Global Generative AI in Finance Market Surpass USD 27,430.7 Mn by 2032

Page Contents

Market Overview

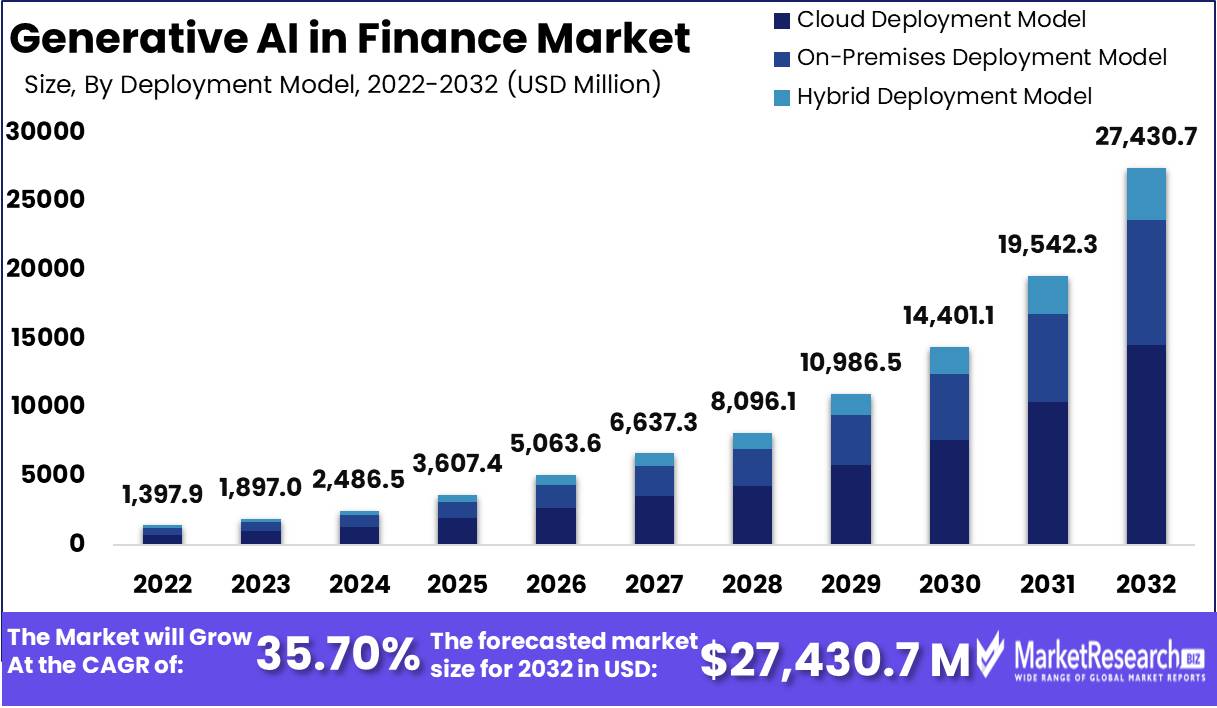

Published Via 11Press : Global Generative AI in Finance Market size is expected to be worth around USD 27,430.7 Mn by 2032 from USD 1,397.9 Mn in 2022, growing at a CAGR of 35.70% during the forecast period from 2023 to 2032.

Generative AI has emerged as a revolutionary technology across various industries, and finance is no exception. Recently, its application in finance has experienced rapid adoption – revolutionizing how financial institutions analyze data, predict outcomes and optimize operations. Furthermore, demand for advanced data analytics, risk management solutions, fraud detection measures, investment strategies and much more continues to skyrocket – creating significant market growth potential in this space.

One area where generative AI is making an impressive impactful statement is in data analysis and prediction. Financial institutions manage vast quantities of information ranging from market trends and customer behavior to historical financial records, so generative AI algorithms are providing an efficient means of processing this data by efficiently processing, analyzing and identifying patterns, correlations, anomalies that would not otherwise be detectable by human analysts – this allows financial institutions to make more accurate predictions regarding market trends, customer preferences and investment opportunities; ultimately leading to improved decision-making processes and increased profitability.

