Digital Currency Statistics 2023 – By Global Market Share, Price Prediction, Regional Analysis, Types, Cryptocurrency, Statblecoins and CBDCs

Page Contents

- Introduction

- Editor’s Choice

- Advantages and Disadvantages of Digital Currencies

- Digital Currency Statistics by Global Market Share

- Digital Currency Statistics by Price Prediction

- Digital Currency Statistics by Regional Analysis

- Segmentation of Digital Currency

- Digital Currency Statistics by Types

- Digital Currency Statistics by Cryptocurrency

- Digital Currency Statistics by Statblecoins

- Digital Currency Statistics by CBDCs

- Uses of Digital Currencies

- Conclusion

Introduction

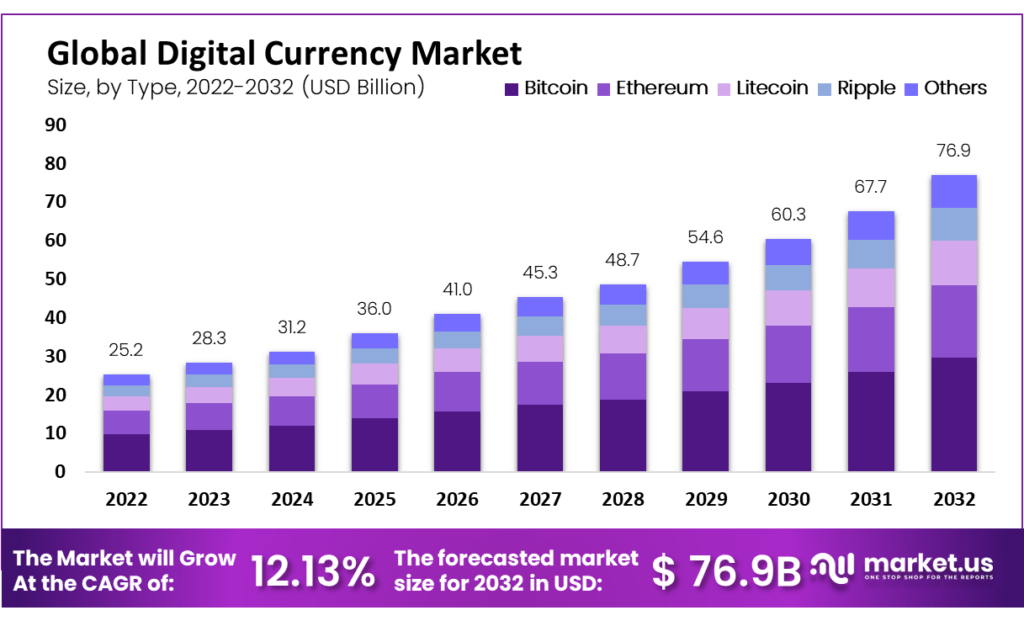

Digital Currency Statistics: The reports say that the Digital Currency Industry is expected to reach a market share of $76.9 billion by the end of 2032, with a growing CAGR of 12.13% from 2023 to 2032. Due to technological advancement, the market of digital currency has started to boost around the world by using software and hardware within different emerging regions. People around the world, now are investing in the market of digital currency as this helps enhance the market value, is easy to use, and drives the market growth effectively.

These Digital Currency Statistics include insights from various aspects that provide light on how Digital currency is becoming so popular around the world in the current situation.

Editor’s Choice

- As of 2023, the global revenue earned by the market of digital currency is expected to be $28.3 billion.

- The global market of digital currency is segmented into many types Bitcoin, Ethereum, Litecoin, Ripple, and others. Currently, the Bitcoin market is dominating the overall market as it is generating the greatest share of around 35%.

- The leading segment by component in the digital currency market is Hardware’s application-specific integrated circuit.

- In considering the process of this industry then mining secures the highest revenue share. As of the 11th October 2023 analysis, Bitcoin mining had a total market capitalization of $8.11 billion.

- The top players in the market are followed by Advanced Micro Devices Inc., Finance, Bit Fury Group Limited, Bit Go Inc., Intel Corporation, NVIDIA Corporation, Ripple, Xapo Holdings Limited, and Xilinx Inc.

- Furthermore, currently, the highest revenue share of the market has been observed in the region of Asia Pacific resulting in $8.5 billion, which is followed by North America, western and Eastern Europe, Latin America, and Middle East and Africa.

