![E-Commerce Of Agricultural Products Market [USD 66 Bn By 2032]](https://www.enterpriseappstoday.com/wp-content/uploads/2023/02/E-Commerce-Of-Agricultural-Products-Market-.jpg)

Page Contents

Introduction: Agricultural E-commerce

Agricultural e-commerce is becoming an increasingly important and influential market in the global economy. With the rise of digital technology and access to the internet, more and more people are turning to online services to purchase agricultural products. The convenience of shopping from home has made it easier than ever for customers to purchase a variety of goods without having to travel or wait in line at stores. Agricultural e-commerce also provides farmers with a secure platform through which they can sell their products, as well as access new markets and buyers worldwide.

The vast potential that agricultural e-commerce offers is immense – for both producers and consumers alike. For example, farmers can use online platforms to efficiently manage their production costs, advertise their products on social media outlets, develop customized business strategies, and even track deliveries straight from their own homes.

Market Overview

The global e-commerce of agricultural products market is experiencing significant growth due to the increasing demand for fresh and high-quality agricultural products, especially from the Asia-Pacific region. The e-commerce platforms provide an efficient and convenient way for farmers to sell their products directly to customers, cutting out intermediaries and reducing costs.

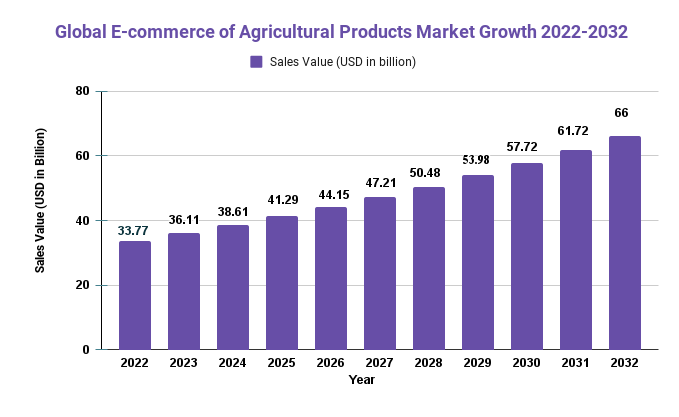

The global E-Commerce Of Agricultural Products market size was valued at USD 33.77 billion in 2022 and is expected to expand at a CAGR of 6.93% during the forecast period, reaching USD 66.0 Billion by 2032.

The demand for ecommerce has increased dramatically due to the increasing use of ecommerce and digitalization of businesses. E-commerce for agricultural products has the potential to reduce product costs and increase demand. A growing number of smallholders from developing countries like China have begun selling agro products directly to their customers via online shops that are managed by third-party trading platforms. There has been an increase in competition between agricultural companies over the past few years. Online sales have made it more difficult for farmers to manage their costs, supply chains, and middlemen. E-commerce can be a boon for small and medium-sized businesses. E-commerce has allowed vendors to lower shipping costs and gain access to previously unknown markets.

E-commerce is proving to be a viable and effective way for smallholders to gain market access. E-commerce allows smallholders to sell their products at a higher price because there is no pricing pressure from middlemen. Smallholders are driving the sector forward with agricultural ecommerce. Technology and digital gaps are a major problem in the rapidly expanding South American and Asia Pacific agriculture industries. Both the knowledge of small farmers and small sellers as well as the infrastructure needed to run e-commerce in rural areas are lacking. A lack of knowledge and infrastructure is hindering the market's growth.

The COVID-19 pandemic have little impact on global agriculture e-commerce. Both the supply chain and transport have been affected by the lockdown in almost every place. The abrupt suspension of transport services has caused significant losses for e-commerce platforms. This market will be influenced by COVID-9 through 2020.

E-commerce is the term for transactions that are conducted via the internet. E-commerce offers services like trade execution, the sharing of trade information among clients and firms, and certain processes and modes to maintain relationships that are based on the internet/web. It is important to monitor economic preferences and indicators as they have an effect on the business. As the world economy recovers, people are more concerned about improving environmental standards, especially in countries that have large populations and high levels of economic growth. This research examines the market's current and future state. It also examines key players, as well as the major markets. This study aims to show the growth in e-commerce of agricultural products in China, Europe, and the United States. Alibaba Group, JD.com, Inc., Benlai, Sfbest, Pinduoduo, Inc., Womai, Yihaodian and Pinduoduo are just a few of the top companies in the global E-commerce market for Agriculture Products.

Request For Sample Report Before Buying@ https://market.us/report/e-commerce-of-agricultural-products-market/request-sample/

Key Takeaways

- The global e-commerce of agricultural products market is expected to experience significant growth in the coming years, driven by the increasing demand for fresh and high-quality agricultural products.

- Asia-Pacific is the largest and fastest-growing region for e-commerce of agricultural products, due to the presence of a large population and growing demand for fresh and high-quality agricultural products.

- The COVID-19 pandemic has accelerated the growth of the e-commerce of agricultural products market, as consumers increasingly turn to online platforms to purchase their daily necessities.

