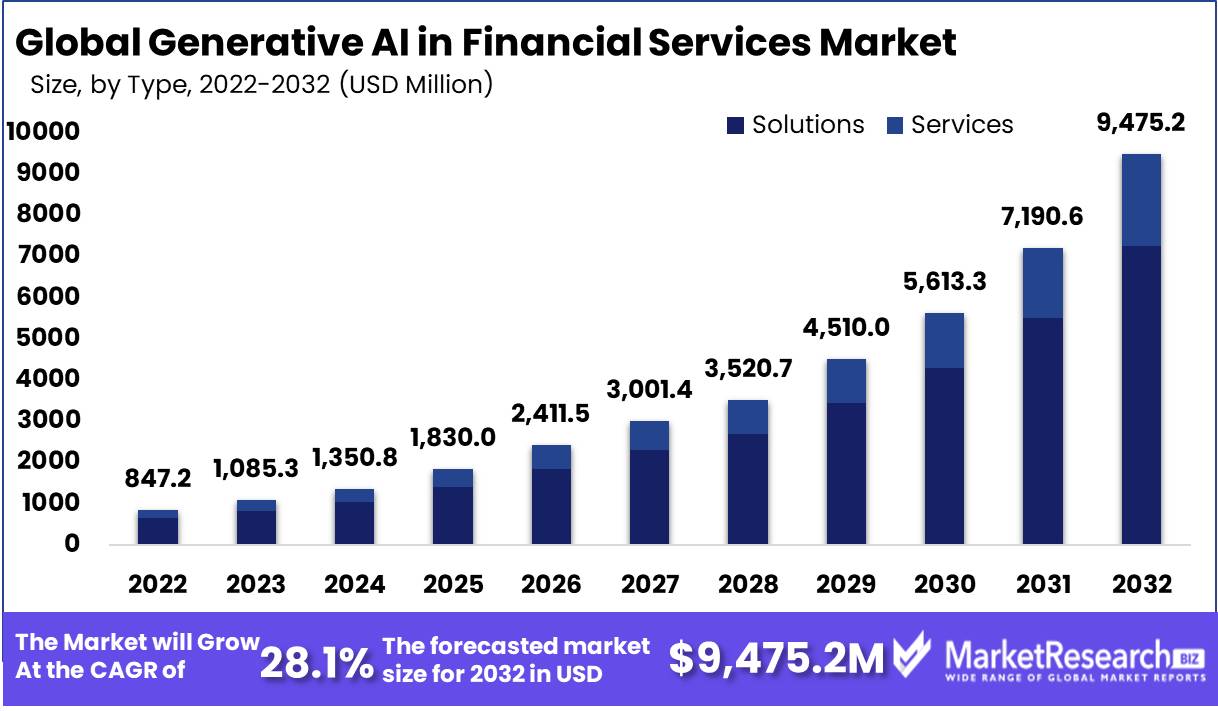

Generative AI in the Financial Services Market to Surpass USD 9,475.2 Mn by 2032

Page Contents

Market Overview

Published Via 11Press : Global Generative AI in the Financial Services Market size is expected to be worth around USD 9,475.2 Mn by 2032 from USD 847.2 Mn in 2022, growing at a CAGR of 28.1% during the forecast period from 2023 to 2032.

Generative AI technology has seen tremendous advances across industries, particularly financial services. There has been an upsurge in interest and adoption by financial institutions looking for innovative ways to enhance operations, enhance customer experiences and foster innovation using this cutting edge tool.

Generative AI for financial services covers an expansive array of applications, from risk evaluation and fraud detection, portfolio optimization and customer service automation through customer relationship automation (CRA), to algorithmic trading. Generative AI systems are capable of producing synthetic data sets which create realistic financial scenarios by simulating market conditions – helping financial institutions make more informed decisions while improving performance.

Generative AI techniques offer one key benefit for financial services firms using it: creating large volumes of synthetic data. As financial institutions frequently deal with sensitive or confidential information that makes accessing real-world data for training AI models difficult, generative AI techniques offer a solution by producing synthetic data which closely replicates that found in reality while protecting privacy and security – helping financial firms innovate without jeopardizing data privacy or security.