- In 2023, the trading segment will dominate the digital currency market with a market share of 32%, which is followed by retail and e-commerce, the government sector, banking, and others.

- The prominent manufacturers of digital currency sectors are JD Financial, Oracle, Rubix by Deloitte, Oklink, ELayaway, SAP, Baidu, HSBC, IBM, etc.

- According to the reports of Zippia, as of February 2023, the largest share was experienced by Bitcoin with a market capitalization of $457.16 billion.

- Furthermore, other segments' market capitalizations are followed by Ethereum ($202.46 billion), Tether ($70.97 billion), BNB ($47.77 billion), and USD Coin ($42.46 billion).

Advantages and Disadvantages of Digital Currencies

Advantages:

- Decentralization is one of the main advantages of digital currencies as any single entity does not have control over the currency. Even the money and transaction control is given over to users and is more efficient.

- Security is another advantage that enables advanced encryption techniques for preventing fraud and enabling secure transaction processes.

- Other advantages are followed by anonymity helps enable anonymous transactions, digital currencies are also used by global people as they can be used by anyone with an effective internet connection, and lower transaction fees are the last effective benefit as it require no other intermediaries.

Disadvantages:

- Volatility makes digital currencies less appealing and one of the best examples is Bitcoin which is best known for volatility.

- Lack of regulation makes the process difficult for users to seek legal sources and security concerns because they are more vulnerable to different security threats and hacking.

- Another is limited acceptance because these are mostly used by businesses and the rest prefer traditional payment methods, environmental impact is the last negative side of digital currency for example biotin mining requires energy consumption which is equivalent to the entire country.

(Source: market.us)

- According to the reports of market.us, the global revenue earned by the market of digital currency in 2023 is expected to be $28.3 billion.

- The market is also expected to grow with a CAGR of 12.13% from 2023 to 2032 and is expected to turn out a $76.9 billion market share by the end of 2023.

- Furthermore, it is expected that the market share is expected to grow faster in coming years followed by 2024 ($31.2 billion), 2025 ($36 billion), 2027 ($45.3 billion), 2028 (448.7 billion), 2029 ($54.6 billion), 2030 ($60.3 billion), and 2031 ($67.7 billion).

