Generative AI in Insurance Market size is expected to be worth around USD 5,543.1 Mn by 2032

Page Contents

Market Overview

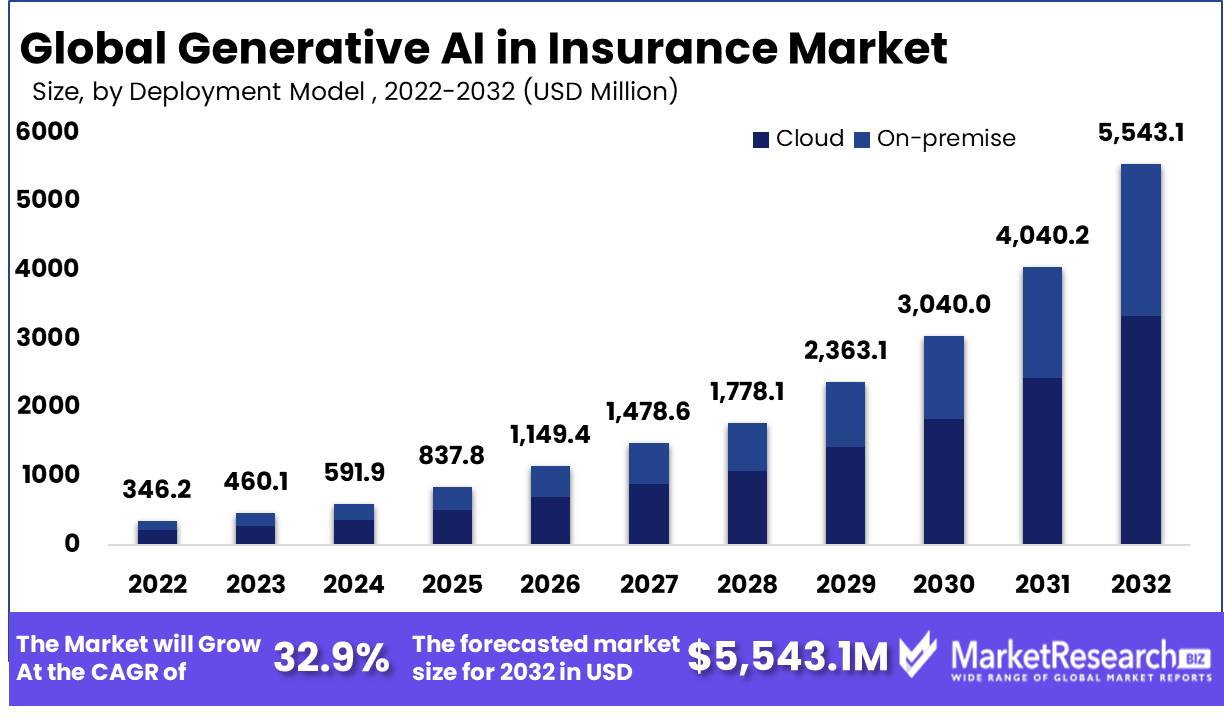

Published Via 11Press : Global Generative AI in Insurance Market size is expected to be worth around USD 5,543.1 Mn by 2032 from USD 346.3 Mn in 2022, growing at a CAGR of 32.9% during the forecast period from 2023 to 2032.

Request a Sample Copy of Generative AI in Insurance Market Report at: https://marketresearch.biz/report/generative-ai-in-insurance-market/request-sample/

Key Takeaways

- Generational AI for insurance improves operational efficiencies by automating processes and speeding decision-making processes.

- Risk evaluation and pricing models benefit greatly from using AI to analyze data and simulate scenarios to provide more precise predictions.

- Generative AI helps deliver customized customer experiences by offering tailored recommendations and marketing campaigns with specific marketing campaigns.

- Generative AI assists with fraud detection and prevention by detecting patterns and anomalies within data, strengthening insurance fraud management.

- Chatbots and virtual assistants powered by generative AI are increasingly being utilized to deliver prompt and customized customer support services to improve customer relations.

- Data privacy, regulatory compliance and ethical considerations pose difficulties in adopting Generative AI within the insurance sector.

- Generative AI offers insurers opportunities to drive innovation, gain a competitive edge, and reshape the insurance landscape.

- Generative AI will play an instrumental role in shaping the future of insurance, opening new avenues of growth and transformation within this field.

Regional Snapshot

North America and, specifically the US, has been at the forefront of adopting Generative AI insurance solutions. With a well-developed insurance market and strong focus on technological developments, many insurance companies throughout this region have turned to Generative AI to improve operational efficiencies, risk assessments, customer experiences and fraud detection efforts.

Europe is another key region in terms of AI adoption within insurance markets. Countries like Britain, Germany, France and Switzerland have experienced substantial adoption of artificial intelligence-powered insurance technologies; European insurers use AI for optimizing underwriting processes, customer engagement enhancement and claims management purposes.