Financial firms can then use this synthetic data for training AI models, creating algorithms or conducting simulations without risking accessing real data sources – giving financial services firms freedom in terms of innovation or experimentation without jeopardising data privacy concerns – giving financial institutions room to innovate without risking data security concerns compromising data privacy issues

Generative AI also plays an essential part in risk assessment and fraud detection. Through analysis of historical data and generation of realistic scenarios, AI models can quickly identify risks, detect anomalies and anticipate fraudulent activities with greater precision – providing financial institutions with an invaluable way to actively mitigate risks, prevent fraudster activities and ensure regulatory requirements compliance.

AI algorithms have also become an indispensable resource in portfolio optimization. By analyzing huge amounts of financial information and creating optimized investment portfolios with realistic risks/reward profiles under changing market conditions, financial institutions can use AI technology to advance asset management strategies while offering improved returns for their clients.

Customer service automation is another area in which generative AI has had an impressive effect, as virtual assistants powered by these models can understand natural language queries, offer tailored recommendations and assist customers with various financial tasks such as account inquiries, transaction processing and financial planning. Not only can this improve customer experience by providing quicker responses but it allows financial institutions to scale customer support operations more cost-effectively.

Request Sample Copy of Generative AI In Financial Services Market Report at: https://marketresearch.biz/report/generative-ai-in-financial-services-market/request-sample/

Key Takeaways

- Generative AI has rapidly gained acceptance across financial services for use in risk evaluation, fraud detection, portfolio optimization, customer service automation and algorithmic trading.

- Synthetic data generated using generative AI is an efficient solution to data privacy challenges for financial institutions looking to train AI models or conduct simulations.

- Generative AI algorithms offer improved risk evaluation and fraud detection by analyzing past events and producing realistic scenarios.

- Portfolio optimization makes use of generative AI's ability to analyze financial data, create optimal investment portfolios and simulate performance under various market conditions.

- Customer service automation powered by generative AI increases customer experience while helping financial institutions expand more quickly and cost efficiently.

- Financial services' use of AI technologies for intelligent decision-making and improved services is experiencing rapid expansion, encouraging innovation and revolutionizing industry practices through smarter decision-making and increased services.

Regional Snapshot

North America and particularly the US has been at the forefront of adopting generative AI for financial services applications. Major financial institutions throughout this region utilize it for risk assessment, fraud detection, algorithmic trading, customer service automation and customer experience optimization purposes. North America boasts an expansive ecosystem of AI startups and research institutions which contributes significantly to innovations in generative AI technology.

Europe has also welcomed Generative AI into their financial services industry with open arms. Countries such as United Kingdom, Germany and France have seen widespread use of Generative AI for portfolio optimization, risk evaluation and regulatory compliance purposes. Financial institutions across Europe use Generative AI to increase operational efficiencies while simultaneously meeting complex compliance regulations and customer experience enhancement.

Asia-Pacific region is seeing rapid adoption of Generative Artificial Intelligence in financial services. Countries such as China, Japan and Singapore are driving innovation and application of Generative AI for fraud detection, algorithmic trading and customer service automation applications. Large financial markets, technological advances and government support for AI development all help accelerate expansion of Generative AI within financial services industry.

Latin America has begun exploring the possibilities of Generative Artificial Intelligence in financial services. Banks from Brazil, Mexico and Argentina are starting to adopt Generative AI solutions for risk evaluation, fraud detection and customer service automation purposes. Latin American vendors hope that increasing adoption over the coming years.

Middle East and Africa regions are witnessing the increased use of Generative AI in financial services. Institutions across countries like UAE, SA and Nigeria are exploring its use for risk management, fraud detection and customer engagement purposes – sparking additional excitement over its potential use due to digital transformation initiatives in these nations' banking sectors and regions' increasing focus on innovation within them. Generative AI represents another strand in digital transformation strategies which could revolutionise this industry further in this region.

For any inquiries, Speak to our expert at: https://marketresearch.biz/report/generative-ai-in-financial-services-market/#inquiry

Drivers

- Financial Industry Data Complexity: Financial services companies typically face vast quantities of complex, heterogenous data that requires analysis. Generative AI provides financial institutions with a means of efficiently processing this information so they can extract valuable insights, make data-driven decisions, and automate tasks traditionally labor intensive.