Risk management is another vital aspect of finance where generative AI has proven invaluable. By analyzing historical and real-time market information, these models can assess and predict risks associated with investments, loans, and other transactions; identify hidden threats; develop mitigation strategies; as well as help financial institutions minimize losses while strengthening their risk management frameworks.

Fraud detection in finance industry costs billions each year. Generative AI algorithms can play an invaluable role in detecting fraudulent activities by analyzing vast amounts of transactional data and recognizing suspicious patterns or anomalies, and adapting to evolving fraud techniques with continuous learning capabilities that reduce false positives while improving detection capabilities – ultimately helping financial institutions strengthen security measures, protect customer assets and uphold their reputations.

Request a Sample Copy of the Generative AI In Finance Market Report at: https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Key Takeaways

- Generative AI is revolutionizing the finance sector by providing more accurate data analysis, predictions, and decision-making capabilities.

- Risk analysis plays a vital role in managing risks by identifying potential threats and providing mitigation strategies.

- Generative AI algorithms enhance fraud detection capabilities, providing greater protection to financial institutions and customers from fraudulent activity.

- Investment strategies can be optimized using AI models that produce recommendations and simulate various scenarios.

- Generative AI applications in finance are experiencing remarkable expansion, driven by increasing demand for advanced data analysis and risk management solutions.

- At the forefront of this market are financial institutions, technology companies, and startups providing AI solutions for finance.

- As the field of finance progresses and adapts, so should generative AI technology. Expect further innovations and expansion.

- Integrity and accountability are central elements of the responsible implementation of generative AI in finance.

Regional Snapshot

North America and, more specifically, the United States is an emerging center of generative AI applications in finance. Major financial institutions and technology companies in cities such as New York and San Francisco are actively using generative AI for data analysis, risk management and investment strategies; plus a robust ecosystem of startups and research institutes dedicated to this area of research exists here as well.

European nations such as the United Kingdom, Germany and Switzerland are taking an aggressive stance when it comes to adopting artificial intelligence (AI) into finance. London as a prominent financial center has seen AI being integrated into trading algorithms and fraud detection systems utilizing it. Furthermore, EU efforts on AI development and regulation is impacting how this AI will be deployed into finance operations.

Asia-Pacific Countries such as China, Japan and Singapore are leading the charge in adopting generative AI to finance in Asia-Pacific region. China in particular has made significant investments into AI technology and infrastructure that have yielded innovative AI-powered financial solutions; Singapore stands out as a global fintech hub actively exploring potential applications of generative AI for finance applications.

Middle East and Africa countries are showing increased enthusiasm for the use of artificial intelligence in financial sectors. Countries such as United Arab Emirates and South Africa are investing heavily in AI research and development projects in order to bolster their respective financial sectors; Dubai in particular has established itself as an AI startup hub, encouraging collaborations between financial institutions and AI startups.

Generative AI adoption in finance is making headway across Latin American nations such as Brazil, Mexico and Colombia. Financial institutions are exploring its use for risk management, fraud detection and customer analytics purposes while governments in these nations support AI initiatives as an innovation driver to promote economic development and drive economic growth.

For any inquiries, Speak to our expert at: https://marketresearch.biz/report/generative-ai-in-finance-market/#inquiry

Drivers

Advanced Data Analytics

The finance industry handles vast volumes of information, and generative AI provides advanced data analytics capabilities that can uncover valuable insights and patterns. Financial institutions are using generative AI algorithms to efficiently process large sets of complex data sets resulting in improved decision making and strategic planning processes.

Risk Management

Generative AI models have quickly become an invaluable asset in financial services. By evaluating vast amounts of data and using predictive algorithms to assess risks, generative AI has helped financial institutions identify hidden threats and develop effective risk mitigation strategies – hence its widespread adoption as a method to enhance risk assessment and mitigation processes.

