Some Crucial ATM Statistics To Understand Its Expansion Worldwide In The Banking Sector

ATM Statistics: ATM (Automated Teller Machine) refers to a specific computerized service that offers a convenient way to manage funds for bank account holders. It is a form of electronic banking terminal that helps customers to carry out simple transactions without the support of a branch operator. Customers can perform self-service tasks such as deposits, cash withdrawals, bill payments, and account transfers through ATMs. ATMs allow customers to have access to bank services 24/7.

A Dallas-based engineer initiated the development and distribution of Automated Teller Machines. In September 1969, the first ATM was installed in Rockville Center, New York, USA at the Chemical Bank branch. Now, with more than 3.2 million ATMs across the world, the ATM has become the most widely used way for customers to communicate physically with their banks. Here we will discuss some important ATM statistics to understand its growth and usage in recent years.

Key ATM Statistics

- There are more than 3.2 million automated teller machines (ATMs) around the world.

- As per ATM statistics, the global ATM market size grew up to $20 billion in 2020.

- The number of automated teller machines (ATMs) across the globe remained stable at 41.24 machines per 100,000 people in 2020.

- The global ATM market is predicted to reach $28.82 billion by 2026.

- As per a report published in 2021, nearly 40 percent of people in the US use an ATM 8 to 10 times per month.

- ATM statistics show that around 10 billion transactions are processed via ATMs in the US each year.

- The development of Smart ATMs has become a popular trend in the ATM market nowadays.

- The Asia-Pacific region accounts for the highest ATM usage across the globe in the ATM market.

- As per ATM statistics and trends for 2021, ATM transactions across the globe grew up to $12.6 trillion in 2021.

- Developing countries have been witnessing rapid growth in ATM deployments.

- As per the latest ATM market, China and India are predicted to be the fastest-growing region for the ATM market in the next few years.

- The banking industry is the biggest consumer of ATM machinery contributing to around 65 percent of total ATM transactions across the globe.

- The worldwide ATM market is segregated into two categories that are in-network (inside banks) and out-of-network (outside banks).

- At present, there are nearly more than 2.1 million in-network machines and more than 1 million out-of-network machines functioning in the worldwide ATM Market.

- Cash transaction has started to see a decline in popularity due to their vulnerability to crime and corruption.

- Competition from online and phone-based banking is also limiting the growth of the ATM market, especially in developed economies.

General ATM Statistics and Trends:

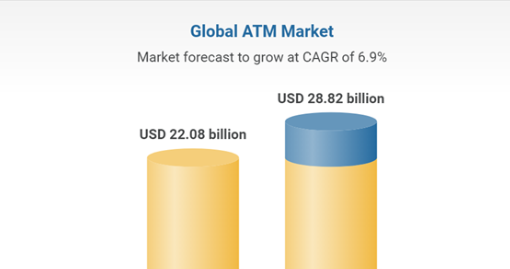

#1. The global ATM market is predicted to reach $28.82 billion by 2026

The worldwide ATM Market was predicted to be worth $22.08 billion in the financial year 2022. The growth rate of the ATM Market is 6.9 percent globally and the worth of the global ATM market is estimated to grow up to $28.82 billion by 2026.

(Source: researchandmarket.com)

(Source: researchandmarket.com)

#2. NCR Corporation, Diebold Nixdorf, Hitachi-Omron Terminal Solutions Corporation, GRG Banking Equipment Co. Ltd, and Fujitsu Frontech Ltd are some major players in the global ATM market

Along with these firms, Hyosung Corporation, Forbes Technosys Ltd, Triton Systems of Delaware LLC, HESS Cash Systems GmbH & Co KG, Euronet Worldwide Inc, Oki Electric Industry Co. Ltd., G4S plc, Nautilus Hyosung Corporation, RapidCash ATM Ltd., and Lipi Data Systems Ltd as well are key players in the ATM market worldwide.

#3. The Asia-Pacific region accounts for the highest ATM usage across the globe in the ATM market

The Asia-Pacific ATM market size was estimated to be worth $6.38 billion in 2020. It is predicted to touch $9.46 billion by 2030. It shows growth at a CAGR of 4.1 percent from 2021 to 2030.

#4. As per ATM statistics and trends 2021, ATM transactions across the globe grew up to $12.6 trillion in 2021

While this number might appear a little meek at first, it is still a testimony to how the popularity of ATM usage is rising. At present, there are more than 3.2 million ATMs around the world.

#5. Largely, the usage in the global ATM market is on the upsurge

ATMs offer multiple benefits as compared to other methods of payment. Finance experts claim that the popularity of ATM services will continue to increase in the future as more people use automated teller machines for their daily transactions.

#6. Developing countries have been witnessing rapid growth in ATM deployments

The deployment of ATMs will continue to grow in developing nations as customers make a steady transition from using cash to utilizing plastic cards or digital wallets.

#7. As per the latest ATM market, China and India are predicted to be the fastest-growing region for the ATM market in the next few years

These countries will show rapid growth in the ATM market due to their enormous populations and rapidly increasing eCommerce industry.