Asia-Pacific region has seen exponential growth of Generative Artificial Intelligence in insurance market. Countries like China, Japan, India and Singapore are adopting AI technologies across industries including insurance. Insurance carriers in this region have explored Generative AI as an option for risk modeling, personalized customer experiences and fraud detection.

Latin America has seen an increasing use of Generative AI within the insurance sector. Countries like Brazil and Mexico are seeing greater adoption of AI-powered solutions by insurers looking to boost claims processing efficiencies, create innovative products or strengthen customer interactions.

Middle East and Africa insurance markets are exploring the capabilities of Generative AI as an insurance solution, including countries like South Africa where AI-related initiatives have surfaced. Insurance carriers in this region are using Generative AI technology to streamline operations, enhance risk assessment processes, and deliver customized services.

For any inquiries, Speak to our expert at: https://marketresearch.biz/report/generative-ai-in-insurance-market/#inquiry

Drivers

- Operational Efficiency: Insurers are seeking ways to streamline and enhance efficiency within their operations. Generative AI allows insurers to automate and optimize various insurance processes like claims processing, underwriting and policy administration with reduced manual efforts and faster decision-making speeds which in turn increase operational efficiencies and productivity.

- Advanced Risk Analysis: Risk evaluation is an integral component of insurance. Generative AI models can analyze vast amounts of historical data and simulate scenarios to help insurers assess risks more precisely, aiding with pricing policies, underwriting decisions and risk management strategies while simultaneously strengthening risk analysis capabilities.

- Customized Customer Experiences: Customer expectations in the insurance industry have changed and customized experiences have become an increasing focus. Generative AI allows insurers to analyze customer data and generate tailored recommendations or offerings tailored specifically for individual customer behavior and preferences, creating tailored insurance solutions which improve satisfaction while building long-term loyalty from existing and new clients.

- Fraud Detection and Prevention: Insurance fraud can be an immense source of losses to insurers. Generative AI helps insurers protect themselves by analyzing large datasets for patterns or anomalies which indicate potential fraudulent activities; by strengthening fraud detection mechanisms insurers can protect themselves and protect their bottom lines from financial ruin.

- Technological Advancements: Advancements in AI technologies such as deep learning and neural networks have made generative AI increasingly accessible and powerful, increasing its capabilities within insurance by offering more accurate predictions, more thorough data analyses, and enhanced decision making processes.

Restraints

- Data Privacy and Security Considerations: Generative AI requires access to large volumes of customer data that must remain private and secure for insurers' use, so assuring its privacy and security should be of great priority in adopting it into insurance products. Compliance with data protection regulations while upholding customer integrity remains key challenge associated with adopting AI-powered generative insurance products.

- Ethical Considerations: Generative AI must be carefully addressed on an ethical level when used for insurance applications. Applying AI algorithms to decision-making processes like risk evaluation or claims handling could raise concerns of fairness, bias and discrimination – creating trust while assuring responsible use. Transparent ethical AI practices will foster this growth for insurance applications of Generative AI.

- Interpretability and Explainability: Generative AI models such as deep learning algorithms may be complex and hard to decipher for insurance providers; explaining AI decisions to customers, regulators or auditors could prove challenging at best; therefore interpretability and explainability are crucial in building trust while upholding regulatory compliance.

Opportunities

- Claims Management Optimization: Generative AI has the potential to streamline claims management processes by automating claims assessment, validating information, and expediting settlements. Insurers can take advantage of generative AI's predictive power by employing its algorithms in improving accuracy while decreasing processing times and improving customer experiences throughout their claims journeys.

- Customer Experience Improvement: Generative AI allows insurers to offer tailored customer experiences using chatbots or virtual assistants powered by AI technology. By tapping into its power, insurers can increase customer satisfaction while deepening engagement for longer-lasting relationships and customer loyalty.

- Product Innovation: Generative AI can facilitate product innovation by uncovering insights and recognizing emerging market trends. Insurers can utilize these models to analyze customer data, market dynamics and regulatory changes so as to develop products and services tailored specifically towards meeting evolving customer demands.

- Cost Savings and Efficiency: Implementation of Generative AI can lead to both cost savings and improved operational efficiencies for insurers. Through automating processes, optimizing risk assessment models, and increasing fraud detection abilities, insurers can reduce operational expenses, streamline workflows, and achieve greater efficiencies within their operations.

Take a look at the PDF sample of this report: https://marketresearch.biz/report/generative-ai-in-insurance-market/request-sample/

Challenges

- Model Robustness and Reliability: Generative AI models depend heavily on the quality of training data and algorithms employed; insurers face an uphill battle in making sure these AI-generated models are reliable, free from biases or errors that might cause inaccurate predictions or decisions to be made by inference.