Fraud Detection and Prevention Strategies

Financial fraud poses significant obstacles for the industry. Generative AI algorithms are effective tools for detecting fraudulent activities by analyzing transactional data and detecting patterns or anomalies indicative of fraud. Their adaptability means generative AI makes an attractive tool for financial institutions looking to strengthen their fraud detection and prevention capacities.

Restraints

Data Privacy and Security Concerns

Finance institutions face unique challenges when it comes to handling customer data with confidentiality and privacy in mind. Implementing generative AI requires strong measures for data privacy that comply with regulations and protect against breaches, while simultaneously managing security concerns effectively. Maintaining and addressing privacy concerns may prove to be formidable hurdles for financial institutions.

Ethical Considerations

Ethical Considerations Its Generative AI raises ethical concerns when applied to algorithms and decision-making processes. Financial institutions must ensure their use of generative AI remains fair, transparent and accountable – bias in data or algorithms may lead to unexpected consequences or unfair outcomes, which must be carefully addressed to maintain ethical standards.

Regulatory and Legal Compliance

Financial services are highly regulated, with stringent requirements from regulatory bodies imposed on their activities. Implementation of generative AI solutions must comply with these regulations, which may prove both complex and time-consuming. Financial institutions must also ensure their use of AI complies with legal and regulatory frameworks that may differ across jurisdictions.

Opportunities

Personalized Customer Experiences

Generative AI algorithms can analyze customer data to deliver tailored recommendations and services, tailored specifically to each customer's preferences, behavior, and needs. By understanding their customers' behaviors and needs better than ever, financial institutions can tailor their offerings more precisely while improving customer satisfaction levels and building stronger relationships with clients.

Investment Optimization

Generative AI models can simulate investment scenarios, evaluate potential outcomes, and develop optimized investment strategies for both financial institutions and individual investors alike. By harnessing its power to make data-driven investment decisions that optimize portfolios for optimal returns.

Automation and Efficiency

Generative AI allows financial institutions to automate laborious and time-intensive processes to increase operational efficiencies while decreasing costs. By automating data analysis, report generation, and other manual processes such as manual processes in financial institutions can allocate their resources more effectively while streamlining operations while focusing on value-adding activities.

Innovation and Competitive Advantage

Financial institutions that embrace generative AI technologies can drive innovation while also gaining a competitive advantage in the market. Utilizing it for data analysis, risk management and customer insights enables institutions to differentiate themselves by offering unique products and services while remaining at the forefront of an ever-evolving finance industry.

Take a look at the PDF sample of this report: https://marketresearch.biz/report/generative-ai-in-finance-market/request-sample/

Challenges

Interpretability and Explainability

Generative AI models often operate like black boxes, making it hard to understand their decision-making processes and the rationale behind AI-driven outcomes. Financial institutions must strike a balance between accuracy and interpretability to build trust while complying with regulatory compliance.

Model Bias and Fairness

AI algorithms are vulnerable to biases present in their training data, which could result in unfair treatment of certain individuals or groups. Financial institutions must take measures to carefully evaluate potential biases so as to guarantee fairness without unintended discriminatory impacts.

Cybersecurity Risks

Generative AI introduces unique cybersecurity challenges for financial institutions. Financial institutions must protect their AI models, data, and systems against potential cyber threats such as attacks on AI algorithms or exploited vulnerabilities within AI systems. Stringent cybersecurity measures and monitoring programs must be in place in order to minimize this risk.

Market Segmentation

Based on the Deployment Model

- Cloud Deployment

- On-Premises Deployment

- Hybrid Deployment

Based on the Application

- Risk Management

- Fraud Detection

- Investment Research

- Trading Algorithms

- Other Applications

Based on the Technology

- Deep Learning Technology

- Natural Language Processing Technology

- Computer Vision Technology

- Reinforcement Learning Technology

- Other Technologies

Key Players

- IBM Corporation

- NVIDIA Corporation

- DataRobot, Inc.