- Generative AI algorithms provide financial institutions with enhanced risk evaluation and fraud detection by analyzing historical data, recognizing patterns, and creating realistic scenarios to accurately detect fraudulent activities more reliably than before. By taking proactive steps against risk mitigation and improving compliance while protecting themselves and customers against financial fraud using Generative AI systems.

- Improved Operational Efficiency: Generative AI automates various financial processes, such as portfolio optimization, algorithmic trading and customer service automation. Financial institutions that implement Generative AI find it helps streamline operations while decreasing manual errors while improving efficiency for cost savings and increased productivity.

Restraints

- Data Privacy and Security Concerns: Financial institutions manage sensitive, personal, and financial data that must remain private and secure. Generative AI techniques involving creating synthetic or analyzing sensitive data raise concerns for data privacy and security; compliance with data protection regulations remains key when adopting widespread use.

- Lack of Transparent Decision-Making: Generative AI algorithms can be complex and opaque, making it hard for anyone to comprehend their underlying decision-making process. This lack of clarity may raise serious concerns in highly regulated financial environments where clear explanations for decisions must be provided in writing. Establishing trust among users as well as addressing interpretability challenges are paramount components to wider adoption.

- Limited Access to Skilled Talent: Producing and Deploying Generative AI Models Requiring Specialized Knowledge in both AI and Finance Domains Financial institutions may face difficulties finding and recruiting highly trained AI and finance specialists capable of using Generative AI Technology effectively; lack of talent possessing both technical knowledge and finance experience may impede its widespread adoption.

Opportunities

- Advanced Portfolio Optimization: Generative AI provides sophisticated portfolio optimization capabilities by analyzing historical data, simulating market conditions and creating tailored investment strategies. Financial institutions can use generative AI to optimize asset allocation strategies, enhance risk/reward profiles and deliver better investment returns to their clients.

- Automation of Routine Tasks: Generative AI technology allows financial institutions to increase operational efficiency, lower costs and free up human resources for more complex or value-adding activities by automating routine and repetitive tasks such as data entry, report generation and compliance checks. By taking this route they can increase operational efficiencies as well as free up human resources for complex activities with greater potential of return.

- Innovation and Product Development: Generative AI presents financial institutions with new avenues of innovation in service provision, helping them leverage it to develop innovative financial products, simulate market scenarios, conduct predictive analyses, stay ahead of competitors by offering cutting edge solutions, and offer customers unique value propositions that exceed competitors.

- Generative AI offers financial institutions an ideal tool for automating data collection, analysis and reporting as a part of regulatory compliance initiatives, helping ensure accurate and timely compliance while eliminating manual errors while decreasing compliance-related risks.

Take a look at the PDF sample of this report: https://marketresearch.biz/report/generative-ai-in-financial-services-market/request-sample/

Challenges

- Ethical Considerations: Generative AI models could potentially produce biased or discriminatory outputs due to biases present in their training data, making their decision-making processes unfair, transparent, or unfair. Financial institutions must address ethical considerations to ensure generative AI models make fair, transparent and impartial decisions when making their decisions.

- Talent and Expertise Gap: Building and deploying generative AI models requires specific expertise from both AI and finance fields, making recruitment of the required talent challenging for financial institutions. Bridging that talent gap by cultivating collaboration among data scientists, AI specialists, and finance professionals is paramount for its successful implementation.

- Financial services operate under an intricate regulatory environment that must be strictly observed when adopting AI solutions, with data privacy, transparency, and fairness among the requirements. Financial institutions need to make certain their generative AI models adhere to regulatory compliance as well as being auditable decision making processes.

- Scalability and Integration: Integrating Generative AI solutions across an entire financial institution can be challenging, while seamlessly scalability must not disrupt ongoing operations or compromise ongoing efforts to integrate systems. Careful planning must take place for seamless scalability without disrupting ongoing operations, but seamless scalability remains key when scaling across an enterprise.