#8. The banking industry is the biggest consumer of ATM machinery

As per ATM statistics, the banking industry contributes to nearly 65 percent of total ATM transactions across the globe.

#9. The worldwide ATM market is segregated into two categories that are in-network (inside banks) and out-of-network (outside banks)

In-network automated teller machines made around 57 percent more revenue as compared to out-of-network automated teller machines. However, out-of-network machines produced a greater net margin due to greater Merchant Service Fees (MSF).

#10. At present, there are nearly more than 2.1 million in-network machines and more than 1 million out-of-network machines functioning in the worldwide ATM Market

A recent study has revealed that banks have been investing more funds in ATM infrastructure than ever before. It shows their assurance of the future of ATMs.

#11. On the other hand, Cash transaction has started to see a decline in popularity due to its vulnerability to crime and corruption

For example, in India where nearly 60 percent of all retail transactions are done in cash, the government has been promoting the use of plastic money as part of its initiative to diminish graft and endorse economic growth.

#12. Competition from online and phone-based banking is also limiting the growth of the ATM market, especially in developed economies

In North America and Europe, conventional banks are trying hard to compete with rivals such as Amazon and Apple Pay.

#13. Many conventional banks now offer their customers online banking platforms for their banking services

These online platforms allow consumers to use a wide range of payment methods such as credit cards and digital wallets. This has created a stern competition for market share between conventional banks and online payment service providers such as Apple Inc., Square Inc., and PayPal Holdings Inc.

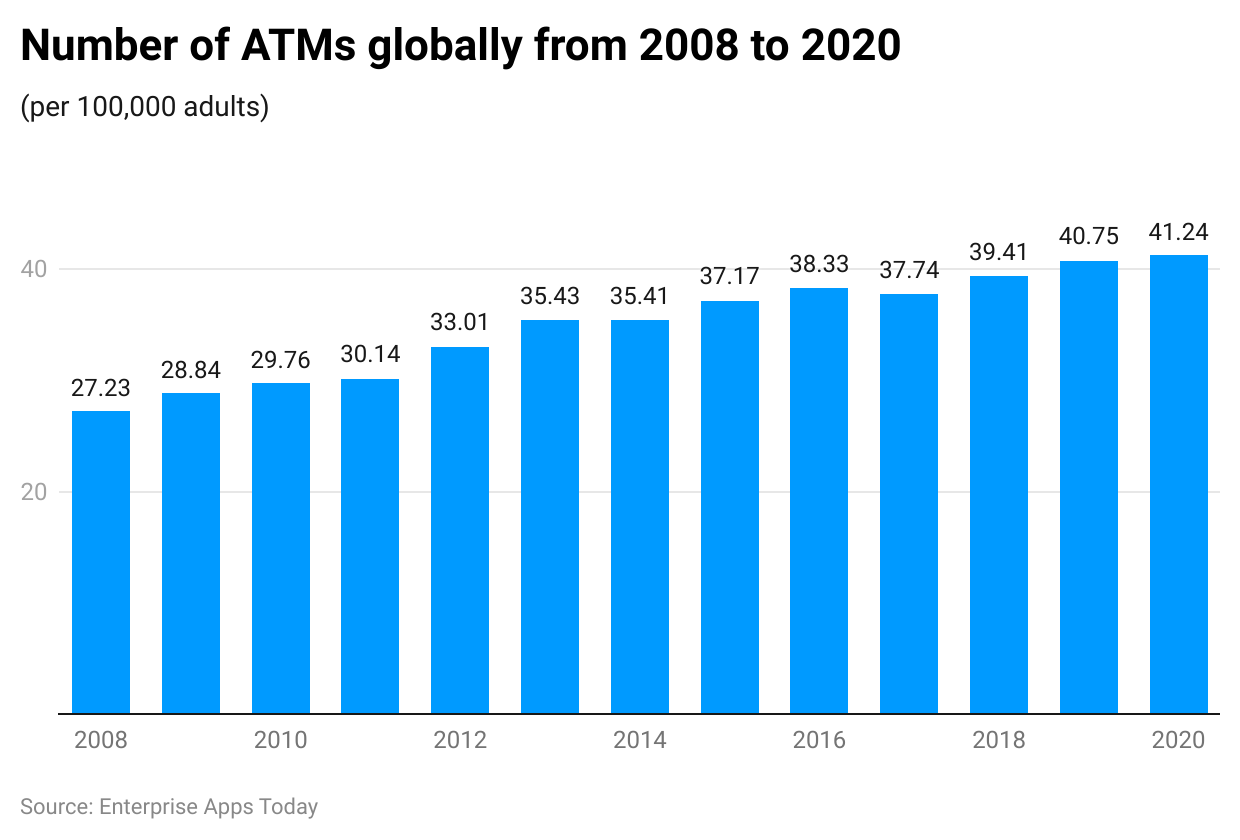

#14. The number of automated teller machines (ATMs) across the globe remained stable at 41.24 machines per 100,000 people in 2020

The count of automated teller machines (ATMs) around the World witnessed no major changes in 2020 in comparison to the financial year 2019. Still, the count of automated teller machines grew up to its greatest value in the financial year 2020.