- Symphony Ayasdi

- ai

- Kavout

- AlphaSense

- Other Key Players

Report Scope

| Report Attribute | Details |

| Market size value in 2022 | USD 413.1 Mn |

| Revenue Forecast by 2032 | USD 1669.3 Mn |

| Growth Rate | CAGR Of 15.4% |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa, and Rest of the World |

| Historical Years | 2017-2022 |

| Base Year | 2022 |

| Estimated Year | 2023 |

| Short-Term Projection Year | 2028 |

| Long-Term Projected Year | 2032 |

Request Customization Of The Report: https://marketresearch.biz/report/generative-ai-in-finance-market/#request-for-customization

Recent Developments

- OpenAI (2021): OpenAI unveiled GPT-3, one of the most advanced generative AI models capable of producing human-like text in various applications. In addition, OpenAI unveiled their private beta of OpenAI Codex: an API built around GPT-3 that enables developers to build apps using natural language interfaces.

- NVIDIA (2021): NVIDIA announced the introduction of NVIDIA Jarvis, an artificial intelligence framework designed for conversational applications using natural language processing. It includes various models and tools including generative AI models to help developers build interactive and natural language-based apps.

- Google (2021): In 2021, Google introduced LaMDA (Language Model for Dialogue Applications), an AI model specifically tailored for conversational applications. LaMDA's primary function is understanding context and producing more meaningful responses during natural language conversations.

- Microsoft (2020) Research introduced DeepSpeed, a deep learning optimization library. DeepSpeed allows for more efficient training of large-scale generative AI models with lower memory requirements while meeting challenges related to scaling up and performance.

FAQ

1. What role does Generative AI have in the financial industry?

Ans. Generative AI in finance plays an integral part in data analysis, risk management, fraud detection, investment strategies and improving decision-making processes.

2. How is Generative AI helping financial institutions manage risk?

Ans. Generative AI algorithms comb through vast amounts of data to identify potential risks, provide mitigation strategies, and enhance overall risk management frameworks.

3. Are generative AI algorithms capable of detecting fraudulent financial activities?

Ans. Yes, generative AI algorithms excel at detecting fraudulent activities by examining transactional data and detecting patterns or anomalies indicative of fraud.

4. Which factors have contributed to the surge of Generative AI in Financial markets?

Ans. Generative AI in finance market growth is driven by demand for advanced data analytics, risk management solutions, fraud detection capabilities, investment optimization services, market competition management and regulatory compliance services.

5. Who are the key players in the market for Generative AI in Finance?

Ans. Market participants include financial institutions, technology companies and startups providing AI solutions for finance; with notable players including major banks, AI-focused fintech firms and AI research institutions.

6. What are the trends for Generative AI in Finance Market?

Ans. Generative AI's adoption in finance varies across regions, with North America, Europe, Asia-Pacific and Middle East and Africa experiencing considerable investment and adoption of this technology.

7. What are the challenges involved with using Generative Artificial Intelligence in Finance?

Ans. Challenges related to data privacy and security include ethical considerations, regulatory and legal compliance, AI model interpretability risks, cybersecurity threats, talent acquisition issues and seamless integration with existing infrastructure.

Contact us

Contact Person: Mr. Lawrence John

Marketresearch.Biz

Tel: +1 (347) 796-4335

Send Email: [email protected]

Content has been published via 11press. for more details please contact at [email protected]

The team behind market.us, marketresearch.biz, market.biz and more. Our purpose is to keep our customers ahead of the game with regard to the markets. They may fluctuate up or down, but we will help you to stay ahead of the curve in these market fluctuations. Our consistent growth and ability to deliver in-depth analyses and market insight has engaged genuine market players. They have faith in us to offer the data and information they require to make balanced and decisive marketing decisions.