Digital Currency Statistics by Price Prediction

Bitcoin

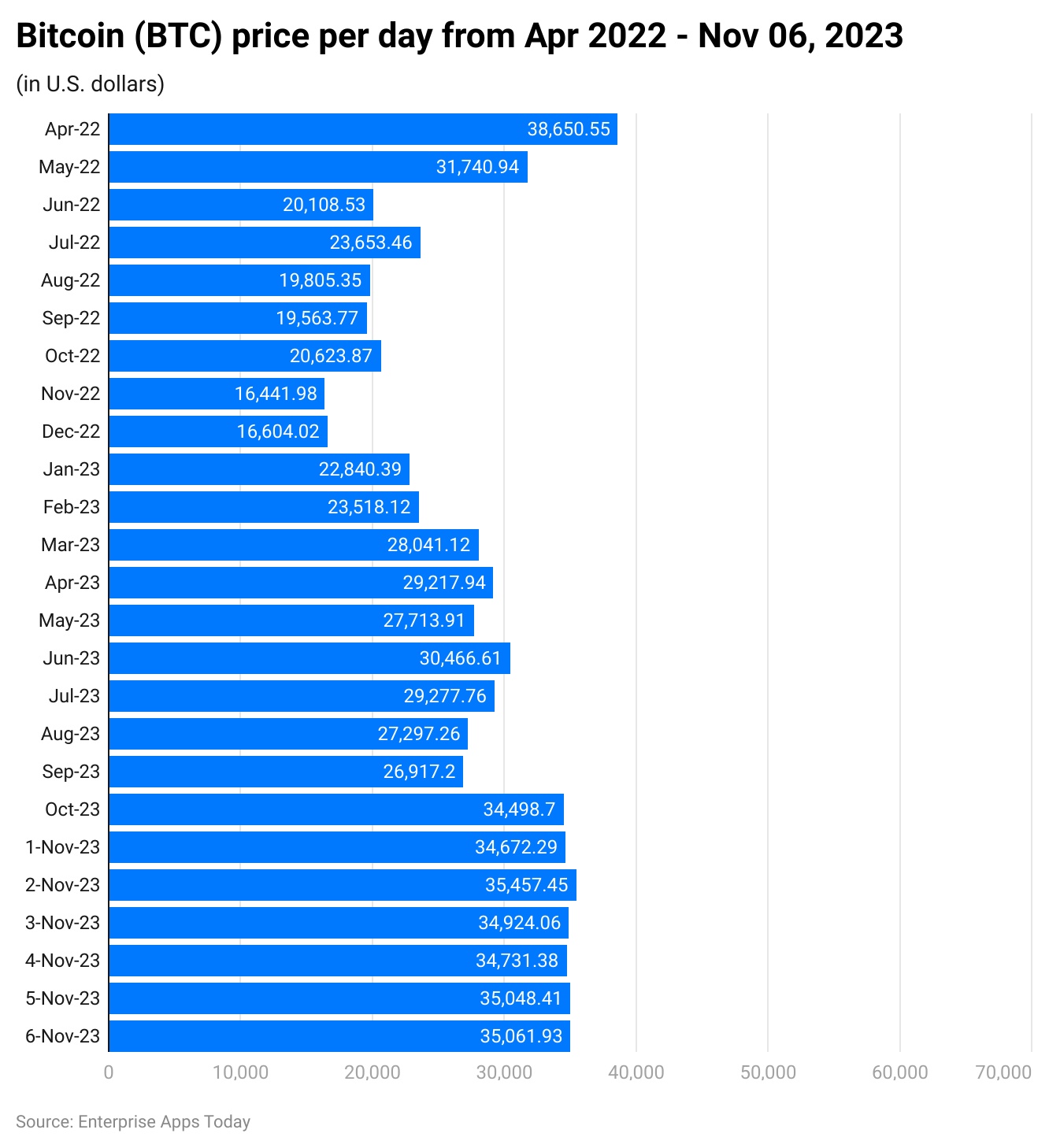

(Source: statista.com)

(Source: statista.com)

- According to Statistics in January 2023, the per day price of Bitcoin was $22,840.39.

- Others price index in following months are February ($23,518.12), March ($28,041.12), April ($29,217.94), May ($27,713.91), June ($30,466.61), July ($29,277.76), August ($27,297.26), September ($26,917.2), 4th October ($27,439.12), 5th October (427,792.11), 6th October ($27,435.87), 7th October ($27,958.2), 8th October ($27,977.54), and 9th October (427,948.1).

Ethereum

- According to the reports of Binance, the value is expected to be $1,889.96 by the end of 2023.

- Price predictions of Ethereum in the coming years are followed by 2024 ($1,984.45), 2025 ($2,083.68), and 2026 ($2,187.86).

- Whereas, by the end of 2025 the price is supposed to increase by 5% resulting in around $7,056.07.