- Data Privacy and Security: Generative AI requires access to sensitive customer data, raising concerns over data privacy and security. Insurance carriers must implement effective safeguards including encryption, access controls and secure storage in order to protect customer information and comply with data protection regulations.

- Talent and Skill Gap: Implementing generative AI requires experienced professionals with backgrounds in AI, data science, machine learning and machine intelligence to implement successfully. Insurance carriers may find difficulty recruiting or retaining staff equipped with these essential abilities in order to develop, deploy and maintain such models effectively.

- Integration With Legacy Systems: Many insurance companies already possess legacy systems and infrastructure that may not easily integrate with generative AI technologies, making their integration a challenge that often necessitates significant upgrades both technological and infrastructure-wise. Integrating AI solutions may prove more complicated.

- Change Management and Adoption: Adopting Generative AI technologies requires insurance companies to undergo organizational and cultural shifts that transcend resistance to change. Employers must provide adequate training and education programs for employees while creating an enabling environment conducive to adopting these generative technologies.

Market Segmentation

Based on Deployment Model

- On-premise

- Cloud

Based on Application

- Fraud Detection and Credit Analysis

- Customer Profiling and Segmentation

- Product and Policy Design

- Underwriting and Claims Assessment

- Chatbots

- Other Applications

Based on Technology

- Machine Learning

- Natural Language Processing

- Computer Vision

- Other Technologies

Based on End-User

- Individual Policyholders

- Commercial Policyholders

Key Players

- DataRobot Inc.

- Tractable

- Google LLC

- IBM

- Allstate

- Lemonade

- Microsoft Corporation

- Amazon Web Services

- Other Key Players

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 346.3Mn |

| Revenue Forecast by 2032 | USD 5,543.1 Mn |

| Growth Rate | CAGR Of 32.9% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Request Customization Of The Report: https://marketresearch.biz/report/generative-ai-in-insurance-market/#request-for-customization

Recent Developments

- Lemonade: Lemonade Insurance has taken advantage of generative AI algorithms to streamline their claims processing system and automate claim handling with an AI bot known as AI Jim that utilizes natural language processing and other AI-powered techniques in an effort to effectively process claims efficiently.

- Zurich Insurance has explored how generative AI can be utilized for risk evaluation and underwriting purposes. They have implemented AI models capable of processing vast amounts of data in order to accurately assess risks, enhance pricing models and streamline underwriting procedures.

- Ping An Insurance has pioneered AI use throughout its operations in China and has established AI-powered systems for fraud detection, customer service and personalized insurance recommendations – thus improving both customer experiences and operational efficiencies.

- Allianz: Allianz has made significant efforts in exploring generative AI for claims management and customer service purposes, using chatbots and virtual assistants powered by this AI to provide instantaneous support, manage inquiries about claims, and deliver personalized services directly to their customer base.

FAQ

What exactly is Generative AI used for in the insurance market?

Generative AI in the insurance market refers to using artificial intelligence technologies like deep learning and neural networks to produce data, predict outcomes and automate processes within the industry.

How is Generative AI helping insurance companies?

Generative AI offers insurance companies several benefits, such as improved operational efficiencies and risk assessments, more personalized customer experiences, fraud detection/prevention efforts and optimized claims management.

Can AI replace human underwriters in insurance?

Generative AI cannot entirely replace human underwriters in insurance; however, it can provide assistance by analyzing data, offering insights, and helping facilitate more accurate risk evaluation – helping make more accurate underwriting decisions more easily.

What are the challenges associated with using Generative AI in insurance?

Implementing Generative AI into insurance presents several unique challenges, such as protecting data privacy and security, satisfying ethical concerns and regulatory compliance, deciphering AI-generated decisions clearly for clients, and closing talent and skill gaps.

How does Generative AI enhance fraud detection in insurance?

Generative AI models can analyze large datasets to detect patterns and anomalies indicative of possible fraudulent activities, helping insurance companies improve their fraud detection abilities while mitigating financial losses. By harnessing AI for fraud detection purposes, insurance firms can gain greater insights and reduce financial losses more effectively.

Can Generative AI improve customer experiences within insurance?

Yes, generative AI can enhance customer experiences within insurance. By analyzing customer data and applying artificial intelligence-powered models to it, these AI models provide personalized recommendations, tailor insurance solutions to each specific case, power chatbots or virtual assistants with prompt customer support services, or power AI chatbots/virtual assistants to provide prompt assistance for every policyholder.

What role has Generative AI played in revolutionizing the insurance sector?

Generative AI is revolutionizing the insurance industry by automating processes, increasing risk assessment accuracy, improving fraud detection capabilities, personalizing customer experiences and optimizing claims management procedures, while fuelling innovation – ultimately altering how insurers serve and serve their customers.

Contact us

Contact Person: Mr. Lawrence John

Marketresearch.Biz

Tel: +1 (347) 796-4335

Send Email: [email protected]

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.