Market Dynamics

- The key driver of global e-commerce for agricultural products is the easy availability of raw materials, inputs, and advanced technology to grow crops. E-commerce platforms offer many advantages to agricultural products, including the availability of various types of seeds and tools, comparisons of quality and prices, as well as descriptive analysis of products. E-commerce platforms don't require the person to be present in order to collect the information. These websites allow farmers to sell their products without the need for middlemen. These e-commerce websites allow consumers and farmers to purchase directly from the seller, which reduces any input costs or other costs. The United States Department of Agriculture (USDA), in its report on Indian Mobile and Ecommerce Grocery Retail found that internet users in Tier 2 and Tier 3 cities have increased from 4.7% to 7% between 2013 and 2014.

- Governments may roll out new schemes and applications to increase demand for ecommerce platforms for agricultural products. This is expected to drive growth in the global ecommerce of agricultural products. Many apps and programs have been launched by the Government of India to help farmers, including kisan Suvidha, IFFCO kisan Agriculture, Pusa krishi and others.

- The market is being resisted by a lack of awareness and inaccessibility to internet in rural areas. Rural areas are home to the largest employer, with 45% of the world's population living in rural areas. Only 26% of the global population working in agriculture.

Market Outlook

- The highest market share for e-commerce of agricultural product market was held by manure and fertilizer segments. This is due to their high adoption by farmers and agricultural companies. It helps to grow crops and allows home delivery.

- In 2022, the harvesting segment was the most popular among all applications. Harvesting refers to the time when crops can be cut from agricultural land. Harvesting the entire crop is done with light and heavy-duty machinery. This saves farmers time, money, and energy. The use of heavy machinery is not required for ploughing, irrigation, or sowing. These activities can be done with light-weight machinery or manually. This segment will be a dominant player in the market during the forecast period.

- North America occupied the largest market share in 2022's global agriculture products market. This is due to the region's high literacy rate, capital intensive harvesting, and advanced e-commerce platforms. The US Department of Agriculture reports that farmers use technology robots, temperature sensors, moisture sensors, aerial photos, and GPS technology to provide accurate information about the weather.

- Asia Pacific will be the fastest-growing region in the market during the forecast period. This is due to key factors like increased acceptance of technology among farmers, decreased input costs and the prevalence of capital intensive farming. To help Indian farmers, the Indian government has provided various technological and digital applications and services. The government also provides subsidiaries to purchase various agricultural machinery, such as tractor, sprinkler, and plant protection equipment.

Drivers

- Increasing demand for fresh and high-quality agricultural products

- Convenience and efficiency of e-commerce platforms

- Reduction in costs for farmers

Restraints

- Lack of infrastructure in rural areas

- Concerns about product quality and safety

- Limited awareness and adoption of e-commerce platforms

Opportunities

- Growing demand for organic and sustainable agricultural products

- Emerging markets in developing countries

- Integration of advanced technologies, such as blockchain and artificial intelligence, into e-commerce platforms

Challenges

- Need for investments in infrastructure and technology

- Regulatory challenges

- Intense competition among e-commerce platforms

Purchase This Report Via Secured Link and Avail Discount: https://market.us/purchase-report/?report_id=21454

Recent Developments

- Increasing adoption of AI and machine learning: E-commerce companies are increasingly adopting AI and machine learning to optimize their supply chain, improve logistics, and enhance customer experience.

- The growing popularity of online grocery shopping: With the COVID-19 pandemic, there has been a surge in online grocery shopping, and this trend is expected to continue in the coming years. E-commerce companies are now expanding their offerings to include fresh produce and other agricultural products.

- The emergence of blockchain technology: The use of blockchain technology is gaining traction in the e-commerce of the agricultural products market, as it provides enhanced transparency, security, and traceability in the supply chain.

Market Segmentation

Type

- Web Portal Model

- Online Content Providers

- Online Retailers

- Online Distributors

- Online Market Maker

- Online Community Provider

- Cloud

Application

- Service Providers Application

- Reduce Business Processes and Input Costs

- Improve the Efficiency of Corporate Transactions

- Increased the Flexibility of Enterprise Supply Chain

- Reduce the Purchase Expense Between the Enterprises of Supply Chain Node

- Improve the Interaction Between Enterprises and Customers

Key Market Players

- Alibaba Group

- JD

- Yihaodian

- Womai

- sfbest

- benlai

- tootoo

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 33.77 billion |

| Revenue forecast by 2032 | USD 66.0 billion |

| Growth Rate | CAGR Of 6.93% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Contact us

Contact Person: Mr. Lawrence John

Market.us (Powered By Prudour Pvt. Ltd.)

Tel: +1 718 618 4351

Send Email: [email protected]

FAQ.

The e-commerce of agricultural products market refers to the buying and selling of agricultural products, such as fruits, vegetables, and grains, through online platforms.

The primary drivers of the e-commerce of agricultural products market include the increasing demand for fresh and high-quality agricultural products, the convenience and efficiency of e-commerce platforms, and the reduction in costs for farmers.

The primary challenges facing the e-commerce of agricultural products market include the need for investments in infrastructure and technology, regulatory challenges, and intense competition among e-commerce platforms.

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.