Litecoin

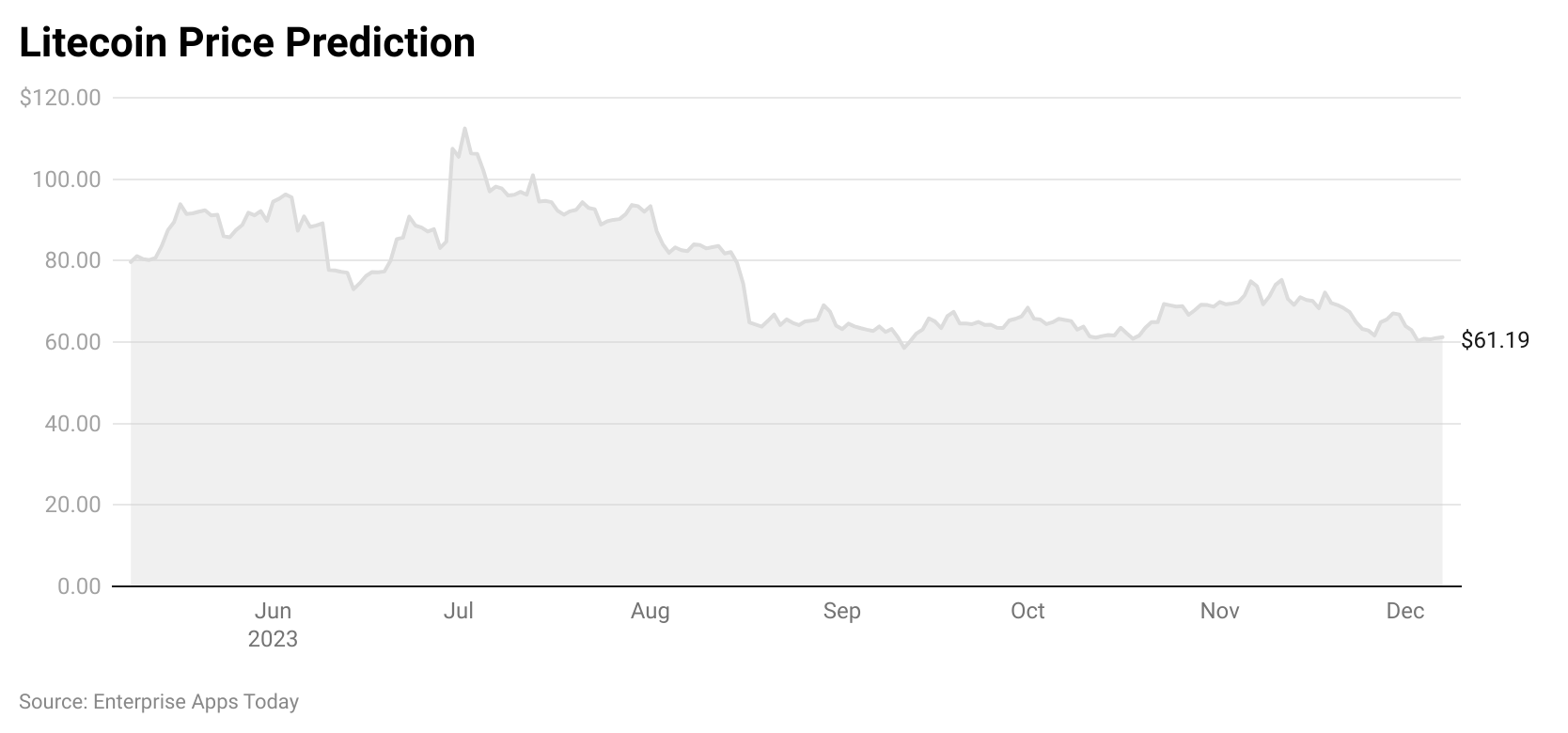

(Source: changelly.com)

(Source: changelly.com)

- According to the reports of the Changelly blog, as of 7th November 2023, the estimated Litecoin is $73.60.

- Other prices of Litecoin in the previous months of 2023 are followed by 1st June ($94.47), 1st July ($105.51), 1st August ($93.37), 1st September ($63.16), October ($68.43), and 1st November ($69.86).

Ripple

- As of 2023, the price prediction of 7th November 2023 is $0.702318 decreased from the last day by 2.69%.

- By the end of 2023, the average price of Ripple is $0.749925, others are followed by 2024 ($1.10), 2025 ($1.67), 2026 ($2.52), 2027 ($3.66), 2028 ($5.37), 2029 ($7.65), and by the end of 2030 ($10.69).

Digital Currency Statistics by Regional Analysis

- As of 2023, the highest revenue share in the digital currency market has been observed in the region of Asia Pacific resulting in $8.5 billion.

- According to the reports of the South China Morning Post, in the coming few years the total size of China’s digital currency is expected to be $140 billion.

- According to the reports of Wionews on 2nd June 2023, digital currencies are used by 9 countries.

- India (India’s Digital Rupee or e INR or E-Rupee).

- Other countries are followed by the USA, Eastern Caribbean (DCash), China (digital yuan or e-CNY), Singapore, Jamaica (Jam-Dex), Nigeria (eNaira), The Bahamas, and Ghana (the Digital Dirham).

Segmentation of Digital Currency

- As of now, there are 4 types of digital currency currency possessing intrinsic utility, tokens, centralized digital currency, and decentralized digital currency.

- Currency possessing intrinsic utility: are not dependent currency on the government and have their intrinsic actual value such as gold, silver, bronze, etc.

- Tokens have less intrinsic value as mostly local currencies are considered as tokens that are required for purchasing products, paying salaries, etc

- Centralized digital currency: These are the digital form of government-based currencies and are issued by central banks that support the financial services of the nation.