Market Segmentation

Based on Type

- Solutions

- Services

Based on Application

- Credit Scoring

- Fraud Detection

- Risk Management

- Forecasting & Reporting

- Other Applications

Based on the Deployment Mode

- Cloud

- On-premises

Key Players

- IBM Corporation

- Intel Corporation

- com

- Narrative Science

- Amazon Web Services, Inc.

- Microsoft

- Google LLC

- Salesforce, Inc.

- Other Key Players

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 847.2Mn |

| Revenue Forecast by 2032 | USD 9,475.2 Mn |

| Growth Rate | CAGR Of 28.1% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Request Customization Of The Report: https://marketresearch.biz/report/generative-ai-in-financial-services-market/#request-for-customization

Recent Developments

- Goldman Sachs has been exploring how generative AI can enhance various areas of their business, with algorithms created that generate synthetic data for testing trading strategies, risk evaluation and improving trading models. Generative AI allows them to strengthen existing capabilities while driving innovation within financial services offerings.

- JPMorgan Chase has invested heavily in artificial intelligence (AI) technologies in order to strengthen their risk management and fraud detection abilities. They have established AI models which analyze large volumes of transaction data in order to spot anomalies that signal potential fraudster activity; using this AI, the company hopes to reduce risks while protecting customers against financial scams.

- BlackRock is one of the leading asset management firms worldwide and has implemented generative AI as part of their portfolio optimization and risk management solutions. They have built models using AI that analyze historical data, simulate market conditions and generate optimized investment strategies – using this approach, BlackRock hopes to optimize portfolio management as well as deliver improved investment outcomes for their clients by taking advantage of generative AI's abilities.

FAQ

What are the applications of Generative AI technology within financial services?

Generative AI in financial services refers to the application of artificial intelligence techniques which generate new data, scenarios or models based on existing financial data. Generative AI utilizes algorithms for simulating realistic financial scenarios, optimizing portfolios and automating tasks while improving risk evaluation and fraud detection.

How is Generative AI used for risk evaluation and detection in financial services?

Generative AI algorithms use historical data and patterns to assess risks and detect potentially fraudulent activities, providing realistic scenarios, identifying emerging risks, and offering solutions for risk mitigation. Generative AI also assists financial institutions proactively detect fraud by analyzing patterns in data streams in real time to detect any abnormalities that might indicate possible fraudulent behavior.

What are the advantages of employing generative AI for portfolio optimization?

Generative AI empowers financial institutions to optimize investment portfolios through the analysis and simulation of vast quantities of financial data, simulating market conditions, and producing optimal investment strategies. Generative AI also assists institutions in optimizing risk/reward profiles, asset allocation strategies and identifying investment opportunities under different market scenarios.

How does Generative AI technology assist financial service customers?

Generative AI-powered virtual assistants and customer service automation systems in financial services can understand natural language queries, provide personalized recommendations, and assist customers with account inquiries, transaction processing and financial planning tasks. This automation improves response times, accuracy and customer experience while helping financial institutions expand their customer support operations.

How is Generative AI being utilized to address data privacy concerns within financial services?

Generative AI techniques enable financial institutions to generate synthetic data that closely resembles real-world information while protecting both privacy and security. Synthetic data can then be used for training AI models, algorithm development, simulations and reduced customer data reliance thereby mitigating data privacy concerns.

What are the challenges associated with using Generative AI for financial services?

Challenges associated with AI include data privacy and security issues, considering ethical aspects, biases or lack thereof in AI models, explaining decision-making logic of an artificially intelligent machine, talent shortage gaps and expertise shortages as well as regulatory compliance as well as integration into existing infrastructure or processes.

What recent advances and companies are involved with Generative AI within financial services?

Goldman Sachs, JPMorgan Chase, BlackRock and Capital One have made significant strides forward with regards to using Generative AI for financial services. These institutions are exploring its application in risk assessment, fraud detection, portfolio optimization and customer service automation as a means to increase operational efficiencies while strengthening decision making abilities for personalized financial offerings.

Contact us

Contact Person: Mr. Lawrence John

Marketresearch.Biz

Tel: +1 (347) 796-4335

Send Email: [email protected]

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.