(Source: Statista)

(Source: Statista)

#15. The ATM market faced its biggest challenge during the COVID-19 pandemic

The ATM market struggled with some major challenges such as reduced in-person interactions, reduced cash flow and credit, and difficulty in ATM service operations during the pandemic.

#16. Due to the rising demand for cash during the pandemic, banks unveiled mobile ATMs to fulfill customers’ banking requirements

Revenues generated from the mobile ATM sector were estimated to grow drastically during a few months of the COVID-19 pandemic as they cut down the need for consumers to move out of their vicinity to withdraw cash.

#17. As per a report published in 2021, nearly 40 percent of people in the US use an ATM 8 to 10 times per month

A report published by the National Cash Systems in 2021 revealed that around 40 percent of people in the US utilize an ATM nearly 8 to 10 times each month, along with an average of 300 times each month.

#18. ATM statistics show that around 10 billion transactions are processed via ATMs in the US each year

Therefore, the rising usage of automated teller machines by customers will add to the growth of the ATM market.

#19. The development of Smart ATMs has become a popular trend in the ATM market nowadays

Smart ATMs are defined as automated teller machines (ATMs) that can perform more than just dish out cash. Smart ATMs improve the adoption of front-line technologies that enhance the consumer experience and reduce fraud as well.

#20. A Sri-Lankan-based Bank known as Nations Trust Bank unveiled the first Smart ATM in Sri Lanka in October 2021

As per the report, the new machine will offer an exclusive banking experience that will let customers withdraw their chosen mix of currency notes to make payment for bus or train tickets or eat at the MMC's eateries.

#21. NCR Corporation declared the takeover of LibertyX for an unrevealed amount in August 2021.

The takeover will allow NCR Corporation to offer digital currency solutions to its consumers, such as the capability to purchase and sell cryptocurrencies, carry out cross-border remittances, and receive digital currency payments via digital and physical networks. LibertyX is a software firm that provides business-related products such as ATMs, sale terminals, and scanners.

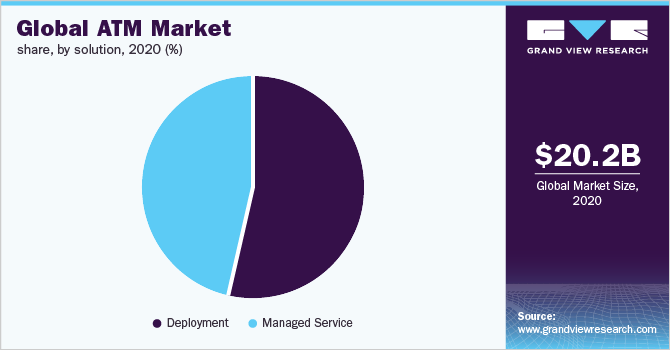

#22. As per ATM statistics, the global ATM market size grew up to $20 billion in 2020

The ATM market includes revenues generated by entities by offering services such as balance inquiry, cheque deposits, updating PINs, and money transactions. The ATM market also consists of sales of display screens, card readers, receipt printers, and cash dispensers.

(Source: grandviewresearch.com)

(Source: grandviewresearch.com)

Conclusion

As technology improves, customers demand technology innovations be implemented into companies they interact with. Already there is a technology transition taking place in the financial services industry. Banks that have plans to re-open physical branches or to close those branches are trying to blend digital innovations with in-person banking to enhance customer experience. Banks are embracing innovative tools and technology such as virtual bank tellers, upgraded ATMs, and smartphone applications to incorporate creativity as they embrace consumers back to the newly-improved physical branches. As per the latest data, cash will continue to have a robust existence in the marketplace.

Due to its ease of use and universality, cash transaction is still a popular way of payment for minor transactions across all demographics. It shows that the percentage of the unbanked population in developing and underdeveloped countries are quite significant, therefore, cash transaction is not going to fully vanish any time soon. These statistics show that ATMs will continue to play a crucial role in the payment market.

Sources

FAQ.

The worldwide ATM Market was predicted to be worth $22.08 billion in the financial year 2022.

The growth rate of the ATM Market is 6.9 percent globally and the worth of the global ATM market is estimated to grow up to $28.82 billion by 2026.

As per the latest ATM statistics, key players in the international ATM Market are NCR Corporation, Diebold Nixdorf, Hitachi, Hyosung Corporation, GRG Banking Equipment Co. Ltd., Omron Terminal Solutions Corporation, Fujitsu Frontech Ltd., Forbes Technosys Ltd., and HESS Cash Systems GmbH & Co KG.

Card readers, cash dispensers, PIN pads, receipt printers, and monitors are some of the elementary hardware elements that are essential for all ATMs. However, some ATMs have modules for wireless connectivity, check scanning, or even dispensing gift cards as well.

The Asia-Pacific region accounts for the highest ATM usage in the world. The Asia-Pacific ATM market is expected to reach $9.46 billion in the next seven years.

Around 3.2 million ATMs (Automated Teller Machines) are installed across the world.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.