- Decentralized digital currency: This is also termed as cryptocurrency and as of 2023 there are more than 25,000 cryptocurrencies around the world.

Digital Currency Statistics by Types

- As to reports, 3 different types of digital currencies are available across the world Cryptocurrency, Stablecoins, and CBDCs.

- Cryptocurrencies are dorm of decentralized digital currencies, stablecoins are similar to cryptos and are termed as subsets, and others are CBDCs used by the nation’s central bank.

- According to Statista, by the end of 2023, the market share is expected to reach $37.9 billion with a CAGR of 14.40% from 2023 to 2027.

- As of 31st January 2023, the market cap of stablecoins was around $138.4 billion.

- In June 2023, the market share of Stablecoin accounted for $125 billion including Tether, USD Coin, Multi-Collateral Dai, Binance USD, and USDP Dollar.

Digital Currency Statistics by Cryptocurrency

- As of reports, it has been observed that 97% of users are confident about cryptocurrencies, and is estimated 420 million users by the end of 2023.

- The basic reasons for using cryptocurrencies are that they allow the creation of investment strategy for the long-term (55%), are different from the modern financial system (38%), and promote trading of short-terms (31%).

- Investments in cryptocurrency are twice in men than women resulting in men (16%), and women (7%).

- As of 2023, the price of Bitcoin is $21,000 and Ethereum costs around $1,600, by the next 2 years it is going to experience huge growth.

- According to the reports of Zippia 2023, countries having a maximum number of crypto owners are followed by India (157.6 million), the United States (44.3 million), Vietnam (25.9 million), China (19.9 million), Brazil (17.8 million), Philippines (14.8 million), Pakistan (14.7 million), Nigeria (12.4), Indonesia (11.7 million), and Russia (9.7 million).

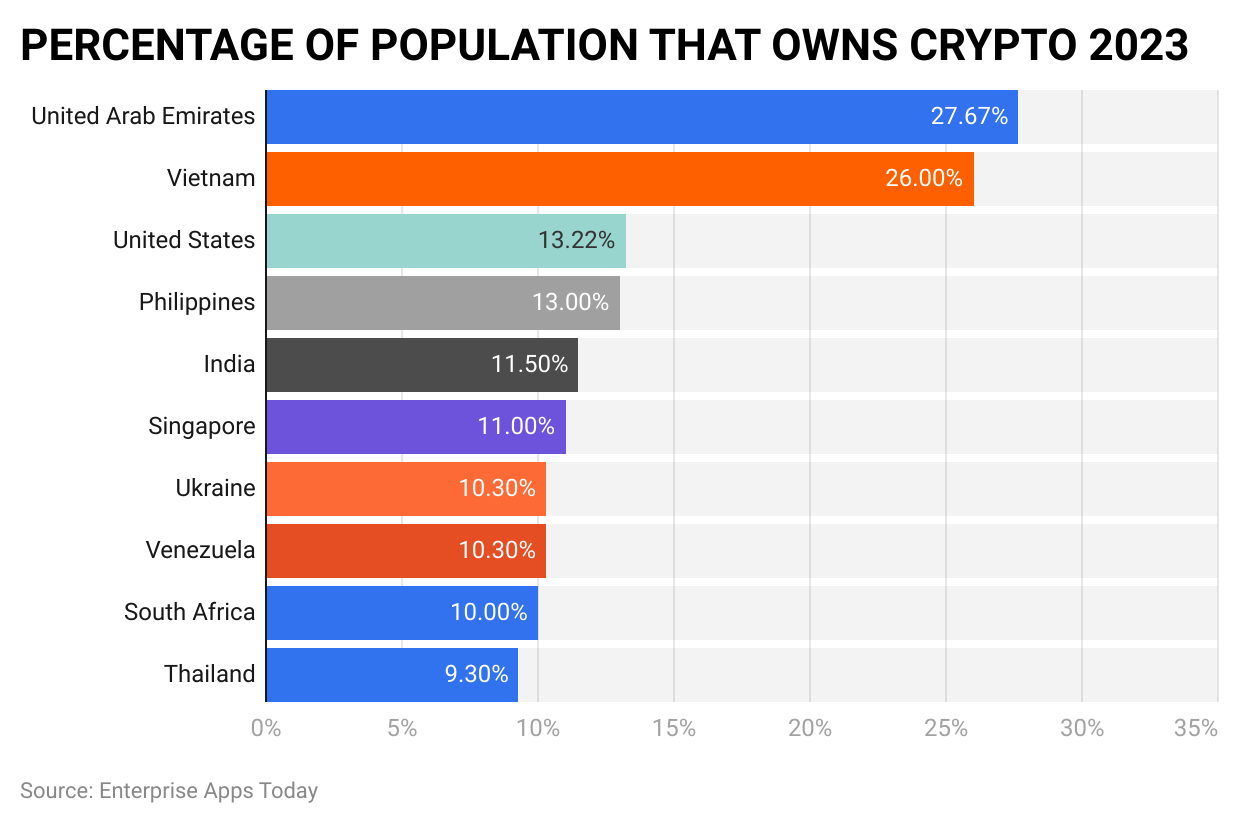

(Source: zippia.com)

- The above graph describes the percentage share of the population that owns cryptocurrencies in 2023 and the highest crypto owner share is experienced in the United Arab Emirates (27.67%).

- Furthermore other countries shares are followed by Vietnam (26%), United States (13.22%), Philippines (13%), India (11.5%), Singapore (11%), Ukraine (10.3%), Venezuela (10.3%), South Africa (10%), and Thailand (9.3%).

Digital Currency Statistics by Statblecoins

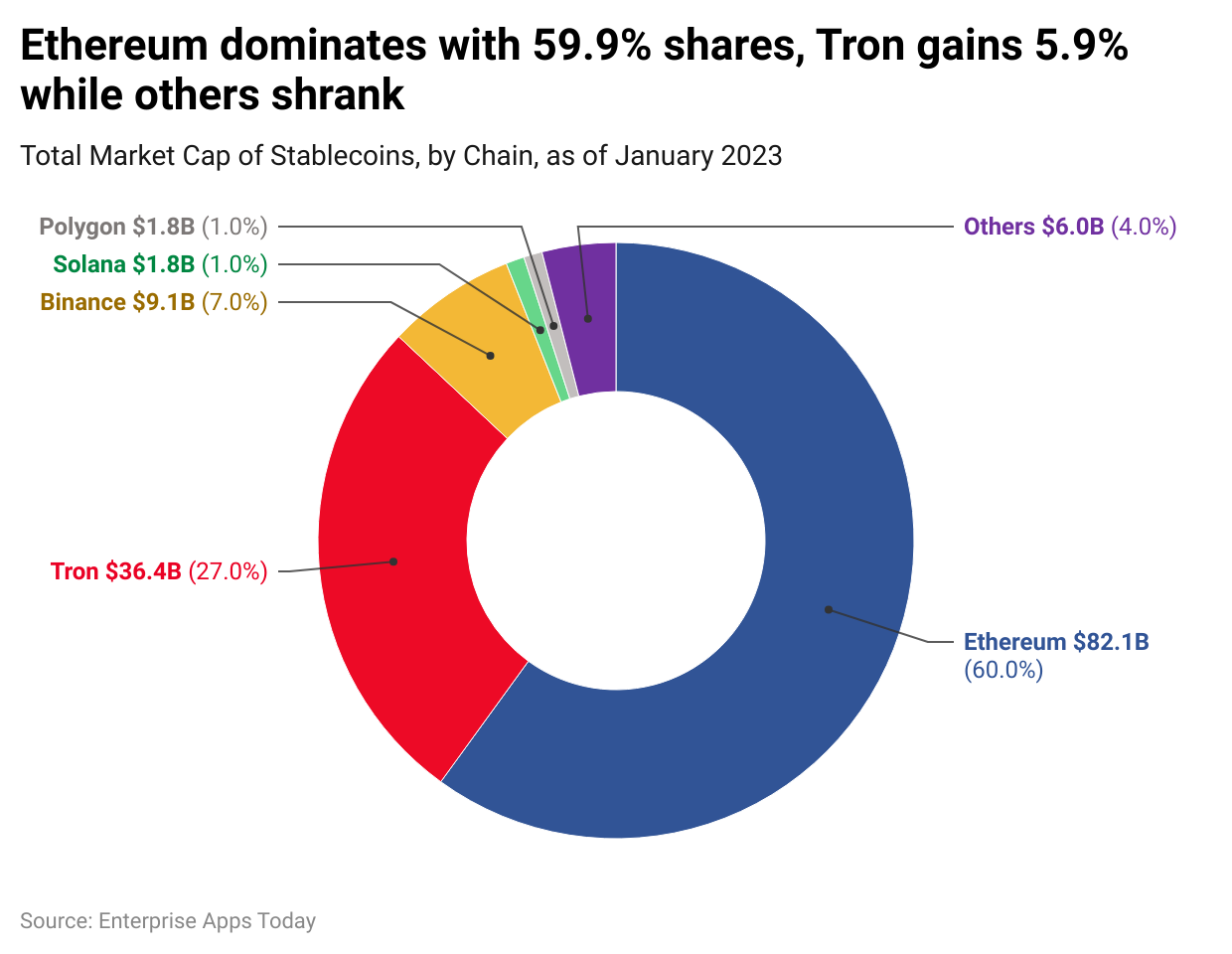

(Source: amazonaws.com)

- As of 31st January 2023, the market cap of stablecoins was around $138.4 billion.

- The segmentation of market cap is followed by USDT ($67.8 billion), USDC ($42.7 billion), BUSD ($15.7 billion), DAI ($5.1 billion), FRAX ($1 billion), and others ($6 billion).

- Over the total market cap of stablecoins, Ethereum is currently dominating the market with a share of 60% and revenue of around $82.1 billion.

- Other shares of Stablecoins statistics by chain are followed by total revenue and market share are Tron ($36.4 billion and 27%), Binance ($9.1 billion and 7%), both Salana and Polygon ($1.8 billion and 1%), and others ($6 billion and 4%).

Digital Currency Statistics by CBDCs

(Source: cdn.statcdn.com)

- According to the reports of Statista on 28th June 2023, the European Union is proposing a legal framework for launching digital Euro.

- As of June 2023, central bank digital currencies (CBDC) have already been adopted by 11 countries, and currently used currencies are the Bahamas, Eastern Caribbean dollar, Jamaica, and Nigeria.

- On the other hand, by the end of October 2023, the Pilot phases of digital currency user countries are the United Arab Emirates, China, Thailand, and Hong Kong.

- According to Reuter’s analysis, by June 2023, around 98% of the world economies are going to explore digital currency versions that are 130 countries.

- By 2024, two other emerging countries such as Brazil and India are going to launch digital currency

- According to Thales' research, by the end of June 2023, China’s digital Yuan had experienced transactional growth resulting 1.8 trillion Yuan ($249. billion) increase from last year.

- As of August 2023, in the United States, no decision has been taken yet on issuing central bank digital currency (CBDCs).

- Whereas, the United Kingdom is still in an exploratory phase as the Bank of England has not decided to proceed with digital currency.

- In November 2022, India launched its own central bank digital currency termed as e-rupee.

Uses of Digital Currencies

- According to the research of Atlantic Council’s Geo Economics, in 2023 China is on the way to expanding its course from pilot CBDC and is termed as one of the largest programs called China’s digital Yuan.

- The China and United Arab Emirates are working on a project to use CBDC and blockchain to enable regional payment transfer between nations.

- The digital currency of India works as an alternative to cash and enables quick cash transfers.

Conclusion

As of today, after completing the article on Digital Currency it can be stated that the market doesn’t depend on any nation’s government regulations and allows in making effective transfer of money. The revenue share of the market is expected to remain highest in the Asia Pacific region with around $8.5 billion. There are three types of digital currencies available Cryptocurrency, Stablecoins, and CBDCs. This article includes many essential current statistics that will help you understand the topic better.

Sources

FAQ.

This helps in completing the payment transaction methods much faster than traditional means.

The Reserve Bank of India allows in issuing of digital currency on behalf of any country’s government. As of now, 11 countries have launched their CBDCs.

Bitcoin is termed as the first digital currency which was released in 2009 as open-source software. Currently, as of November 2023, there are above 25,000 cryptocurrencies around the global marketplace.

This is possible through decentralized networks that mainly depend on blockchain technology and then get stored in computer networks.

It’s very simple to use crypto exchanges such as Coinbase, Gemini, and Binance to convert Bitcoins into cash safely.

Barry is a lover of everything technology. Figuring out how the software works and creating content to shed more light on the value it offers users is his favorite pastime. When not evaluating apps or programs, he's busy trying out new healthy recipes, doing yoga, meditating, or taking nature walks with his little one.